Key Takeaways:

- Klaytn has been performing extremely well during this relief rally

- Their recent partnerships with Binance and Alameda Research, coupled with Defi Kingdom’s migration to the network has given the blockchain a resurgence in activity

- However, their token buyback has introduced some doubt into what is going on behind the scenes

___________________________________________

The last week has seen a much welcome relief rally in crypto, with Bitcoin moving 12% from the lows. However, one altcoin had a major move that went relatively unnoticed.

Klaytn’s native token $KLAY rose 100% in less than a week, outperforming even the Elon-fueled Dogecoin rally.

However, not everything is at is seems. Did the project gain user interest due to strong partnerships and a resurging ecosystem, or is there something else going on behind the scenes?

Also Read: Are Uncollateralized Loans Possible in Web3.0? This DeFi Project May Have The Answer

An Introduction To Klaytn

klaytn is an enterprise blockchain, developed by South Korean internet giant Kakao. Their online messaging application, KakaoTalk, has more than 50 million global users, and is used ubiquitously in South Korea.

The Layer 1 blockchain is built for the metaverse, GameFi, and creators.

Klaytn X @DefiKingdoms is coming soon! 🚀 More details will be revealed during the special AMA held next Monday, 22 August! https://t.co/xTffWvEmjn

— Klaytn (@klaytn_official) August 19, 2022

With DefiKingdom’s recent move to the blockchain, we have seen a resurgence of interest, and Klaytn has not let the opportunity go to waste.

In fact, they have gone all out in both marketing and token buybacks to boost traction for the Layer 1.

While $Klay, like most other altcoins, is down approximately 90% from all-time-highs, it has apparently risen from the dead.

Key Players in The Klaytn Ecosystem

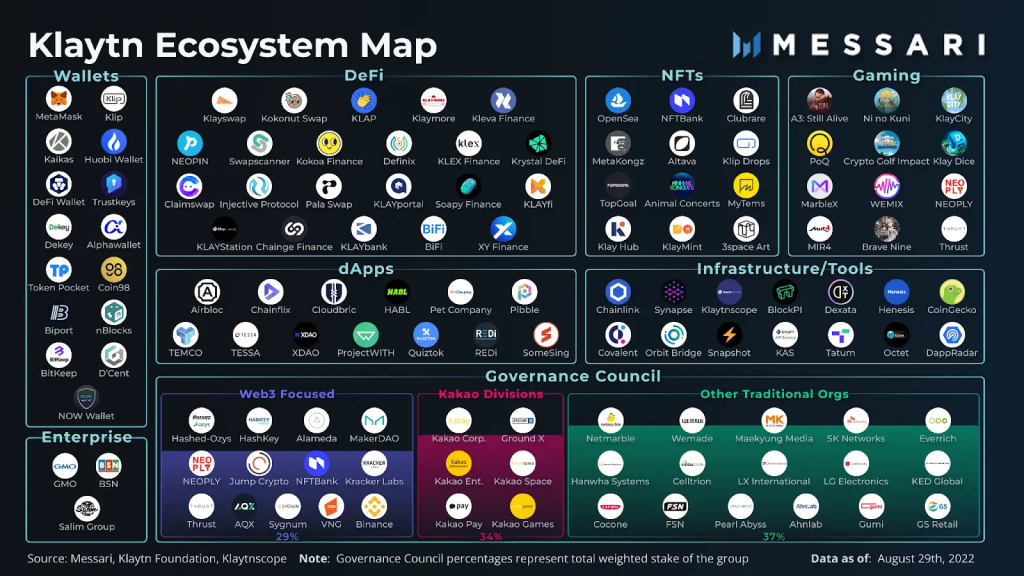

As a metaverse-centric platform, it is no surprise that Klaytn is home to many Web3.0 games, on top of the traditional Dexes and AMMs.

Recognizing this, it became the first non-Ethereum blockchain to integrate with Opensea, and both entities eventually partnered to expand the NFT ecosystem in asia.

Furthermore, Klaytn currently has four service chains, similar to Avalanche subnets, all of which are gaming-focused.

They are operated by

- MarbleX – blockchain subsidiary of South Korea’s largest mobile-gaming company, Netmarble

- NEOPLY – blockchain subsidiary of leading South Korean game publisher NEOWIZ

- Wemix – blockchain subsidiary of South Korean game developer Wemade

- Bora – subsidiary of Kakao Games with its own native cryptocurrency

Outside of these service chains, the majority of Klaytn’s TVL is housed in Klayswap, an Automated Market Making protocol.

Partnerships With Binance and Alameda Research

Klaytn’s governance council is stacked with movers from both the Web2.0 and Web3.0 worlds.

Recently, the blockchain announced that it would be onboarding Binance, a leading centralized exchange, to the council.

Welcome #Binance to join the #Klaytn #GovernanceCouncil. Please stay tuned for what Klaytn and Binance can achieve with our shared vision to foster the sustainable growth of #blockchain! https://t.co/nizMdnsNeP

— Klaytn (@klaytn_official) October 22, 2019

While not much about the partnership is known, it hinted at a possible listing on Binance, and wider adoption of the Klaytn ecosystem.

This followed an announcement earlier this year that Klaytn had recruited Alameda Research as a strategic partner to the ecosystem. Alameda Research is one of the largest quantitative trading firms, founded by FTX CEO Sam Bankman-Fried.

This partnership meant Alameda would actively contribute to Klaytn, with research partner Brian Lee saying that there was “immense potential” in the blockchain’s ecosystem.

With Alameda funding early-stage projects on Klaytn and Binance’s partnerships, the Layer 1 became an attractive place for budding Web3.0 projects to build on.

Did Klaytn Manipulate The Markets?

Likely the biggest factor for $Klay’s massive price spike has been their massive buyback and burn program.

📢 $KLAY Buyback Announcement

— Klaytn (@klaytn_official) October 24, 2022

To stabilize Klaytn’s ecosystem, a buyback is in progress:

1️⃣ Klaytn Foundation's stablecoin reserves will be used

2️⃣ Only through spot purchases from the market (CEX)

3️⃣ All KLAY purchased will be burnt

More details: https://t.co/rRCQr46ndM pic.twitter.com/TpuWawGtzo

However, the team never disclosed how much $KLAY would be bought, and only made the announcement after the buyback in order to “prevent front-running or market manipulation”.

Interestingly, the buyback, which is estimated to be around 6-7 figures, was announced on the same day as their strategic partnership with Alameda Research.

So me and bunch of my friends joined the discords and other means of communications to ask few questions about the buyback + burn. Some of us were nice, some aggro.

— Runner (@RunnerXBT) October 28, 2022

Some of the replies of their team/mods

"and is being strategically executed to minimize market volatility", yikes pic.twitter.com/3rHr7YCGZd

A thread by user RunnerXBT highlights that there were a large number of longs placed prior to the buyback announcement, despite the lack of news.

While these could be entirely up to coincidence, the peculiar series of events points to something shady happening behind the scenes.

Closing Thoughts

If there is one thing we need more of during the bear market, it would be transparency.

Thanks to the many hacks and scams, sentiment has never been worse. Furthermore, depressed prices have translated into a general lack of enthusiasm.

With the average retail participant simply looking to invest in their favourite projects, the manipulation and shady on-goings behind the scenes are not something they should have to deal with.

Instead, clearly communicating a protocol’s intentions and executing in a professional method could be the way to retain and build trust in Web3.0

Also Read: Revealed: Hodlnaut Employees Allegedly Instructed To Withdraw Funds While Users Went Bankrupt