It’s 2023 and there is no doubt that we are in the midst of a multi-year bear market. While this has become painfully obvious with the collapse of CeDeFi, the new narratives and thought leaders in crypto have yet to be properly etched out.

However, many crypto participants have been quick to latch onto trends, nostalgic of the gains made or missed in the bull market.

If you’re still in crypto however, it’s time to re-evaluate your view of the market, and where the bear will take us.

Also Read: This Bear Market Is Trying To Teach You Something

“Web3.0” is Dead, Long Live Crypto

Love it or hate it, the term “web3.0” comes from a centralized, capitalistic point of view. The incessant need to rebrand “crypto” originated from its negative connotations with cyber criminals, drugs, and online gambling.

Furthermore, the infancy of crypto meant that there were a lot of rough patches that the industry as a whole had to figure out.

2) We're going back to "crypto" (native, organic, punk rock) vs. "Web3" (bad juju, consultant approved, weak) in 2023.

— Ryan Selkis 🥷 (@twobitidiot) December 22, 2022

More Personal Wallets, Privacy, DeFi, DePIN.

Less exchanges, black box lenders, and ponzinomics.

Web3.0 was a term used sparsely in conjunction with the ideals of crypto – decentralization and self-custody.

With only builders and long-term believers remaining, it is nigh time that these ideals lead the entire space, and we return to what crypto was originally about.

Once we reach proper product-market fit is achieved in crypto, we won’t need buzz words like “web3.0” – it will simply sell itself.

Fundamentals are in, and Retail Will Be Destroyed

With the collapse of most decentralized and centralized ecosystems, there will likely be a reemergence of importance in “DYOR”, with extreme checks and balances for funds still looking to invest.

Gone are the days of spray and pray tactics which guaranteed any VC a 100x on launch day. Instead, there will likely be an equities-like evaluation of any major project alongside extremely critical scrutiny.

While memes can, and will continue to succeed, the constant 1000x pumps pushed by crypto influencers will die in the bear.

What is @bonk_inu and how has it taken over @solana? This new dogcoin has a > $50M market cap and rising! 🐕#SOL #Solana #BONKhttps://t.co/boioqYvW7f

— BSC News (@BSCNews) January 3, 2023

A key example is Bonk Inu, a doge-like memecoin native to the Solana Network. Despite it’s narrative-grabbing rise, it has managed barely double digit returns since its release.

Products like GMX, Cap Finance, and Uniswap, instead, may see a return to stardom, as we migrate our funds back to Dino-Defi, if anything at all.

7/ Dying yields meant on-chain asset managers became invisible to most of crypto

— Chain Debrief (@ChainDebrief) January 3, 2023

However, as the market cycle shifts away from memes to fundamentals, asset managers could stand to net higher returns https://t.co/dniovi6ehT

With the return of fundamentals, one thing is for sure – retail’s advantage will slowly be chiseled away, much like with equity markets.

There’s No Point in DCA-ing

“Time in the market beats timing the market” is a popular saying amongst crypto influencers.

The phrase is borrowed from the stock market, which has a historic upward trend, and an average return of 10%.

In crypto, however, most coins fall spectacularly from grace.

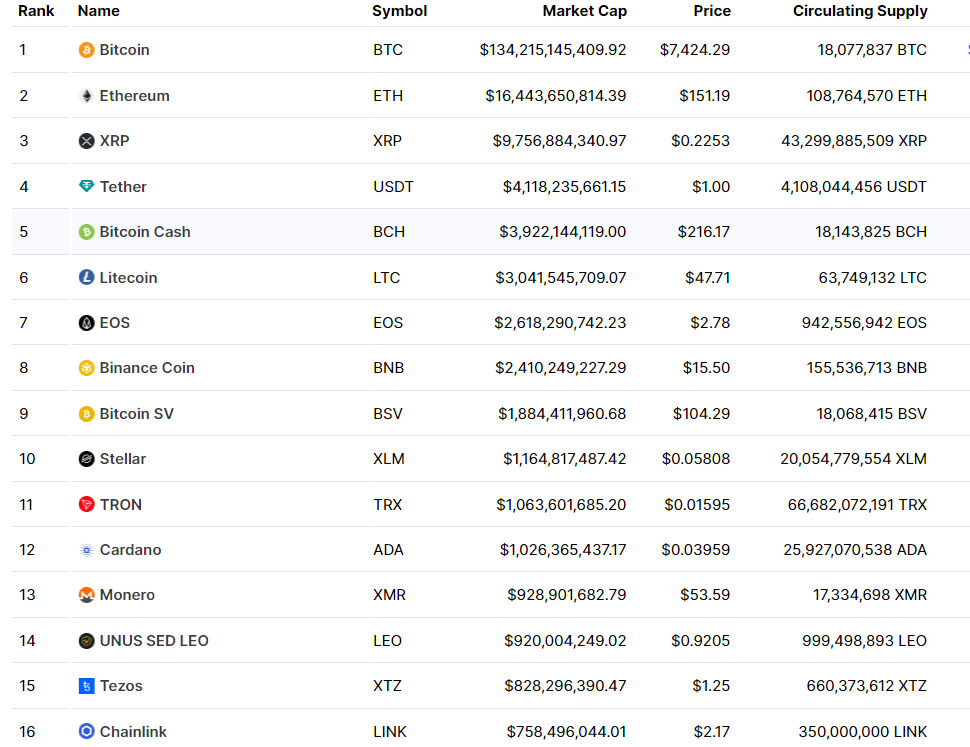

A quick look at the top coins of 2019 shows that many of them have failed to outperform even Bitcoin, aside from Ethereum.

As such, fans of the DCA method have two major outcomes they have to decide between

- DCA into a non-blue chip that is likely to fail

- DCA into ETH/ Bitcoin and not outperform the market

While the latter option is likely a safe 5-10x, factoring in the rugs, volatility, and headaches along the way, it may be best to chase those kinds of multiples elsewhere.

Closing Thoughts

If you’re still here in 2023, it means that you haven’t (yet) given up on crypto. You’re here despite FTX, despite rugs, and despite >99% crashes.

However, pure conviction is not the end all be all. Whether you are a speculator or a builder in the space, theories need to be re-written and past portfolio all time highs have to be relinquished.

Coming into the new year, we should all approach Web3.0, I mean crypto, with a fresh slate.

Also Read: Key Takeaways From Messari’s Top 10 DeFi Trends In 2023

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief