Over the past month, Solana has garnered significant attention from the cryptocurrency community, with its native token (SOL) registering a 50x-70x price increase year-to-date, propelling it into the top 10 cryptocurrencies by market capitalization.

For those unfamiliar with Solana, it is similar to Ethereum in that it is a web-scale open source blockchain that allows decentralized apps and marketplaces to be built on it.

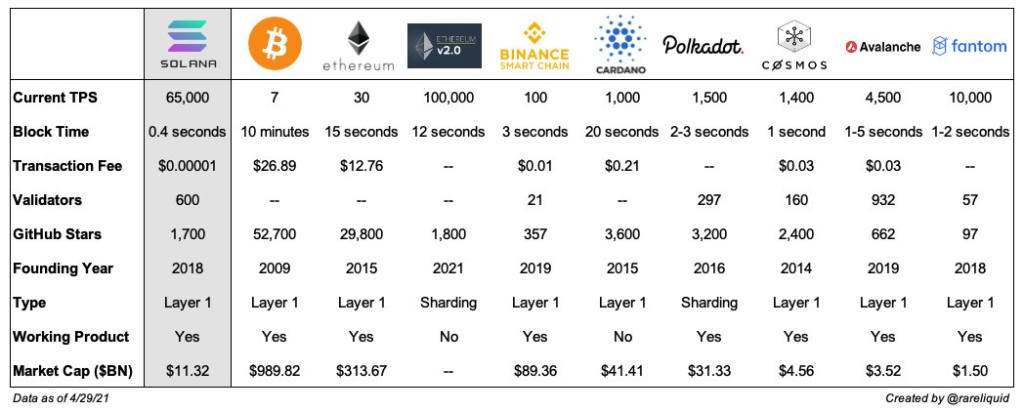

Solana uses a combination of proof-of-stake and proof-of-history consensus mechanisms to improve throughput and scalability. The network supports 50,000 transactions per second, faster than what Ethereum can support.

Why you should still buy Solana

There has been debate on whether to buy Solana recently, especially since the price has gone up. Here are some reasons that support a call to buy Solana now:

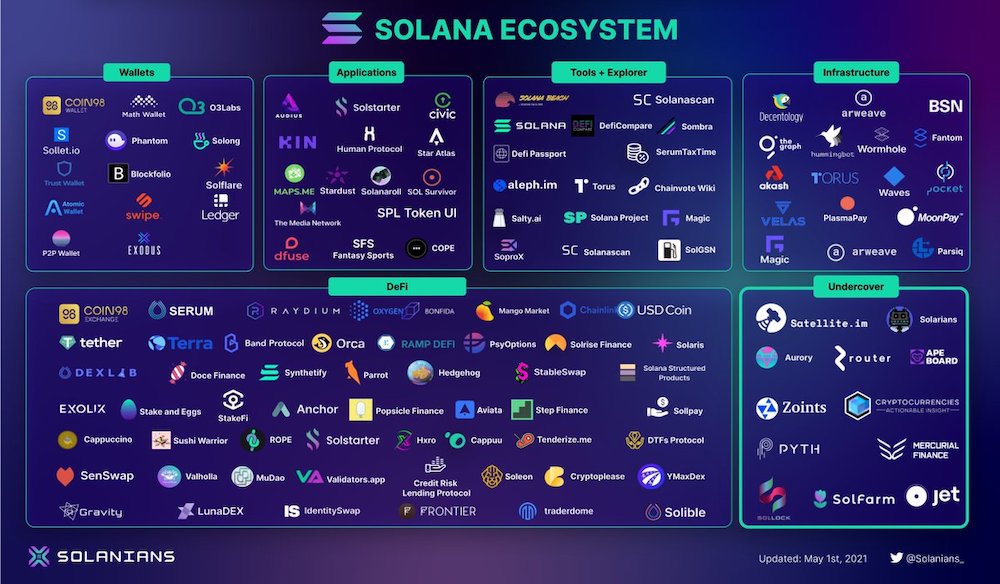

As Solana has increasingly demonstrated its value proposition to developers, the number of protocols running on it have grown significantly, with a total of 302 at the time of writing (compared to 47 in May this year).

However, this still lags behind other blockchains such as Ethereum, which has over 3,000 decentralized applications in its network.

Popular decentralized applications (Dapps) on Solana include Rayduim (leading decentralized exchange in Solana), Mango Markets (cross-margin trading and lending), and SolFarm (yield aggregation). Solana’s native token, SOL, is also listed on all major exchanges, including Coinbase, FTX, Binance, and Gemini.

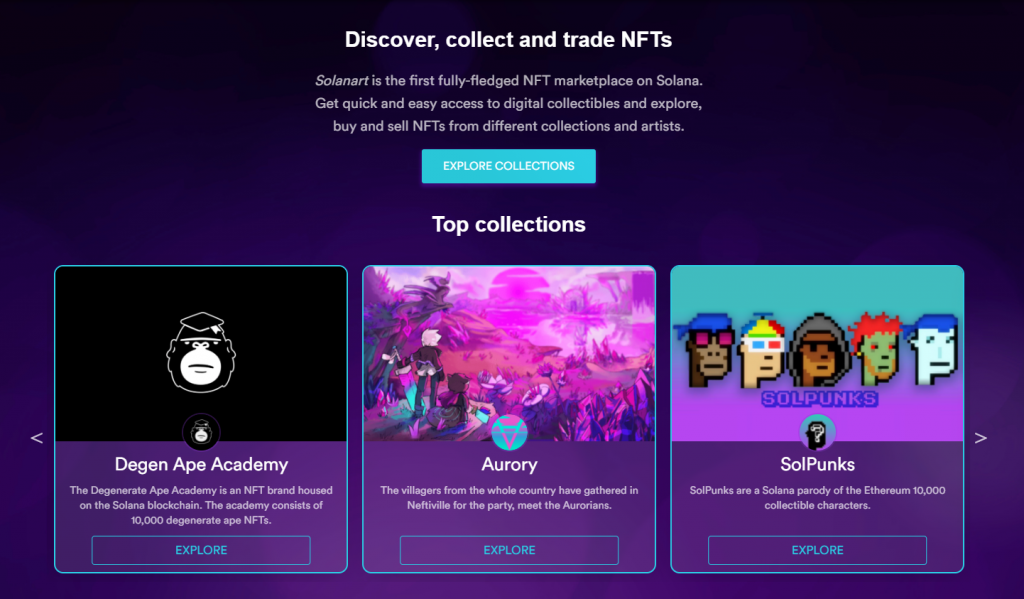

The popularity of new segments such as play-to-earn gaming and NFTs in the cryptocurrency space offers a large white space opportunity for Solana, given the large user bases and high transaction volumes involved.

Several high profile games are set to be launched on the Solana network. This includes Star Atlas, a space-themed, mass-multiplayer, virtual gaming metaverse.

While the Ethereum network is in the process of upgrading, many users continue to be frustrated by high gas fees and network congestion, particularly at times of ‘peak’ usage, such as during limited NFT releases and NFT gaming events.

This has led to a rise of NFT projects on the Solana ecosystem too.

As more developers join the ecosystem and build new protocols on Solana, it will be exciting to see how the network develops in comparison with its more mature peers such as Ethereum and BSC.

Solana is also one of the most popular Layer 1 blockchain now that is enjoying a L1 DeFi Summer 2.0.

If you believe that Solana is here to stay and there will be more projects being built on the Solana ecosystem, Solana is a good project to look into.

Reasons not to buy Solana

While there are proponents of purchasing Solana, there are also reasons why it might not be a good idea to buy it just yet.

Chasing the high is always not a good practice as this is a sign of overbuying. In just 2 weeks in end of August, Solana grew over +300%.

Expectedly, the price of Solana has retreated from its high of $210 to currently $140, a drop of 40%.

Recently too, Solana was hit with a bad incident — where ‘intermittent instability” had disrupted some services last Tuesday, after Solana’s transaction load peaked at 400,000 transactions per second.

“These transactions flooded the transaction processing queue, and lack of prioritization of network-critical messaging caused the network to start forking,” Solana’s team said on Twitter.

Unlike Ethereum which has a 100% uptime, Solana crashed after a wildly popular project launched on its platform, sending questions on how secure and reliable is the Solana blockchain in handling throughput. Did Solana’s blockchain infrastructure sacrifice reliability for scalability?

This is actually not the first time Solana blockchain went down. In December last year, the Solana network had to be restarted too when the network went dark briefly.

Update: The network is live again and functioning as normal.https://t.co/8j5sVgA9OS https://t.co/4H5ZQMn82R

— Solana (@solana) December 4, 2020

While many may be confident that Solana is a strong contender to be the next Ethereum killer, Ethereum has been enjoying 100% uptime and has the most decentralized applications built on it. It will be hard to convince all existing applications to move their funds and users over to the Solana blockchain.

At times of uncertainty, projects will always choose a flight to safety, and will likely go back to Ethereuem, the proven OG blockchain. Other than Ethereuem, there are also several other blockchains such as Avalanche, Harmony One, FTM that promises high scalability. They all pose as competition to Solana, and are trying to compete for a slice of the DeFi pie.

In the DeFi space where it is a zero sum game, developers and decentralized applications are always looking around to deploy their projects on new blockchains which commonly dish out high rewards and funds in order to attract more projects.

Here’s a thread on what’s next for Solana:

0/What’re the next steps for @solana? A thread

— S◎lanians ☀️ (@solanians_) September 18, 2021

In the “cool down” time like this, it’s a great chance for us to slow down and look for what the ecosystem need

This thread will share some of our views on what is lacking and what we think will trigger the next explosion on Solana

2/ To find the answer to this problem, we have tried to create a pool on Solana. What’s surprised us is that right now, Solana doesn’t have a Permissionless AMM.

— S◎lanians ☀️ (@solanians_) September 18, 2021

4/ To scale faster, we need a place where everyone can create a permissionless pool, just like Uniswap or Pancakeswap.

— S◎lanians ☀️ (@solanians_) September 18, 2021

6/ Right now, the only AMM we see that meets the criterias is @Saros_Finance. If other projects have this idea or are about to implement it. Feel free to share here, would love to share your project with the community.

— S◎lanians ☀️ (@solanians_) September 18, 2021

8/ – Almost all money flow into the Solana is for the stable farm from Saber and Sunny

— S◎lanians ☀️ (@solanians_) September 18, 2021

– Others are locked to join the IDO on Solanahttps://t.co/UNxCB353Xv

10/ Also, the money needs to be in motion (margin trading, options, perpetual)

— S◎lanians ☀️ (@solanians_) September 18, 2021

> That’s why the next step in Solana might be Lending/ borrowing and Derivative

12/ But right now, Serum and other projects will need to do more to enhance user experience

— S◎lanians ☀️ (@solanians_) September 18, 2021

For example, when we bought ships from @staratlas marketplace, we had to settle the order on Serum, and to settle the order, we have to find the market ID of different ships

14/ NFT

— S◎lanians ☀️ (@solanians_) September 18, 2021

NFT is also a niche that attracts a lot of attention on Solana, but the problem we see right now is too many collectibles.https://t.co/OgjoyB9RqS

16/ One of the potential niches we would love to see is Gaming x NFT

— S◎lanians ☀️ (@solanians_) September 18, 2021

Games coming to Solana is mind-blowing, with the fast txs and cheap fee, Solana provides one of the best places to build quality on-chain games

Next step >> Use your NFT, not just buy ithttps://t.co/exbaLNTFdH

18/ This led to a network outage, and this happened likely because of bots spamming txs on the network.

— S◎lanians ☀️ (@solanians_) September 18, 2021

These are the various reasons for and against buying Solana now. It is also important for investors to do their own research to determine if it is worth purchasing Solana.

Also Read: An Introduction To Solana – Why It Is The Hottest Blockchain Right Now