Crypto “bribes” were a term first coined by users of DeFi (Decentralized Finance), more specifically, by those of Curve Finance.

These bribes are actually gamified incentivizes that help direct rewards for liquidity pools, in exchange for an incentive, such as a third party protocol’s governance token, or a stablecoin such as USDC.

Given that bribes, and VeTokenomics as a whole have become such an integral portion of DeFi, here is a quick run down so that you can take one step further into the world of Web3.

Also Read: Understanding The Curve ($CRV) Wars and What It Means For The Curve Ecosystem

First, a recap on Curve Finance

To truly understand bribes, you must first understand what is Curve.

Curve Finance is the fourth largest cryptocurrency protocol by TVL (Total Value Locked), and finds a niche in stablecoin and blue chip swaps.

The DEX (Decentralized Exchange) has enabled extremely deep liquidity for these pools through the emission of incentives – mainly in the form of it’s native $CRV token.

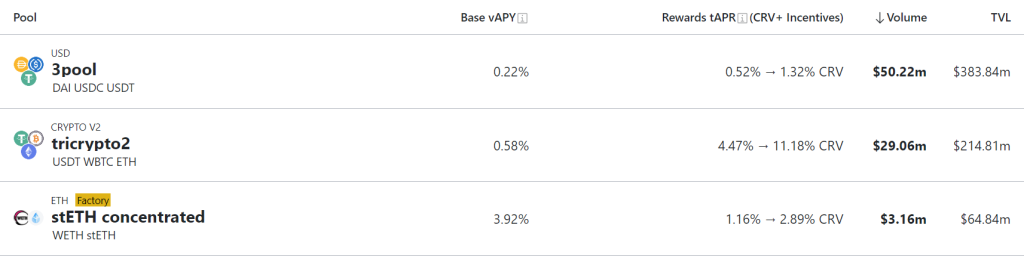

The most notable pool on the site is it’s “3pool”, which is also referred to as it’s “tricrypto” pool. This pool allows for swaps between DAI, USDC, and USDT at very low slippage, even for large transactions.

However, the base rewards for such pools are not as high as other sites.

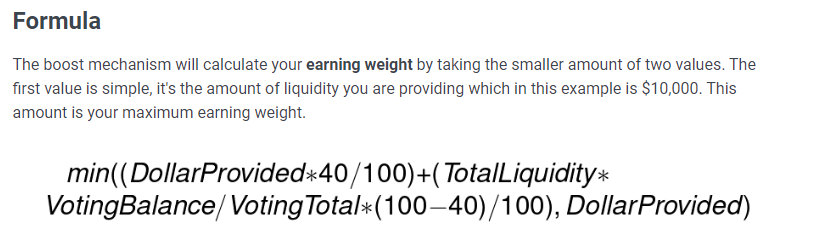

To increase the rewards on their liquidity pair, users can lock up their governance tokens, in this case $CRV, as vote-escrowed governance tokens, and receive $veCRV.

The amount of $veCRV received will be proportional to how long users lock up their $CRV tokens.

Using $veCRV, users can then “boost” yields on their liquidity pairs on the minter page, following the following formula.

How do bribes work on Curve?

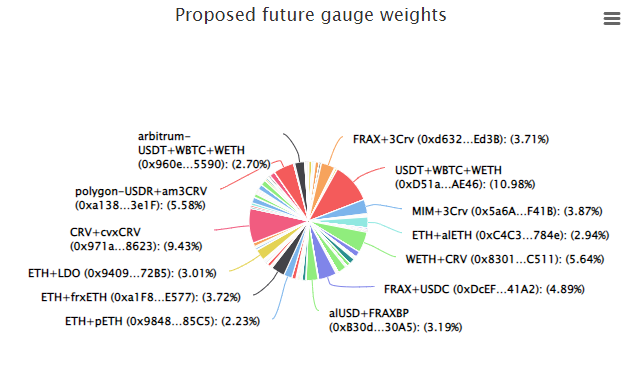

Aside from earning a share of protocol fees, $veCRV also allows users to vote toward the “gauge weight”.

As Curve continues to emit governance tokens for liquidity incentives, $veCRV holders are able to direct these emissions to the LP of their choice.

Typically, this would go to the liquidity pair that they are personally invested in.

For example, a $veCRV holder who LPs in the FRAX-USDC pool would ALWAYS want to vote toward that pool for maximum rewards.

This creates a problem for new protocols.

Say, protocol A wants to create a liquidity pair on Curve called A-USDC. Should they want to incentivize liquidity, they would have to either

- Offer their own tokens as liquidity rewards

- Accumulate sufficient $veCRV to outvote current holders

While both are viable options, they are extremely resource-intensive. Printing tokens and diluting supply in the first case would still lead to competition with $veCRV holders.

The latter solution would require a lot of money, given that $CRV currently has a fully diluted market capitalization of $2bn. Accumulating even 1% of that would require $20,000,000.

Andre Cronje, renowned Fantom developer and nicknamed the “godfather of DeFi”, realized that there was a gap in the market, and created a streamlined method for “bribing” $veCRV holders.

Through THIS site, protocols were able to direct $CRV emissions to their own LPs by directly incentivizing $veCRV holders.

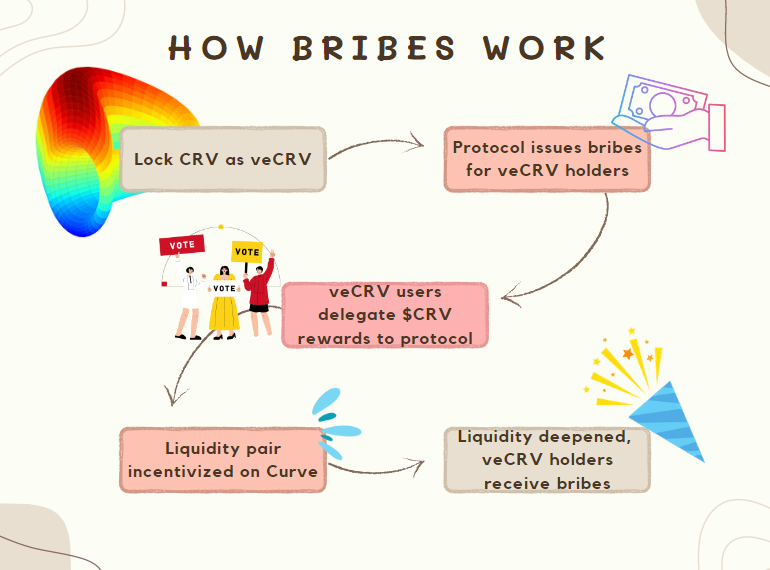

Essentially, the bribing process works like this:

- Users lock $CRV as $veCRV

- Protocol A creates A-USDC LP on Curve

- Protocol A “bribes” or incentivizes $veCRV holders with it’s native token, $A

- $veCRV holders vote for $CRV emissions on A-USDC LP

- A-USDC liquidity deepened

- $veCRV holders get rewarded with $A

Major use case for DeFi bribes

During the bull market, one of the most egregious bribers was $MIM, the native stablecoin of Abracadabra, a money-market protocol by Daniele Sesta.

$MIM’s primary goal was to become the de-facto cross-chain stablecoin. To achieve this, it needed deep liquidity pairs and heavy usage.

Therefore, the abracadabra protocol heavily incentivized $veCRV holders to vote for LPs that used $MIM.

If you look at this pie chart carefully the green is how much fire power we are willing to add to make sure nobody can bribe more than us, or have better APY than us. Full stop 🛑 https://t.co/SRW3GqBavW

— Daniele (@danielesesta) October 17, 2021

These had a two-fold effect.

Firstly, trades involving $MIM were extremely liquid, which was important during a period of heightened on-chain activity. This not only meant that traders did not lose out to slippage, but a liquid stablecoin pair also helped $MIM retain it’s peg.

Secondly, LP-ing $MIM pairs was heavily profitable, and essentially risk-free. Not only were u earning trade fees, but also massive rewards from the directed emissions.

$veCRV holders who were already voting for the $MIM pools could also double-down on their votes by LP-ing in the $MIM pool.

The Future of Bribes

While bribes have taken a backseat amid lackluster DeFi activity, they are sure to make an eventual return.

With liquidity being at the forefront of DeFi, and even TradFi, incentivizing $veCRV users to vote for a protocol – regardless of what stage it’s at, will likely be beneficial to it.

A budding protocol, for example, can encourage more liquidity and attention to it’s native token via the issuance of bribes. LP-ing, after all, is often a two-way street.

Another well-established protocol could use bribes as a cost-effective method to ensure that it’s token holders are happy, and do not encounter massive slippage when making traders.

We have already seen it’s usefulness in aspects of cryptocurrency, like increasing the dominance of a stablecoin such as $MIM.

Big week -> big fees for $cvxCRV stakers 🎉 pic.twitter.com/08dXvuYewE

— Convex Finance (@ConvexFinance) March 16, 2023

To that end, protocols like Convex and [Redacted] Cartel have established the groundwork for accumulating governance tokens.

With the number of platforms creating their own version of “vote-escrow” tokens increasing, protocols such as Convex have made it their mission to accumulate a basket of them, in order to reap attractive rewards.

Furthermore, this current bear market has made it “cheaper” to accumulate those tokens, due to the lack of interest surrounding DeFi, accelerating their accumulation strategies.

Also Read: What Is Redacted Cartel And Is It Here To Stay?

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chaindebrief