With the Bellatrix hard fork passing, the merge is inching ever closer.

Bellatrix activated! 🎉

— terence.eth (@terencechain) September 6, 2022

Next stop: the merge

See you on the other side💫 pic.twitter.com/01FCSDyqs5

Scheduled for mid-September, the hard fork will help Ethereum achieve scalability while reducing energy consumption.

However, it also comes with major headaches – especially for DeFi applications

Also Read: The Four Best Ways To Play The Ethereum Merge

Magic Internet Money

In a previous article, we covered how the Ethereum merge may double your tokens.

Essentially, third parties may create forks of the current Ethereum Network, which will result in your tokens getting cloned.

A short thread about EthPoW and what is quite likely to happen:

— Marc "Aavechan.lens" Zeller 👻 💜 (@lemiscate) August 1, 2022

Spoiler TL;DR: Galois et Guo delenda est

🧵👇

With such a lucrative opportunity on the horizon, crypto participants are rushing to stack up as much $ETH as possible.

This led to borrow rates exceeding 20% on major DeFi platforms such as Aave.

In response, the popular automated market maker has proposed to temporarily halt Ethereum borrowing.

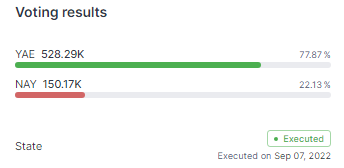

With a final count of 77.87% in favor, the proposal was executed earlier today in order to “mitigate the risk of high utilization“.

This follows Binance’s decision to suspend Ethereum withdrawals ahead of the merge.

Not The Only Ones

Aave is not the only protocol to halt Ethereum-related activities ahead of the merge.

Proposal 122 prepares for the Merge and a potential POW fork by protecting cETH user liquidity.

— Compound Labs (@compoundfinance) September 2, 2022

It imposes a borrowing cap of 100,000 ETH, and introduces a new interest model with very high upper bounds.

Voting begins in 2 days.https://t.co/7LvUk1lOk7https://t.co/krTBxFUQEe

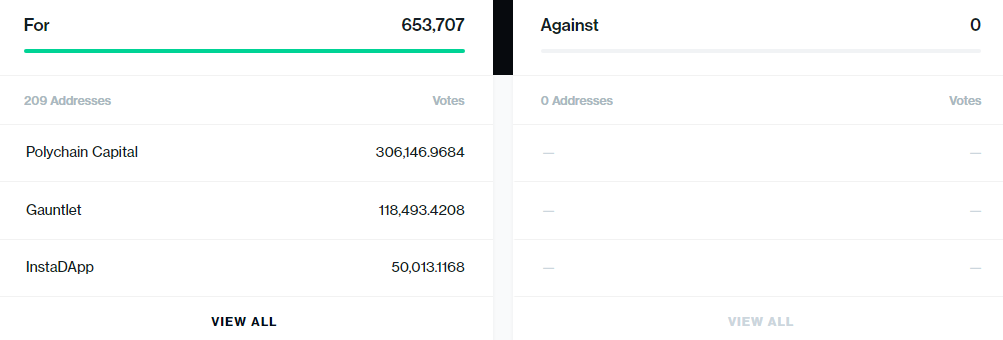

Compound Finance, an Ethereum-based Money Market protocol, is looking to pass a hard limit on $ETH borrows.

While there are still 18 hours left, the proposal has been unanimously agreed to, with a 100% voting in favour.

At the time of writing, it is uncertain how many other DeFi protocols are planning similar contingencies.

Most platforms have also expressed the opinion that they will solely be supporting the Proof-of-Stake Network, and not forks.

In fact, most in the crypto space will not have to do anything in preparation for the upcoming merge.

Also Read: What Are Replay Attacks? Why You Need To Know Them Before The Ethereum Merge

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief