Key Takeaways:

- Bitcoin’s net outflow on crypto exchanges reached a record high this week

- With crypto’s relief rally, many altcoins surged double or triple digits, led by Dogecoin

- The Fed could possibly pivot says Morgan Stanley Analyst, which could spur on risk-on assets like crypto

___________________________________________

Thanks to the recent relief rally, crypto’s market capitalization has finally returned over USD$1 Trillion. While we are far away from bull market valuations, Bitcoin floating at $21,000, the top of its October range, has allowed investors and speculators alike to breathe a sigh of relief.

Although most participants do not expect an immediate reversal to $69,000, there have been several large factors that may indicate the past month as a bottom for awhile.

Tomorrow (2 Nov) will also see key decisions from the United States Federal Reserve on various economic outlooks. This includes rate hikes, economic forecasts, as well as a speech from Federal Chair Jerome Powell.

With such pivotal events coming, will crypto be able to retain these bullish levels, or will we see a quick return to a sub $1T market capitalization?

Also Read: What Does Elon’s Twitter Takeover Mean For Crypto?

Why Did Crypto Markets Go Up?

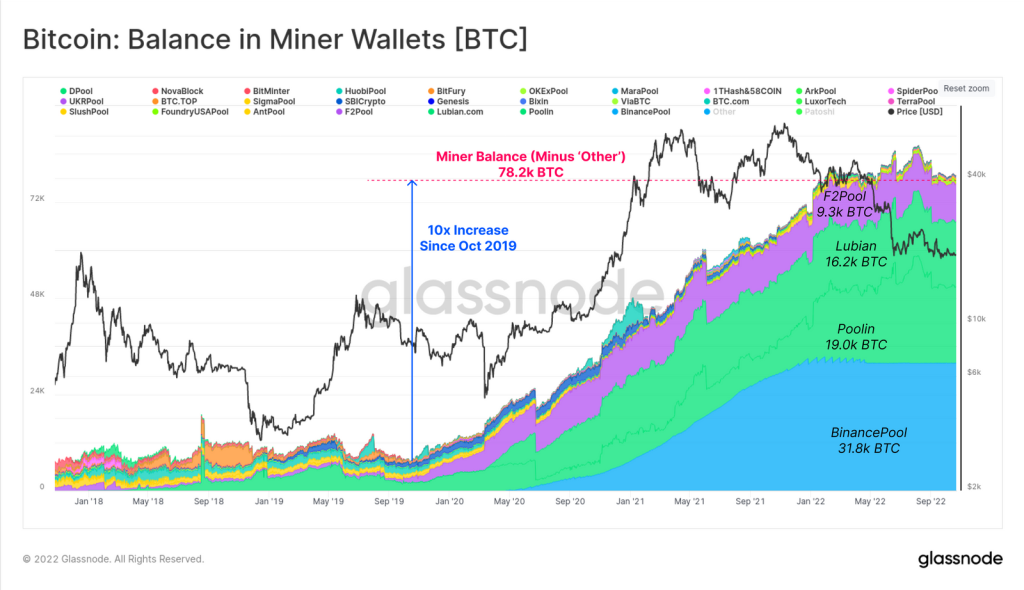

The tail end of October realized the end of a miner selling spree.

Despite there still being a $1.5B overhang in the mining industry, constant downward pressure in the markets has been somewhat relieved. Core Scientific, which has been rampantly selling their reserves to cover costs, now only has 24 $BTC left in holdings.

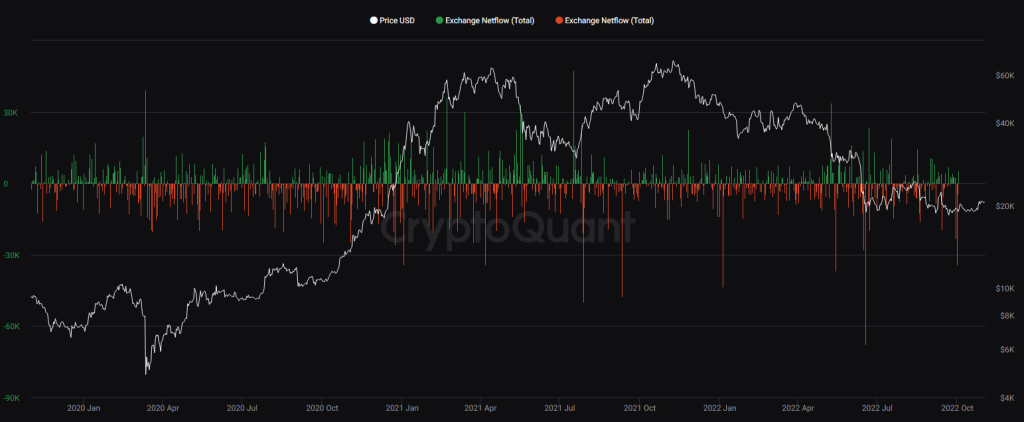

Furthermore, a record 55,000 $BTC were withdrawn from leading crypto exchange Binance, signalling massive demand at these prices. Across exchanges, the net outflow of Bitcoin amounted to upwards of 57,000, or approximately $1.15B at these prices.

The DXY, or U.S Dollar Index, which has seen a parabolic rise in 2022, has also finally shown some reprieve. Despite a 100% increase in M2 money supply, the DXY’s upwards momentum has been a bane to crypto and other risk-on assets.

Will Crypto Continue It’s Bullish Momentum?

All eyes are on the Federal Reserve at the moment, and many market analysis are speculating a pivot sooner rather than later.

With the last few CPI announcements showing higher-than-expected inflation numbers, the Federal Reserve has been leaning hawkish, with rate hikes in an attempt to curb inflation.

However, this phase of quantitative tightening by the Fed may be coming to an abrupt end, with a pivot to more bullish narratives.

A recent interview with Morgan Stanley strategist Mike Wilson gave some insights into the current economic climate. Ranked the best portfolio strategist for 7 years running, Wilson believes that the end of Federal tightening is near, and we may see a return of risk-on assets in the near future.

As speculators prepare for the FOMC meetings and decisions on rate hikes, a dovish stance could lead to a continuation in the current rally.

The Doge-Fuelled Altcoin Season

With $BTC hovering at $21,000, many altcoins have put in double digit returns from the lows. Thanks to Elon Musk’s tweets, the memecoin $DOGE has pumped more than 150% in the last week.

‘Tis the mother fucking alt szn. Get excited. pic.twitter.com/3ssgIOo51Z

— Arthur Hayes (@CryptoHayes) October 29, 2022

Some have likened this phase of the market cycle to a mini altcoin season, with more than $2B in shorts liquidated over the last 7 days. Crypto twitter has also been rife with new narratives such as airdrops, fan tokens, and new Layer 1s.

Despite the bear market, traders have fueled a rally across the charts, and top cryptocurrencies have shown tremendous strength. More impressively, even altcoins without a current narrative such as $SAND and $AVAX have pushed more than 20% returns.

While $BTC is known to be a less volatile asset, being outperformed by almost every token in the top 100 makes a case once again for holding altcoins, even $ETH, as compared to a piece of digital gold at this phase of the market cycle.

Closing Thoughts

While Bitcoin is being moved off exchanges at an astounding pace and the relief rally seems to have established a new range, it is safe to say that the long-term trend is still intact.

Despite the fed possibly pivoting dovish in the near future, the current outlook is still bearish. Till Bitcoin retests major support levels and continues a consistent upward trend, the bear market is still here.

Nevertheless, this relief rally has shown the inherent strength of Web3.0, and bullish accumulation means only one thing – less coins for future participants. While the forces of supply and demand are not immediate, they will shine eventually.

Till then, the market is rife with narratives to play, something that can give even that could cause a spark in even the most pessimistic crypto participant, and prevent us from exiting the market.

Also Read: Bitcoin To 9k? Here’s What Max Pain Would Look Like in Crypto

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief