Layer-1(L1) blockchains are the main network in an ecosystem, they are the base network where transactions are processed and settled. They usually accept transaction fees in their own native token.

Some examples of layer1 blockchains are Ethereum, Solana and our three focuses of today Sui, Sei and Aptos.

With the advent of Ethereum in 2015 the crypto world became more than a world of “virtual money”, smart contracts and the ability to run DApps was a major revolution brought about by Ethereum.

Although a remarkable feat there were also shortcomings, one of which is scalability which causes delays in transaction processing and increases transaction fees, especially during high demand like we saw in the last bull run.

Solving these problems and including other modifications have been the mission of so many layer-1 blockchains.

Today our compass is set on Sui, Sei, and Aptos.

Also Read: 8 Tokens To Watch Out For in 2023

What Is Sui?

Sui is a permissionless proof-of-stake layer-1 blockchain that can support a wide range of application development with speed and at a low cost.

Myten Labs, the creator of Sui, was founded by former Facebook (now Meta) employees. They identified two fundamental flaws in current blockchain design that they aim to solve which are:

- On-Chain Storage is impractical and leads to high gas fees, low throughput

- Smart Contracts aren’t cross-platform, too many points of failure

They intend to tackle these issues with Sui by building Sui with a variation of the Move programming language they overcame the problem of storage, which is centered around objects instead of accounts, scaling both interoperability as well as transaction speed.

Sui settles most transactions almost instantly while more complex transactions take about 3 seconds, transactions run in parallel or in order if needed and Sui can scale with more machines.

What is Sei?

Built using the Cosmos SDK and Tendermint Core, Sei is a layer 1 blockchain purpose-built for an orderbook with the goal of being the layer-1 for DeFi applications.

Founded by Jeffrey Feng and Jayendra Jog, Sei prioritizes reliability, security and above all else high throughput, enabling an entirely new echelon of DEX and DeFi products.

According to Sei, apps built on the blockchain benefit from specialized built-in orderbook infrastructure, blazingly fast execution, deep liquidity, and fully decentralized matching service.

Sei is a permissioned blockchain, which means that proposals will need to get approved and see it get passed through its governance before they can be deployed.

What Is Aptos?

Aptos is a Layer 1 Proof-of-Stake blockchain built with the Move programming language and the Move VM for application development, which are created and optimized for blockchain use cases.

Aptos aims to become the safest and most scalable blockchain in the world. $APTOS is used to pay for gas fees on the Aptos Blockchain.

Aptos Labs, the creators of Aptos, was co-founded by Mo Shaikh and Avery Ching, both former Meta (Facebook) employees.

See more about Aptos here

Tokens and Vesting Schedules

Currently at the time of writing Sui and Aptos have gone mainnet already while Sei is going mainnet soon, therefore Sei has no live native token for now.

Mainnet is closer than you realize… pic.twitter.com/jOjA43B6N9

— Sei 🚢 (@SeiNetwork) May 17, 2023

Sui has a maximum supply of 10,000,000,000 of which 94% is locked leaving us with a circulating supply of 528,273,718 which is less than a billion tokens amounting to a market cap of $623.36m and at the time of writing SUI is trading at $1.18.

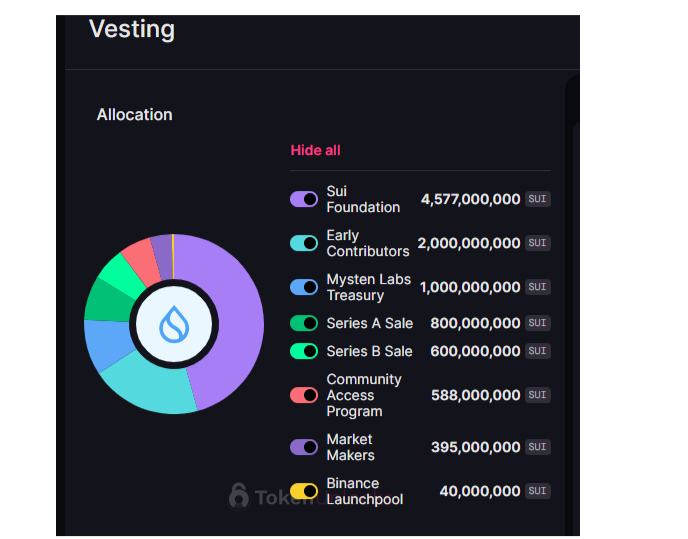

The Sui foundation is 46% of the tokens allocation with another 20% going to early contributors before 10% will go to Mysten Labs treasury.

Now Sui’s next token unlock is happening on June 3rd 2023 and 0.6% of the token’s supply which is 61,083,333.36 valued at $71.4m will be unlocked.

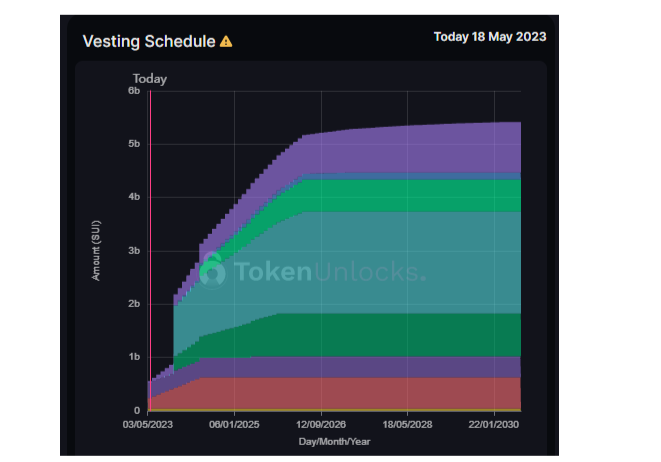

$SUI’s token vesting schedule runs all the way to 2030 with more and more units of the token to be released in the course of subsequent token unlocks.

This means that the token is extremely inflationary for example all through 2024 there is no token unlock that is less than 2 billion units of SUI which at its current value is at least $2 billion at every unlock.

Given that a bulk of the total supply is allocated to Myten Labs(46%) and early contributors (20%) there is a tendency to be sell pressure that will lead to downward price action if there is no corresponding increase in demand following these forthcoming token unlocks.

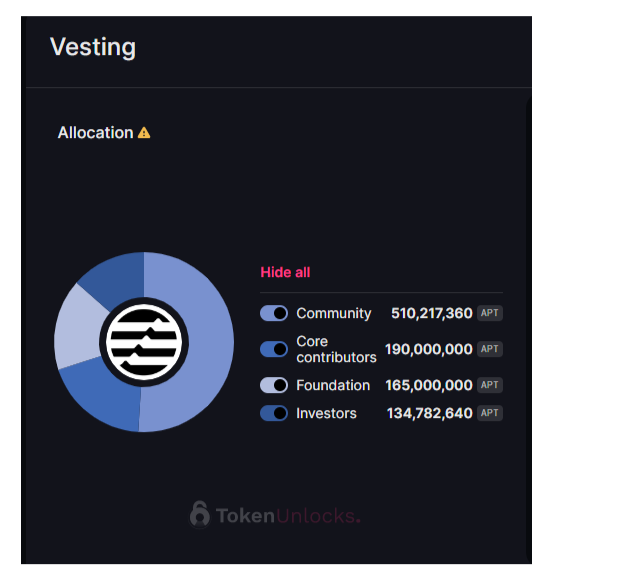

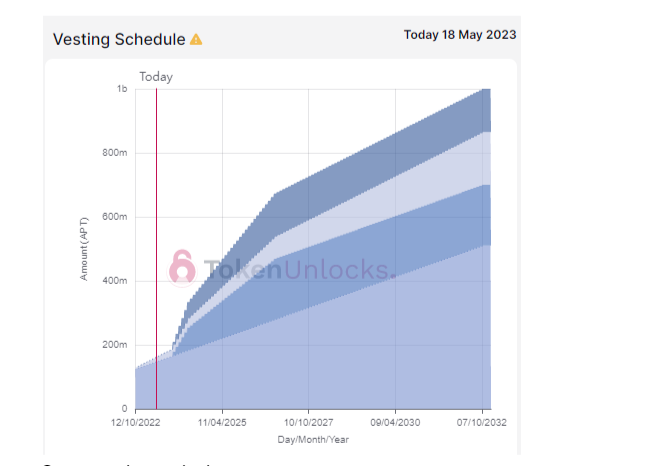

While Aptos release a total supply of 1,000,000,000 tokens upon mainnet launch with 84% still locked. Aptos have an infinite maximum supply. The market capitalization of Aptos is $1.69 billion with a circulating supply of 196,803,610 currently trading at $8.64 .

Aptos is very community oriented as can be seen in their vesting allocation 51% of their initial total supply was allocated to the community with 19% and 17% going to core contributors and founders.

Its emission type is inflationary and the initial 1 billion supply will be fully released by 2032.

Aptos next token unlock is scheduled for June 24th, 2023. 4,543,477.94 currently valued at $39,301,084 will be unlocked.

Community and Ecosystem

One of the challenges of Layer 1s is their lack of organic users especially during bear markets as funds will be flowing out of protocols because of falling prices and bearish sentiments.

Aptos” main net went live in October 2022, and since then it has had a decent number of daily transactions in 2023 daily transactions have ranged between 458,889 and 872,576.

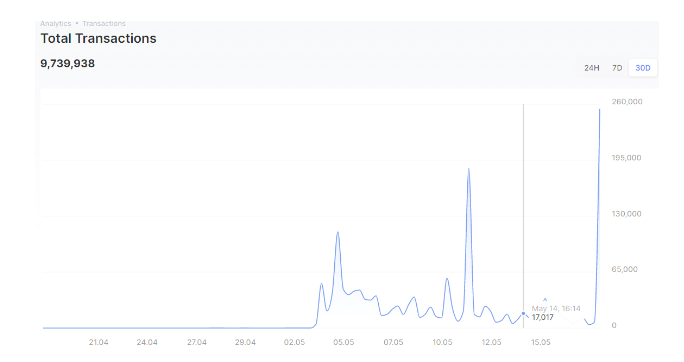

Sui, on the other hand, is currently having its highest daily transactions at 209,000, since it’s main net launch earlier this month.

Another issue for Layer-1s is how lopsided their TVL (Total Value Locked) is, this gives us an idea of the protocols within the ecosystem that are actually generating this volume.

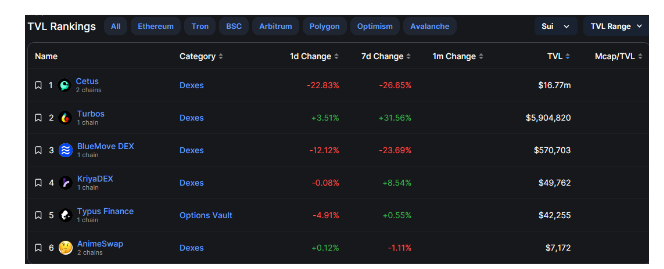

A more evenly spread TVL is desirable as it shows that the ecosystem is buzzing rather than being dominated by one protocol.

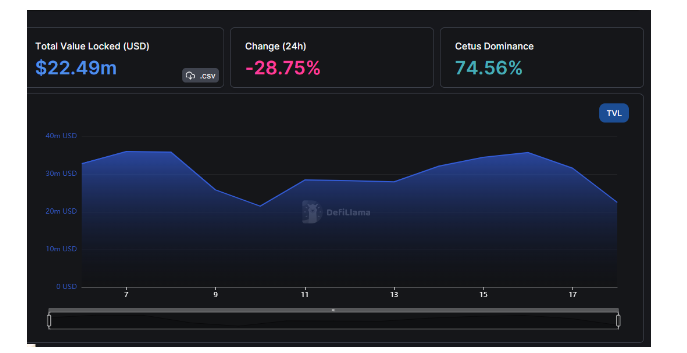

Sui has a TVL of $22.49 million and 74.56%(16.7m) of this is in one protocol, Cetus a DEX and liquidity pools that run on the Move programming language-based chains Sui and Aptos.

The second runner-up Turbos is another DEX and the difference between Turbos and BlueMove which is the third on the list is enormous. Turbos has a TVL of 5.9m and BlueMove has $570,000.

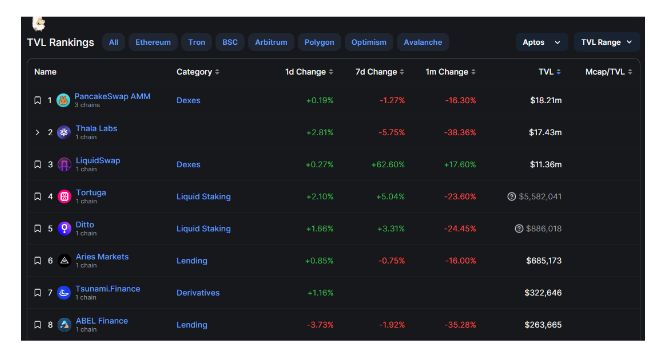

As for Aptos the blockchain has a TVL of $48.97m and 37.1% (18.27m) of this is in Pancakeswap AMM, which is running on three chains BSC, Ethereum and Aptos.

PancakeSwap AMM is followed closely by Thala Labs at $17.43m and LiquidSwap a DEX at $11.36m before Tortuga at $5.5m then others.

Transactions Per Second and Throughput

Transaction Per Second (TPS) refers to the number of transactions a network can process each second.

Since Layer-1s usually set out to solve the problem of scalability TPS is one of the ways they do this because it reflects the processing capacity of the blockchain at least theoretically.

This processing capacity expressed in TPS is known as “throughput”.

Sui has a TPS of 297,000 meaning theoretically the blockchain can process up to 297,000 transactions per second.

1/2 Comparison of TPS on @SuiNetwork and popular blockchains

— Suians (@Suians_) May 19, 2023

With a capacity of up to 297K transactions per second (TPS), the #Sui blockchain is currently outperforming the entire blockchains #SuiNetwork is definitely that one – TOP 1 BLOCKCHAIN in the crypto space 🚀 pic.twitter.com/F3hCfzqfL5

Meanwhile, Aptos has a capacity of 160,000 TPS while SEI has a TPS of 20,000 in theory.

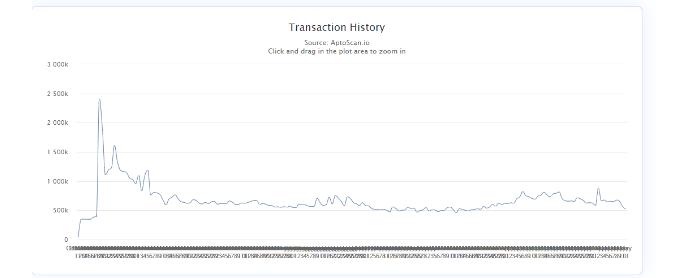

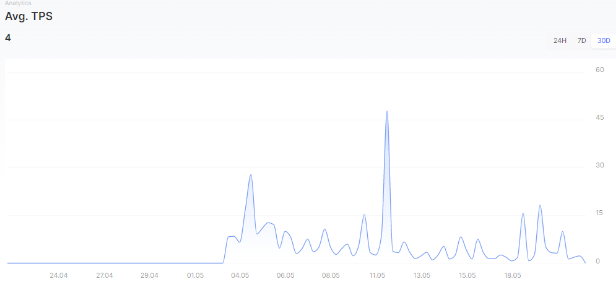

Now, over the last 30 days, Sui has an average of 4 TPS, in this period SUI’s highest TPS was 48 and lowest was 1 on May 11th and 19th, 2023. At the time of writing Sui’s TPS is 4 with 104 validators.

The lowest TPS Aptos has had over the last 30 days is 15 with a peak of 2020 TPS. At the time of writing Aptos have 6 TPS with 108 validators.

You might notice the big difference between the current on-chain TPS over the last thirty days and the theoretical TPS of this layer-1s.

This is why some might feel that all these high TPS numbers thrown around by layer-1s are all pies in the sky until they have enough adoption and can sustain a fully loaded throughput.

Time To Finality (TTF)

Time To Finality (TTF) measures the time it takes for a transaction to be considered final in a blockchain network i.e. the amount of time needed to fully confirm a transaction.

Messari reported a TTF of 2-3 seconds for SUI before they went live (mainnet). Now after mainnet launch, SUI network has come out to say they have a TTF of 480 milliseconds.

Time to Finality measures the point in the transaction lifecycle where both the transaction itself, as well as the effects of the transaction, are final, and can be used in subsequent transactions.

— Sui (@SuiNetwork) April 27, 2023

Sui was able to achieve an average time to finality of ~480 milliseconds.

Aptos has a TTF of 0.9 seconds making Masseri declare them the live network with the fastest Time To Finality.

Sei theoretically has a TTF of 0.6 seconds although they are not live on mainnet yet.

Daily Active Accounts

Sui went to Mainnet on May 3rd and started with 28,852 active accounts since then their highest daily active account is 104,001 recorded on May 19th. They have never recorded below 4000 daily active accounts since they went live to the time of writing.

Over the last 30 days, Aptos has never had below 12,000 daily active accounts even reaching a zenith of 17,566 in the said time frame.

Closing Thoughts

One of the most innovative facts about Sei is it attempts to solve the Exchange Trillima between decentralization, scalability and capital efficiency.

Sei addresses the DEX scalability problem by building the first Layer 1 specialized for trading, optimizing every layer of the stack to offer the best infrastructure for trading apps.

So which L1 will perform best? Well, a strong contender is “Aptos”, after allocating 51% of 1 billion units of Aptos (initial total supply) and doing an airdrop to the community which put sell pressure on the price, Aptos is still trading for $8.

There is room for Sui or Sei to overtake and dominate but until then I think Aptos is the Layer-1 blockchain that might perform better.

Also Read: Blockchains With The Highest Developers Count In 2023

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief

This article was written by Godwin Okhaifo and edited by Yusoff Kim