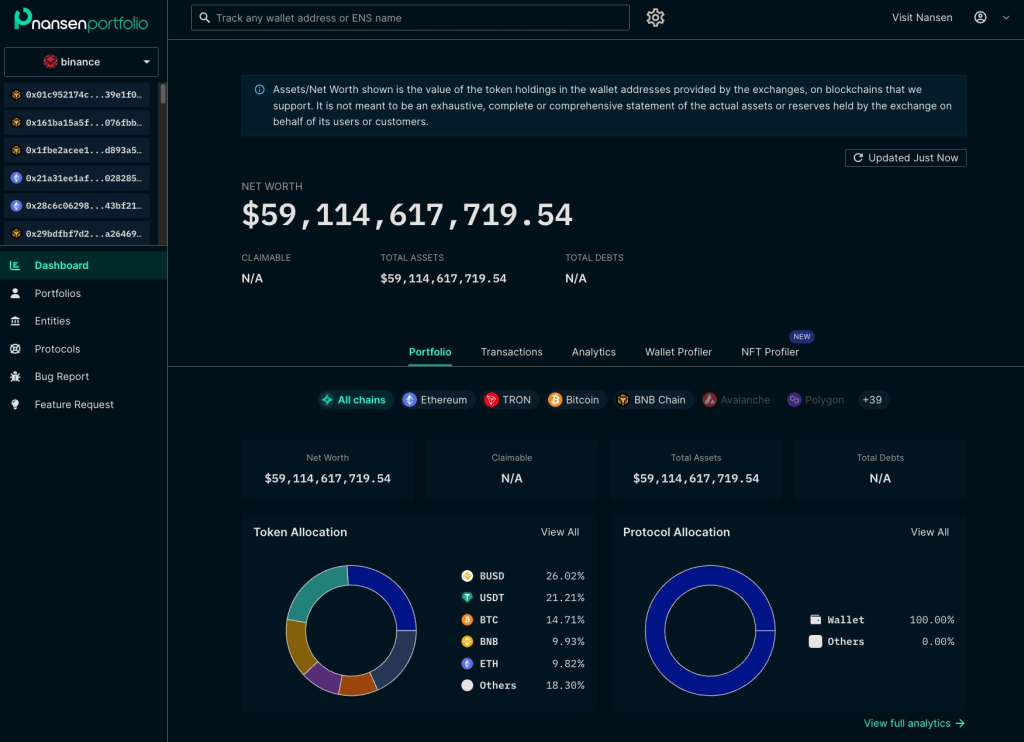

Although highly unlikely, history has a way of either repeating itself or proving us wrong. In our previous article, we looked into the proof of reserves of Binance and found out that on the “clean reserve’ scale, they are closing in on the 90% mark. Today, we talk about the entirety of Binance’s FUD, but not with the intention of spreading it but bringing awareness.

Read how We Used On-Chain Data To Look Into Binance’s Proof Of Reserve.

As the clock continues to tick, time has its unique way of revealing truths. It is only a matter of time, and until then, your main goal is survival. By that, I mean protecting your funds by getting them all under self-custody and out of the centralized exchanges your regularly patronize.

The clock is ticking, “you have only a few hours/days left to withdraw from exchanges.”

The mysterious case of minted BNB

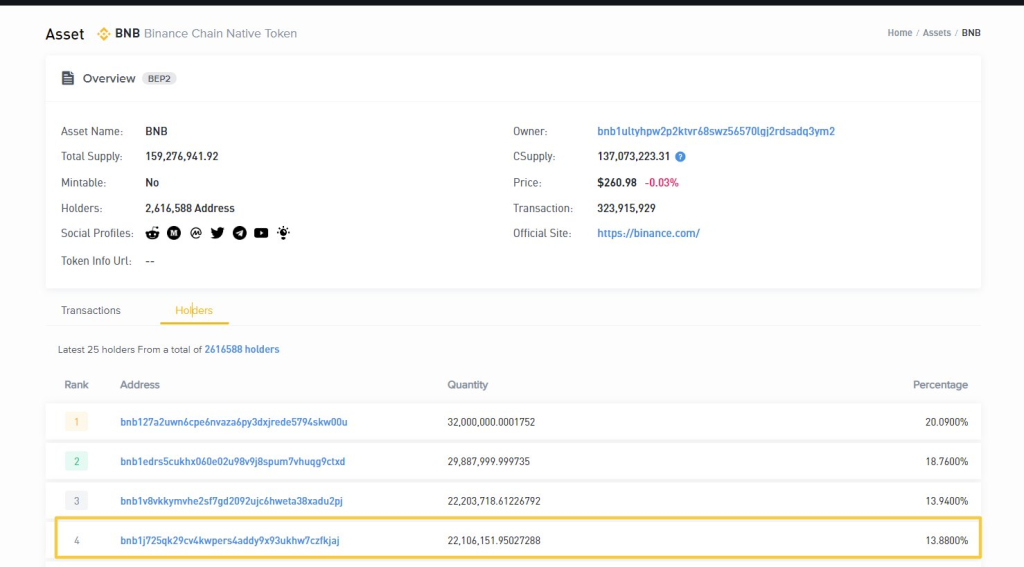

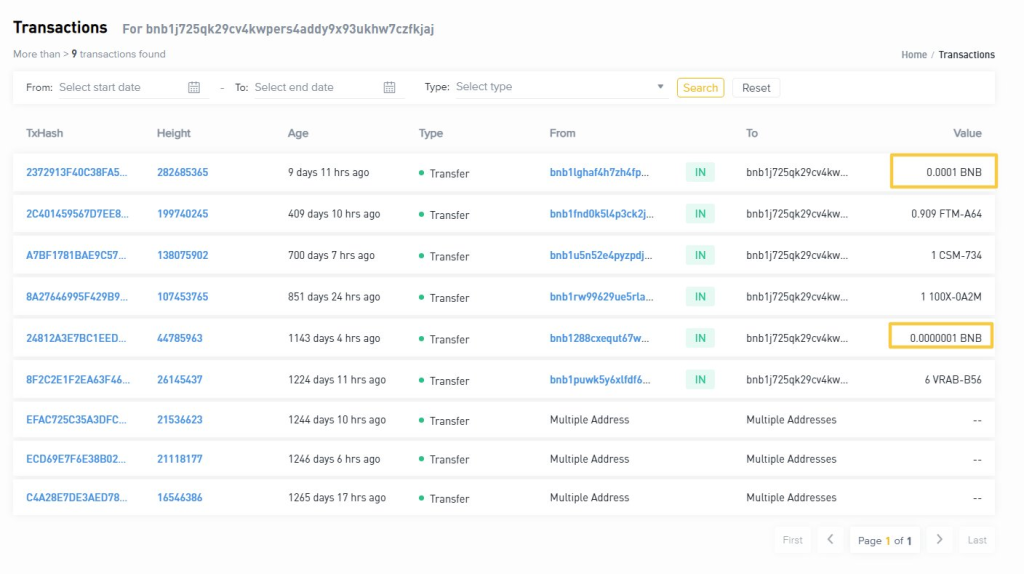

Call it sus as you may, but the fourth largest wallet, which holds 22M worth of BNB, has no transaction history of funds being deposited. One beauty of the blockchain is its open-sourced nature, so this wallet is particularly interesting.

With only nine recorded transactions to its name and two deposits for less than 0.0001 BNB, it begs the question, where on earth did the 22M BNB come from?

Now 22M BNB is worth ~ $5.7B. That is no amount you would have oversight on, but it has been left unaccounted for.

There are so many questions about the “BNB Printer” I have right now. Firstly, are they inflating reserves? We know how that ended up with the entire FTX saga. Secondly, could it be that they are purposefully masking certain transactions?

Also, the top 10 wallets hold 152M BNB, all of which are connected to Binance's declared wallets by large deposit & withdrawals (excluding the glitch wallet above).

— Cryptohippo (@cryptohippo65) December 16, 2022

Binance has only declared 38M BNB as their hot & cold wallets on their reserve page.https://t.co/nfb2PxWVSx

Could Binance has way more BNB than it declared in the reserves? What are the implications of this?

The hidden risks holding BUSD

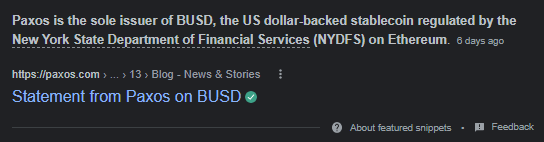

Did you know the issuer of BUSD (Binance USD) is not Binance themselves but involves another entity called PAXOS?

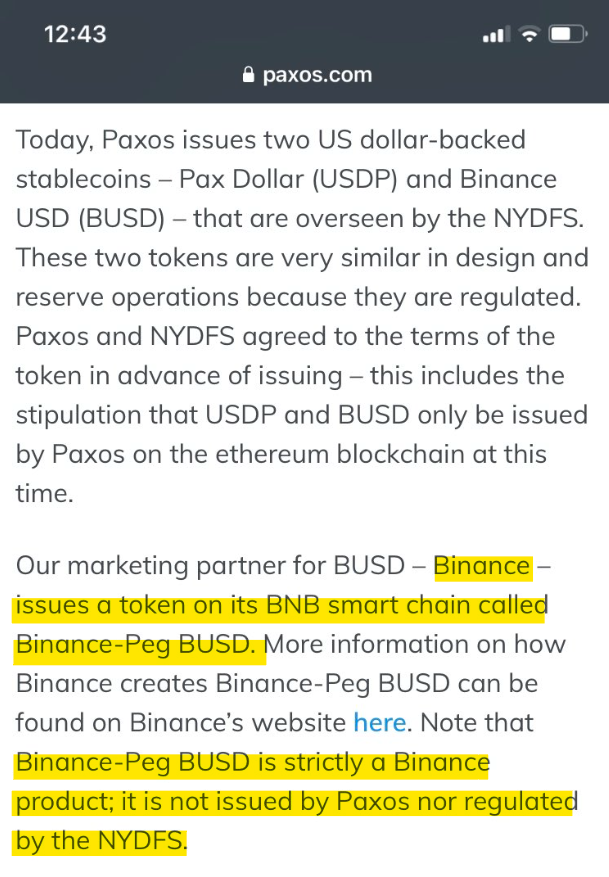

According to PAXOS, BUSD on Binance smart chain is created by Binance, which is therefore not regulated by NYDFS.

Here is where we have to tread carefully. It has to be clear that USDP and BUSD are two different stablecoins, and not all BUSD is regulated. They are not all the same, either.

TLDR, the only BUSD which are regulated are on the Ethereum blockchain; anywhere else is simply synthetics.

Again, reading this a little further made me ponder a few questions, could this be a similar case to how FTX used FTT? If naming conventions are purposefully masked, I wonder how far they would go to hide other things. But of course, these are all speculation; they are innocent until proven guilty.

It might be wise to get out of any BUSD, and once the dust settles, you can decide to re-enter again. But the main takeaway should be the first part of the sentence, to get out.

Chinese exchange cartel?

There is some circulating evidence to suggest that Chinese exchanges sent large amounts of funds to each other right before the world demanded proof of reserves, which did its ‘cleansing’ of centralized entities.

You can see signs of this "Coordination" with Justin Sun/Huobi and Tether both loading capital on to Binance to protect it this week. Crypto .com and Gate were also doing something similar in November. This is simply not coincidental.

— Mike Alfred (@mikealfred) December 15, 2022

I subscribe to the idea that there needs to be balance at this stage of web3 and crypto. This can be in the form of crypto and regulation, privacy and open-sourced nature, and how centralized entities play a part in laying the groundwork of web3.

But if this turns out to be accurate, faith in any centralized entities will be zero. And so will crypto as a whole.

Not all coins are made the same; some are better than others.

The proof of reserve from Binance shows us that BTC & ETH make up only 24.5% of the reserves, while BUSD, USDT & BNB alone make up 57% of the reserves.

The low amount of BTC on the exchange reminds me that FTX had no Bitcoin in its wallets when it failed. These are just some PTSD thoughts; it could be my spidey senses, though.

When BTC and ETH are entirely drained in this reserve, do investors get their funds back in BNB? or maybe BUSD (which one, though, lol)?

It now has to ring some bells, centralized entities and their native tokens. Now That FTX has Broken The Trust For Everyone, What’s Next For Us?

Different company, same message?

This could be the stars aligning, pure coincidence or people at the top have a handbook titled “a dummies guide on how to console crypto investors”.

Here are some sources for both Binance and Celsius CEO telling us that retail investors will lose their crypto in self-custody, likely implying that we should leave our coins with them instead.

And here’s one of Alex Mashinsky of Celsius.

Hey Bitcoiners w/ coins on @celsiusnetwork, PLEASE see what @mashinsky has to say about you, in his own words.

— Cory Swan.com (@coryklippsten) May 17, 2022

DM me with proof that you’ve withdrawn 1 BTC or more from #Celsius to self-custody, and I’ll give you 1 year of membership in @SwanBitcoin Private Client Services FREE. pic.twitter.com/QjsEFe5n4I

People in management are stepping down

I know of at least 7 @binance executives that have left the firm in the past 60 days. 🤔🫣

— Andrew (@AP_ArchPublic) December 9, 2022

Remember the head of Alameda Research, Trabucco, stepping down right before the fallout of FTX? If you need any indicator, people in management stepping down and, after that, the company failing could possess a higher success rate than the RSI and Bollinger band indicators you use for trading.

LOL.

— Mike Alfred (@mikealfred) December 13, 2022

Among the funniest and most frightening things about this company is that no one knows the name of the corporate parent, the CFO (may not exist), or any board members.

One of the most deceptive and nefarious large companies in human history.

But this, again, might be very well untrue. So let me slap that “allegedly” sticker first.

The common denominator is the auditor

Armanino LLP.

That is the auditor that all these Chinese exchanges use.

Nexo, FTX, Gate, Kraken all share the same "auditor" who doesn't audit but issues attestations

— otteroooo (@otteroooo) December 16, 2022

Same "auditor" no longer wants to issue attestations or write rubbish proof-of-reserves used to mislead (assets published, liabilities not)https://t.co/5qfZW7DaxV

This could be another successful indicator; you must run faster when the auditor runs.

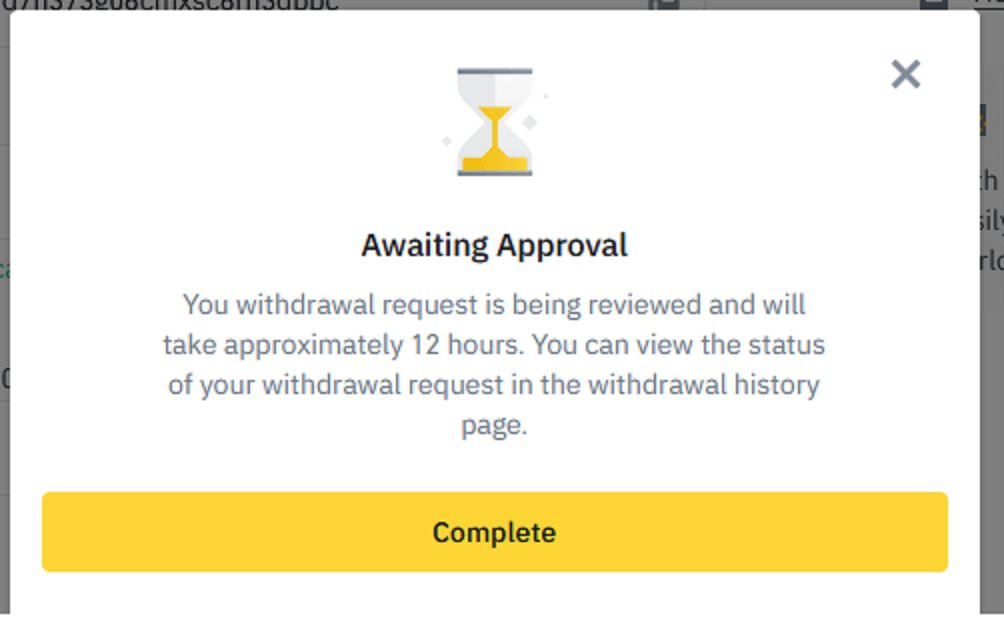

Blocking withdrawals

These two don’t add up.

Exhibit A

Alright guys, time to put a countdown timer on the collapse of Binance.

— Bitfinex’ed 🔥🐧 Κασσάνδρα 🏺 (@Bitfinexed) December 15, 2022

CZ just completely bombed an interview, be sure to watch this whole clip. pic.twitter.com/hchP5aZkYu

Exhibit B.

Still looking for answers to why Binance has to make customers wait 12 hours to take their coins off the exchange when they said they are in a good financial position.

Could all these be delay tactics?

Closing thoughts

While you can, there is no better time than now. Now is the best time to be self-custody. Watch how things unfold from afar; being part of the audience is okay.

If you choose to get all your funds out, here are some wallet characteristics you should note.

when choosing a wallet, these are the characteristics otter looks for:

— otteroooo (@otteroooo) August 31, 2022

☑️ non-custodial

☑️ private

☑️ not owned by Big Finance

☑️ doxxed team

☑️ ease of use

☑️ open source

☑️ audited

☑️ hardware wallet support

☑️ flashbot protection

Also read the Top 3 Decentralized Platforms As An Alternative To Centralized Exchanges.

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief