Key Takeaways:

- Earlier this year, Hodlnaut halted withdrawals for all users

- A circular by their interim judicial management shows that certain employees withdraw funds prior to the halt

- The circular also confirms that Hodlnaut misled users on their $UST exposure

___________________________________________

The latest circular from Hodlnaut’s Interim Judicial Managers has possibly revealed shady practices at the company.

In August this year, the cryptocurrency yield platform announced that they would be halting withdrawals, swaps, and deposits for all users, and subsequently filed for Interim Judicial Management (IJM).

However, their actions leading to, and following the IJM, have been shady at best.

Recently, new reports have emerged that certain employees were warned to withdraw funds prior to the platform halting all services.

Also Read: Hodlnaut Updates: What Is Judicial Management And What Does It Means For Hodlers?

The Hodlnaut Saga: A Complete Timeline

The collapse of Terra Luna and 3AC were disastrous for many crypto firms. Heralding the start of a CeFi collapse, the events exposed shady practices and poor risk management in many centralized firms.

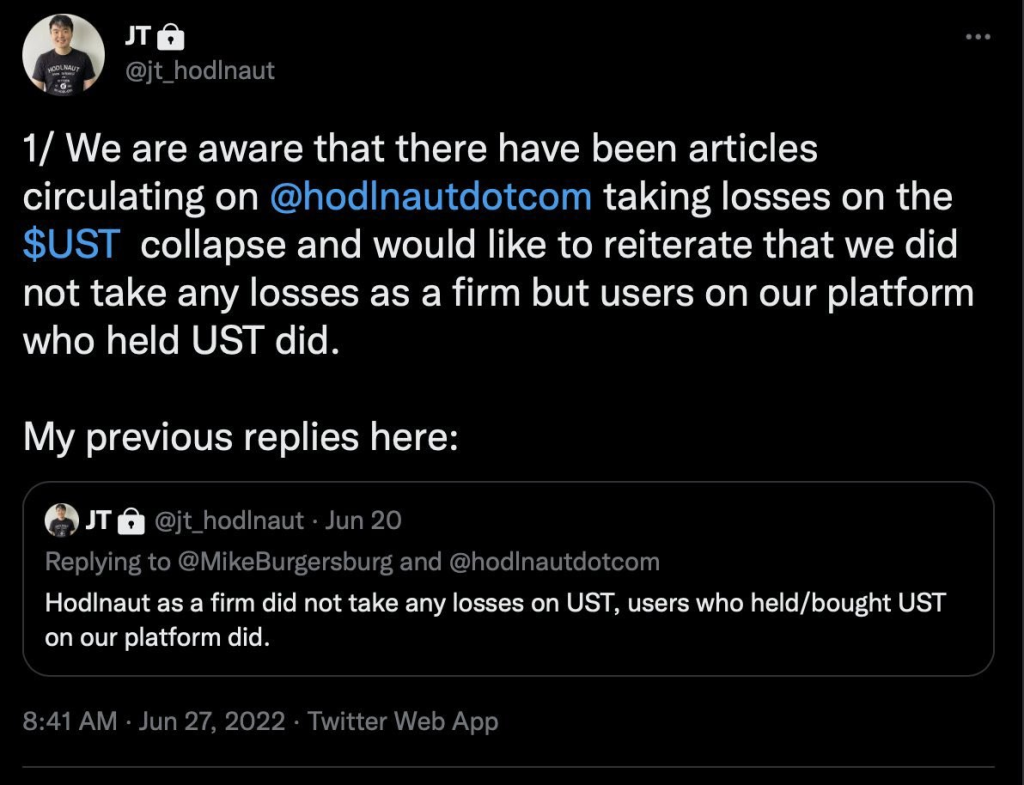

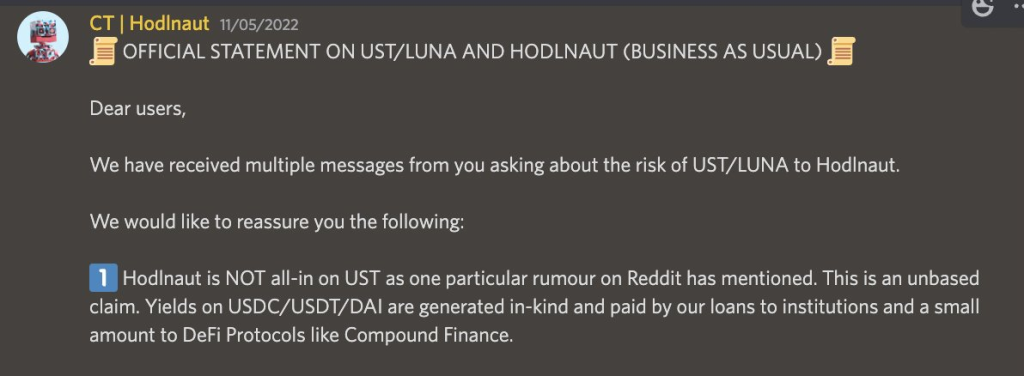

Hodlnaut was one of them, and despite their alleged “lack of exposure” to the Terra ecosystem, it became clear afterwards that they were heavily involved with $UST.

Remember, Hodlnaut only listed UST in April, and claimed that they generated yield in-kind. But this is clearly a lie – before they ever listed UST, they were moving millions upon millions of dollars into Anchor (and were also paying better rates than competitors). (12/25) pic.twitter.com/Tn6zLipQPy

— FatMan (@FatManTerra) June 26, 2022

Not only did they have exposure to $UST, they employed reckless strategies on the way down, attempting to mitigate some losses. This includes selling $UST as low as $0.40, shorting it through margin, and re-entering Anchor post-collapse.

Dear users, we regret to inform you that we will be halting withdrawals, token swaps and deposits immediately due to recent market conditions. We have also withdrawn our MAS licence application. Here is our full statement https://t.co/5KfHUBzWsn Our next update will be on 19 Aug.

— Hodlnaut (@hodlnautdotcom) August 8, 2022

Shortly after, they announced that they were halting services on the platform and filed for IJM.

Also Read: Singapore Police Force May Seize Hodlnaut Funds, Rendering Them Fully Insolvent

Insider Trading at Holdnaut?

With the collapse of Hodlnaut, many users lost access to funds, and some even lost life savings.

However, a recent circular to creditors from their Interim Judicial Managers shows that employees were able to save some funds prior to the platform halting.

Singapore IJM report indicates that certain Hodlnaut employees were warned to withdraw funds before the withdrawal halt was applied to all other retail investors. The report also confirms that Juntao Zhu and Simon Lee constantly lied about the firm's UST exposure. pic.twitter.com/AuxsXASZzx

— FatMan (@FatManTerra) October 27, 2022

Almost $1 million in funds were withdrawn by certain employees, who may have had insider information of what was going to happen.

Moreover, the report confirmed that management lied about their exposure to $UST and the Terra ecosystem, intentionally misleading customers on their risk management protocols.

The platform had also continued to promote their services following the fall of Terra, which may have led to even more customers depositing their idle funds.

Hodlnaut has been placed under Interim Judicial Management by the Singapore court, and yet it seems like they have just deployed 1,999 stETH (~$3mn) into @ribbonfinance Covered Call vaults, even though users have not been able to withdraw funds.

— lawrence_xyz | Qatar World Cup 2022 (@law_xyz) September 2, 2022

Here's the screenshot below 👇

The platform also continued to enter risky positions such as covered calls on ribbon finance, despite being their IJM.

Hodl-Not Your Funds in CeFi

The CeFi domino effect triggered by 3AC and Luna has been painful to not just those in the ecosystem, but the majority of crypto users.

The silver lining, however, is that DeFi has performed as intended, despite choppy market conditions. While exploits and hacks have been painful, the underlying protocols highlighted the benefits of smart contracts and decentralization.

On the other hands, CeFi platforms have only made headlines for the wrong reasons. The easy $UST arbitrage opportunities coupled with risk-on activities for supposedly “safe” platforms are not what Web3.0 needs, especially in the bear market.

Also Read: Can We Trust Centralized Exchanges? Why I Am Moving All My Funds Out

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief