The Terra ecosystem has been bustling with activity ever since the Columbus 5 upgrade concluded successfully in early October. Fast forward to today, we have had at least half a dozen protocols launched and I have never been busier keeping up with them.

During this time, I have written on some such as Nexus and Stader, reviewing on how they will value add to the ecosystem. As the ecosystem progresses, so does the complexity and the choices available for high APR strategies.

For most of us, money is a finite resource and sometimes, it can be challenging to keep up and decide where to shift your money to next. From the way I see things, there seem to be two main tactics that most people go for these days.

Firstly, there are high-yielding farms in the 3 digits range from new projects such as Valkyrie and Nexus. However, the volatility of those tokens are pretty crazy. Even with the insane APRs, impermanent loss (IL) could wipe out your gains in a short span of time. Just look at Valkyrie’s chart for example.

Secondly, another easy money-making opportunity is to ape into Initial Dex Offerings (IDOs). However, the process of getting an IDO spot is long and arduous.

Even then, you might not be guaranteed an allocation because of bot activity. Being able to discover such gems of an opportunity would require you to follow the Terra ecosystem very closely which requires a fair bit of time. However, with the unhappiness surrounding bot activity, newer projects are opting for more novel strategies.

One such example is pylon scout. While this levels the playing field in allowing everyone to get a chance to participate in the IDO, it eliminates the possibility for a quick 10x. To be honest, this is the main attraction of an IDO, where everyone hopes to make a quick buck upon token listing.

To sum it up, both tactics require either a strong stomach for volatility or time spent keeping up with the latest updates to be the earliest adopter. This got me thinking if it could be sustainable in the long run.

While reflecting on these two issues and feeling like I’ve missed out a lot, I realized that I have a strategy that has been running like a well-oiled machine in the background since I started my exploration of the Terra universe.

Enter Mirror Protocol.

Overview of Mirror

Mirror, which launched in December 2020, is a DeFi platform that allows users to issue and trade synthetic assets. These synthetic assets are largely shares that track the price of real-world assets such as shares of Tesla, Apple, and more.

It is similar to buying and selling shares on Tiger or Moomoo, except that you can buy in fractions (Think buying $10 worth of AMZN at a time).

Anchor, which launched in March 2021, is essentially a savings protocol offering low-volatile yields on Terra stablecoin (UST) deposits, which is the Terra ecosystem’s native stablecoin.

Despite the short timeframe, these two are arguably the grandfather protocols of Terra.

Why Mirror is my favourite farm

As I contemplate the potential of each new protocol, I’m constantly benchmarking them against my strategy on Mirror protocol.

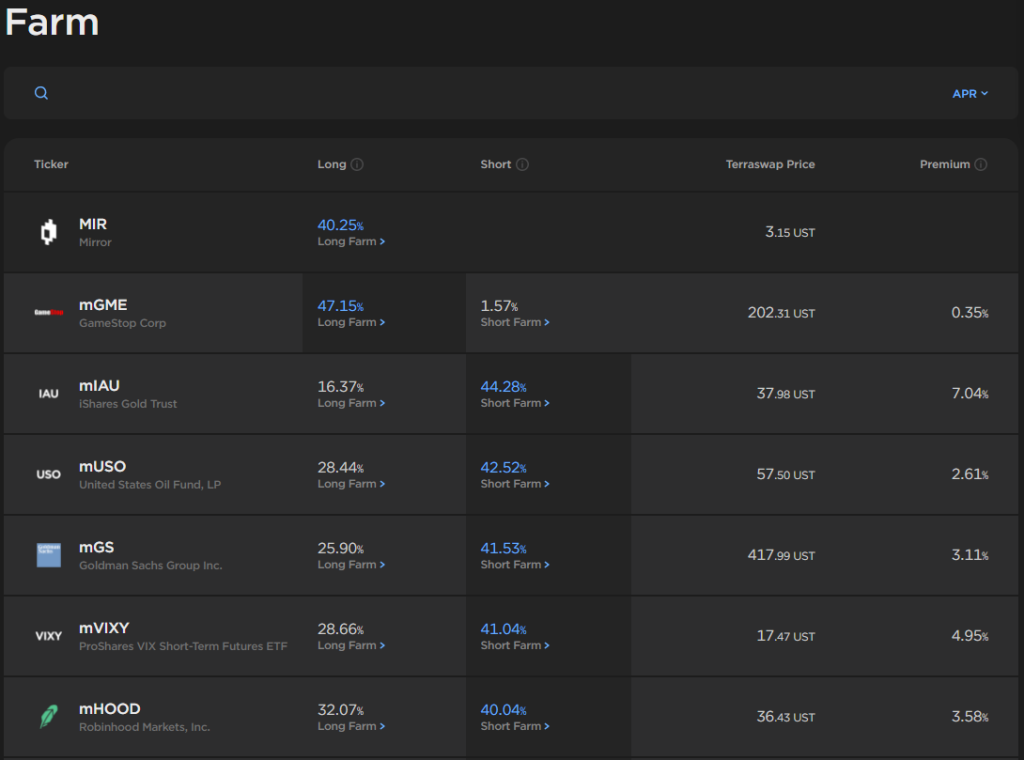

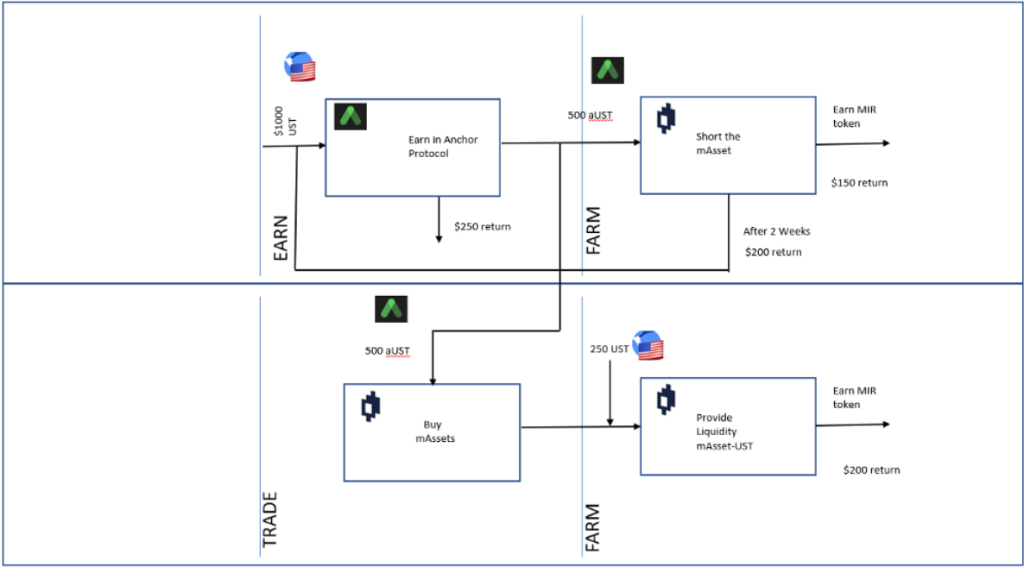

On Mirror, I use a delta-neutral strategy which allows me to get yield from three places. The yield comes from Anchor Earn, and both the short and long farms on Mirror.

For the uninitiated, a delta neutral strategy basically utilizes multiple positions, in this case two, to ensure that any price movements in the underlying asset cancels out and brings the net change to 0.

The biggest attraction for me was the ability to use aUST from Anchor as collateral when short farming on Mirror. This was the first time I had the opportunity to earn yield on yield and I knew I had to grab it!

Strategy

So, what is this strategy and how does it work? Let me outline how you can go about setting it up yourself in 4 simple steps. For a more detailed explanation, you can check out this video instead. Assuming you have 1000 UST to farm:

- Deposit two thirds of it in Anchor Earn (i.e 666 UST)

- Short farm an mAsset of your choice, using aUST as collateral, at 200% collateralization ratio on Mirror

- Immediately buy the same amount of mAsset that you are shorting using the remainder of your principal (ie 333 UST)

- After the two weeks lock up period, you can claim the locked UST and either a) put it into Anchor Earn (0 IL) or b) open a long farm position with the mAsset you bought in step 3. Do note that the strategy in b will expose you to some IL

*Do take note that a 1.5% fee of the minted value will be incurred when closing out a short position.

Personally, I have been using this strategy with mBABA since August. It has been great so far for two reasons.

Firstly, returns from this strategy have been hovering around 40-50% APR based on the past 30-day rolling average according to mirror tracker.

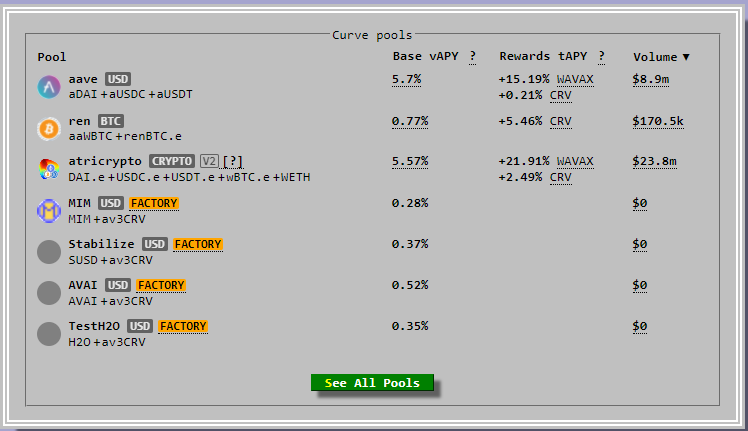

This means that I have been earning at around this rate or higher since August. You could liken this to the pools in Curve, except that the APR here is higher and does not fluctuate as much. Another plus point is that there is no IL. The example shown below are farms on the Avalanche network.

Secondly, I really like the fact that the price of MIR has been rather stable (as compared to newer farm tokens). It has been in the $3-4 range since August. As such, I know that the tokens I earn won’t drop in value drastically, wiping out my profits.

In short, this strategy presents predictable and stable returns. Furthermore, the only risk I’m exposed to is liquidation risk. This is besides systematic risks such as smart contract risks that cannot be eliminated regardless of the farm.

Apart from this, one consideration would be the length of time spent in this farm. Generally, the longer you remain in this farm the better because of the 1.5% fee when closing out your short position.

Why you can consider it

This strategy that I have described above might sound intimidating and complex. However, it is relatively easy to follow if you watch the video I’ve linked above. Furthermore, there are many articles out there that give a step-by-step guide as well.

As mentioned earlier, the risk with this strategy is the possibility of being liquidated. This can be alleviated by farming less volatile assets such as gold (mIAU) or silver (mSLV). This is in addition to starting with a 200% collateralization ratio. Of course, the farming rewards will be lower but as long as it outperforms Anchor Earn’s 19.5%, I would say it is worthwhile.

If you are waiting for an automation of this strategy, you can look forward to the delta-neutral vault by Nexus protocol. It should launch by the end of this year or early next year. The vault essentially manages the risk of liquidation while automating all the above steps for you.

Conclusion

Everyone has their own investing style but the world of crypto is such that one would feel FOMO when not going for the highest yielding play. While it may be worthwhile figuring out the next opportunity for you to 10x your money quickly, it could sometimes be best to take things slow and easy. After all, we are in this for the long haul.

Hence, it may be worth considering going for less risky strategies which return stable yields as part of your portfolio. As a famous American economist once said, “Investing should be more like watching paint dry or watching grass grow”.

Stop staring at your Discord page or Twitter notifications incessantly. Take a break and go out and enjoy the warm sun on your face occasionally. There’s no shame in going for lower yielding, yet more stable farms!

[Editors Note: This article represents the writer’s personal opinion and does not constitute financial advice. Please do your own research and readings before committing your capital to any farms.]

Featured Image Credit: DeFi Prime

Also Read: A Guide to Liquidity Pools: Key Factors to Consider Before Getting Started