Decentralized finance (DeFi) has taken the world by storm. Empowering investors to take control of their finances, it has brought in a significant amount of attention to the crypto space. The yields offered by staking models and liquidity farming far exceed those of traditional investments.

There’s certainly more risk involved too. However, for those who believe in crypto’s staying power, DeFi projects seem to be worth exploring. They offer ways to use funds more efficiently and add utility to existing investments.

On Solana itself, hundreds of DeFi apps have emerged over the past year. Raydium has established itself as one of the blockchain’s top decentralised exchanges, with over US$600 million worth of value locked (TVL). Oxygen is exploring customisable ETFs and DeFi Land is turning investing into a Farmville-esque simulation game.

With all these developments, there’s been a pressing need for organisation. There’s simply too much going on for any one person to keep track of.

That’s where Step Finance comes in.

Simplifying Solana’s DeFi ecosystem

“Step Finance is the frontpage of Solana,” says co-founder George Harrap. “Our mission is to take the currently disjointed and hard-to-understand ecosystem and distil it into a single platform.”

Most DeFi users are well aware of the struggle to keep track of investments. It’s easy to forget the protocols which you’re enrolled in, and checking each one manually can be a time-taking process. This also makes it tough to compound your earnings.

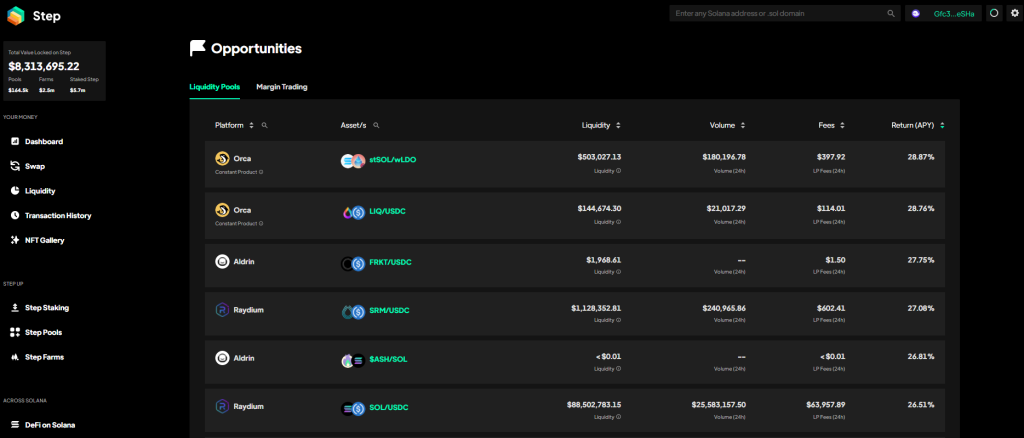

Step Finance allows users to connect their wallet and visualise their transactions across all Solana contracts in one place. The platform keeps a track of balances and allows rewards to be easily claimed from a variety of protocols and yield farms.

2/

— Step Finance | Solana's Portfolio Dashboard (@StepFinance_) February 2, 2022

New feature: reward options are now live!

This is a major new feature for our users: every time you use Step's AMM to swap, you'll earn Reward Options.

These give you the right to purchase $STEP at pre-set strike prices. pic.twitter.com/0RGK1WgNcj

“Step is built by DeFi degens for DeFi degens,” says Harrap.

Along with his team, he came up with the idea after a careful look at what the DeFi space was missing. “We found the need for a place where you can effectively track and take action across all the weird and wonderful apps being created in Solana’s DeFi ecosystem.”

The need for data aggregation

It’s fun to ape into projects for no reason, but as the crypto space continues to grow, we need the ability to make informed decisions. Data aggregation might not be the sexiest of terms, but it plays an integral role in bringing order to the chaos.

“DeFi is all about empowering users and a key way to do this is by making sure that they’re readily able to access information about their crypto-based activities. Data aggregators provide these insights and make DeFi that much more accessible.”

– George Harrap, co-founder of Step Finance

Crypto adoption would become a more appealing notion once users don’t have to sift through Twitter threads and Discord servers for market information.

“More data indexing is needed on Solana. we are working with a few projects on this but nobody has nailed it yet,” Harrap adds.

The development of such apps also helps bring legitimacy to Solana’s ecosystem. It becomes easier to compare the different services being offered and make smarter investment decisions.

Taking control

“DeFi is the future of finance for those who want to have control over their finances,” Harrap reckons. “It comes without the red tape and intermediaries found in the traditional financial world.”

On one hand, DeFi is already making financial instruments a lot more accessible, especially for the world’s unbanked population. That being said, there are still some ways to go when it comes to ease of use.

"YEH SO STEP IS LIKE THIS PLACE THAT TRACKS EVERYTHING ALL THE SOLANA STUFF BUT THEN ALSO IT HAS A BUNCH OF TOOLS WHICH CLOSE TOKEN ACCOUNTS AND SERUM ORDER ACCOUNTS SO ITS LIKE FREE MONEY YOU FORGOT IT WAS THERE" pic.twitter.com/tFf4hgojjR

— Step Finance | Solana's Portfolio Dashboard (@StepFinance_) March 24, 2022

“While it may take a while to become truly user friendly, new investors are becoming aware of the pitfalls of the TradFi system’s oversight and control.“

– George Harrap

Apart from curving bureaucracy, DeFi also comes with the benefit of being readily available.

“DeFi doesn’t have office hours,” Harrap says. “Users see the benefit of constant access to their funds while the banks close after 5pm and over weekends. As this awareness spreads, the appeal of DeFi will continue to grow.”

Looking to the future

As someone who has been involved in crypto for over a decade, Harrap has always seen potential in the space — potential which is finally being realised.

“Crypto is already proving useful in specific day-to-day situations, as seen during the most recent crisis in Ukraine,” he explains.

“While using crypto to flee from a war is an extreme example, the overall acknowledgement that cryptocurrencies have use cases when normal banking fails is important. As the roadblocks currently experienced by users are overcome, more day-to-day uses will surely follow.”

Harrap also believes that the future won’t be ruled by any one blockchain. “We see people — the consumers — pushing for a multi-chain future. I see cross-chain compatibility as a natural progression.”

Easy transfer of funds is one of the pillars of cryptocurrency, and being able to move across blockchains is an important part of that idea.

“We are already seeing this with centralised exchanges. Now, it’s shifting to decentralised cross-chain transactions too, which is what bridges are doing. I think this is a trend that will continue.”

Was this article helpful for you? We also post bite-sized content related to crypto — from tips and tricks, to price updates, news and opinions on Instagram, and you can follow us here!

Featured Image Credit: Step Finance

Also Read: An Intro To DeFrag Finance — How It Gives You Instant Liquidity For Your NFTs