Derivatives are contracts between sellers and buyers to trade an underlying asset at a specific price and date, the major types of derivatives are Options, Futures, and Perpetual contracts.

While Bitcoin’s momentum has quelled following a quick rise to Year-To-Date Highs, data surrounding derivatives have continued to rise. With a rise in open interest generally corresponding to bullish price action, let’s analyze analytics surrounding Open Interest and Futures Contracts and delve into what it could mean for Bitcoin.

Also Read: Technical Analysis Basics – How to Identify Support and Resistance

The Contango Dance: Derivative Data Outpaces SPOT Traders

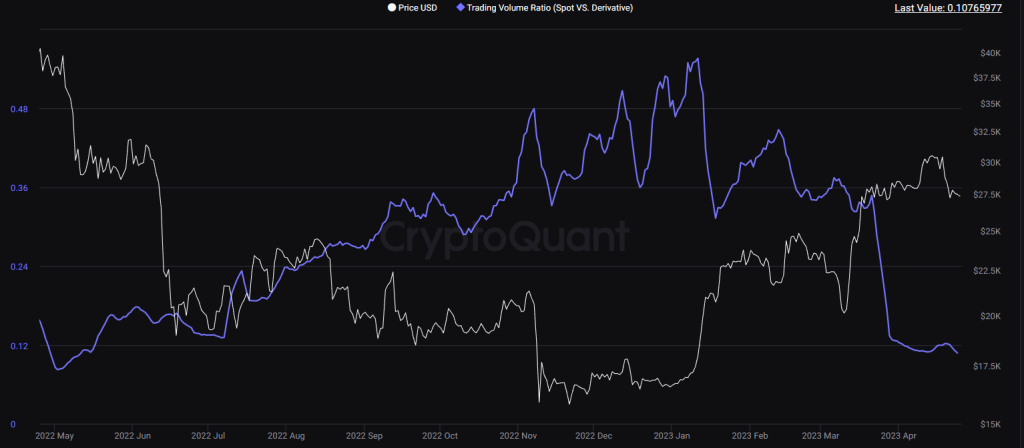

The ratio of spot trading volume to derivatives trading volume has been declining steeply since March 26th, although spot trading volume increased in March by 9.6% it can’t be compared to the 46.8% increase in derivatives, indicating that crypto investors and traders are moving towards crypto derivatives.

Analytics platforms reported as per March, data shows that Bitfinex, Deribit, and Gate were the top three exchanges that showed an increase in the amount of derivatives trading.

They recorded an increase of 123%, 112%, and 66%, respectively.

Meanwhile, the top three exchanges for spot trading were Gate, Bybit, and Bitfinex, increasing correspondingly by 117%, 113%, and 61%.

Futures market trends and #BTC

— Woominkyu (@Woo_Minkyu) April 17, 2023

In the futures market, analyzing the "net_volume" movement, which represents the difference between long and short position volumes, using a 72-day moving average can help to some extent in predicting #BTC price fluctuations.

*Long position… pic.twitter.com/9AGHyLfO92

Although Bitcoin derivatives traders don’t necessarily own Bitcoin, derivatives can be used to tell the sentiments around Bitcoin more long positions might reflect bullish sentiments while more short positions may translate to bearish sentiment.

Rise in Open Interest Fuelled Q1 Momentum

Open Interest (OI) is the total number of open positions by market participants at any time, while Trading Volume accounts for all the contracts that were traded in a given period.

Open Interest is calculated by summing up all the opened positions, regardless of whether they are long or short, and subtracting those that have been closed.

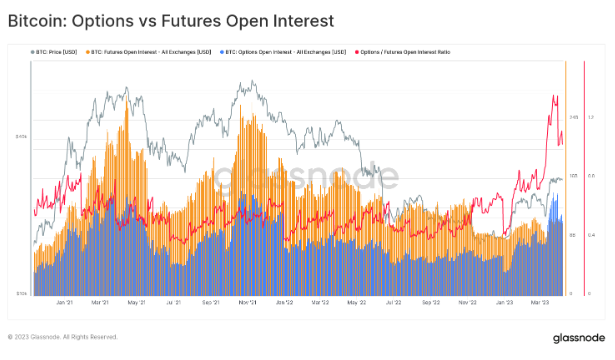

Options open interest in Bitcoin skyrockets to a record high of $10.3 billion over open interest in futures which was at $10 billion as reported by Glassnode.

Glassnode reported that the soaring Open Interest stems from traders buying up large amounts of call options in Bitcoin, which give them the right but not the obligation to buy BTC at a certain price regardless of the actual spot price.

This data indicates the possibility of a bullish continuation.

There are more than 242,838.BTC worth of open call options, while Put options are at 134,755.64BTC with a Call/Put ratio of 1.8, indicating a difference of 10,808,305BTC at the time of writing.

Open interest for options started increasing on the 12th of March peaking on March 31st its highest peak since November 2021.

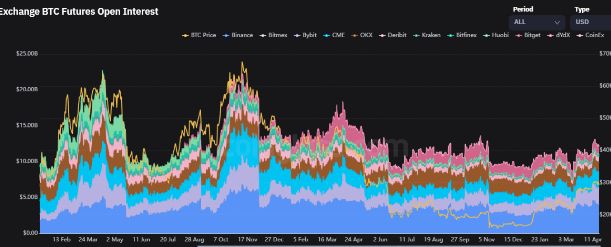

As for futures, the chart have been somewhat flat across exchanges although futures volume and open interest saw a few spikes in March.

The Bottom Line

When call options outweigh puts options it may translate to bullish sentiments, with a larger margin indicating stronger bullish sentiment.

It can be observed from both charts that the Open Interest of Bitcoin derivatives has a positive relationship with the price action of Bitcoin.

So bullish or bearish sentiments in Bitcoin derivatives will eventually reflect on the price of the underlying asset which is Bitcoin and vice versa.

More bullish sentiments, therefore, indicate the possibility of upward price movement of Bitcoin.

With this information it is no surprise that in Q1 2023 where Bitcoin derivatives saw a great increase propelled by more call options the price of Bitcoin also had an 80% increase YTD.

Finally, it is unwise to rely on a single indicator when making trading decisions. Open interest can be combined with the price and the trading volume to have an idea of the current market sentiment.

Also Read: Stay Ahead Of The Crypto Curve With These 5 Charts

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief

This article was written by Godwin Okhaifo and edited by Yusoff Kim