Stablecoins are the backbone of crypto. Without them, markets would crash, valuations would be difficult, and Web3.0 would likely be unusable.

Which is why when Terra offered a free 20% APY on their native algo-stable $UST, users flocked en masse to the network, in hopes of easy yield. Ironically, the collapse of LUNA is also what caused many in the space to shy away from platforms offering high yield, and take a more conservative approach with their “safer” assets.

While we may have all shied away from yield-farming, earning yield on your stables can make a very big difference to your portfolio, especially when the bull market returns. As such, let’s explore some top stablecoin yield opportunities, their APRs, and what risks are involved.

Also Read: Top 10 Yield Farming Opportunities For Ethereum (2023)

1. Curve Finance (DAI, USDC, USDT, LUSD, MIM, Frax)

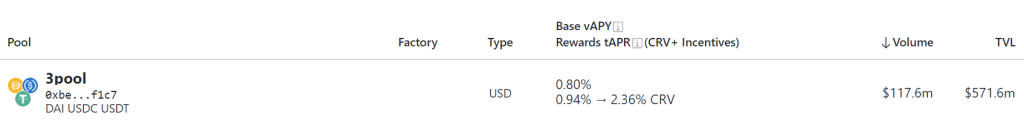

Decentralized Exchange Curve finds its niche in trading between stablecoins and blue chips thanks to its deep liquidity pools. In fact, Curve is currently the fourth largest protocol by Total Value Locked, and supports 12 Networks in total, including Polygon, Optimism and Avalanche.

With $122M in daily volume, Curve charges a 0.04% trade fee which goes to liquidity providers, and a 0.02% admin fee for the protocol.

It’s largest liquidity pair by TVL is the 3Pool, which consists of DAI, USDC, and USDT, which allows users to swap between the 3 stablecoins with low slippage.

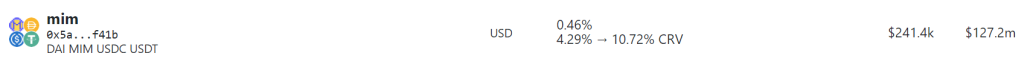

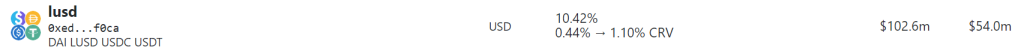

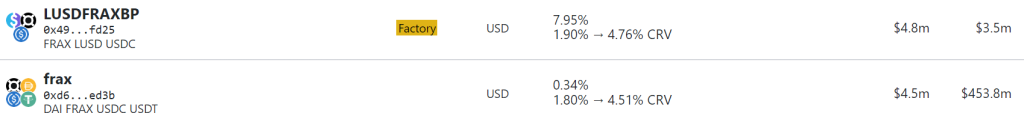

Other notable pools includes its LUSD, MIM, and Frax Pools, which function similarly to the 3pool, but include a larger variety of stablecoins.

For those wishing to earn yield on non-USD pegged stablecoins, Curve also has liquidity pools for Euro and Korean Won based stablecoins.

Historical APR: 1 – 10 %, boosted for $CRV stakers

Risks: Smart Contract risk, stablecoin depeg risk,

Curve’s front end has been compromised before. However, this was discovered to be a flaw by their service provider, and liquidity pools were not at risk.

2. Aave (DAI, USDC, USDT, BUSD, FRAX, GUSD, LUSD, sUSD, TUSD, USDP)

Aave is a lending and borrowing protocol powered by a Decentralized Autonomous Organization (DAO), which supports 7 different networks, including Ethereum.

Being one of the oldest protocols in DeFi, Aave is known for its reliability, having never been exploited in its long history – despite many attempts. Thanks to its legacy, it currently sits as the third largest protocol by Total Value Locked, at a whopping $4.63 billion dollars.

As a money market, Aave also hosts a whopping 10 different stablecoins on its platform that can be loaned out.

While yield on Aave has gone down due to the lack of borrowers, many still choose to stake on Aave, not only due to its historical reliability, but also the ability to borrow against their assets. However, we can see from $GUSD’s 67% yield that a sudden increase in borrowing can lead to an insanely high yield for depositors.

Historical APR: 1 – 3 %

Risks: Smart Contract Risk, Liquidation risk for borrowers.

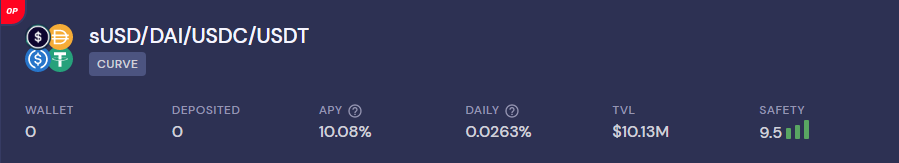

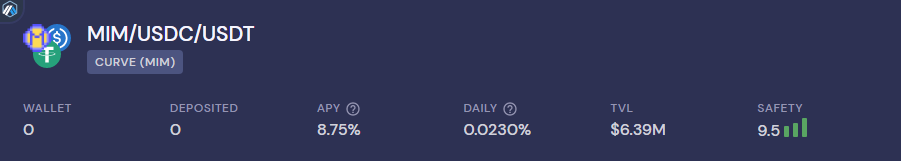

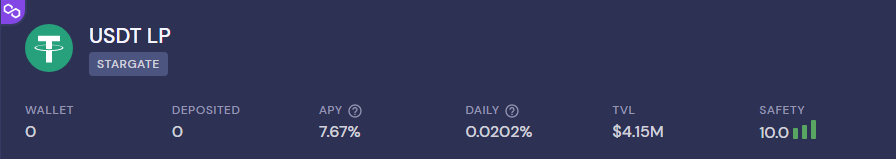

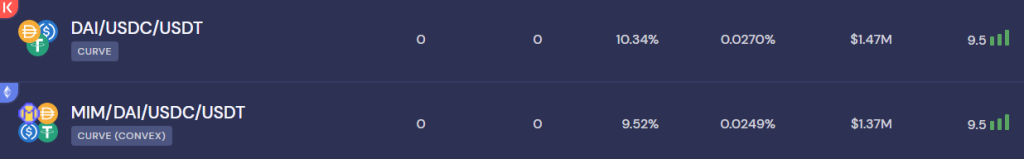

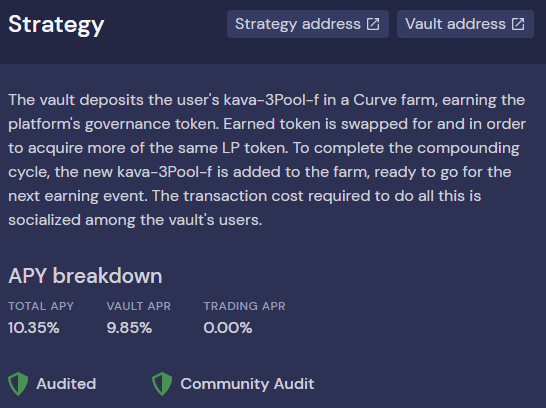

3. Beefy Finance ( DAI, USDC, USDT, sUSD, MIM)

Beefy Finance is a decentralized, multi-chain yield optimizer launched in October 2020 by a team of anonymous developers to help investors automate and maximize returns.

Ranked 28th by Total Value Locked, Beefy currently supports 17 networks, with options to stake, provide liquidity, and participate in defi yield vaults.

While the strategies involved are nothing out of the ordinary, Beefy specializes in helping users auto-compound their rewards. This not only saves users time and gas fees, but instantly increases the amount of yield generated for depositors.

Beefy also offers transparent information on each and every vault, breaking down the strategy used to yield farm, a safety score that ranks it out of 10, and details on the assets involved in every vault.

This makes Beefy an inclusive platform for users of all experience levels, even for novice yield farmers who may not be familiar with yield-farming strategies.

Historical APR: 5 – 10 %

Risks: Smart Contract Risk, Counterparty Risk

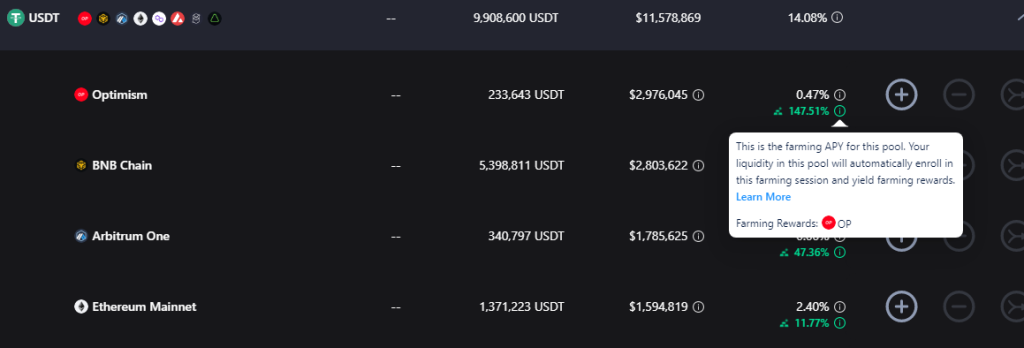

4. Tarot Finance (USDC, MAI)

Tarot Finance is a multi-chain decentralized lending protocol which was first created on the Fantom Network. Since then, it has expanded to include Optimism, Aribtrum, BNB, and has plans to eventually be deployed on the Ethereum Network as well.

With Tarot Finance, users are able to supply tokens into only one side of any liquidity pair, gaining access to rewards from swaps fees, without the risk of impermanent loss. Some vaults also assist users in auto-compounding, helping them gain additional gains from re-staking with minimal fees.

Users can also borrow against their deposits on Tarot in order to multiply their APRs in leveraged yield farming. However, this is not recommended for novice yield farmers due to liquidations risk, especially for non stablecoins.

USDC supply vaults are also available for users who do not wish to participate in liquidity pools. These are deployed by Tarot Finance in select strategies, and come with a 10% performance fee on earned yield.

Historical APR: 8 – 54%

Risks: Smart Contract Risk, Counterparty Risk, liquidation risk for borrowers

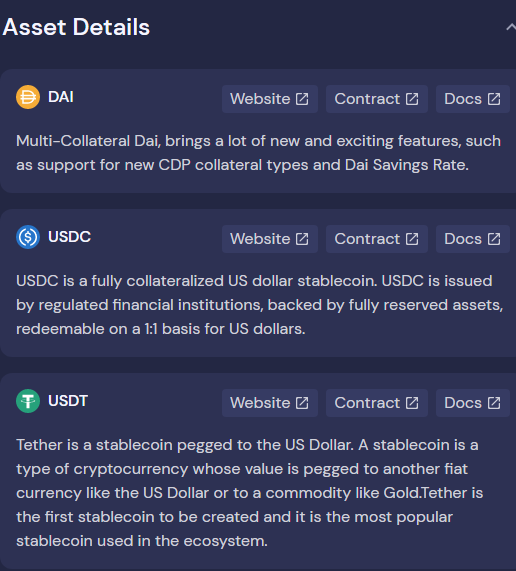

5. Celer Bridge (USDC, USDT)

If you’re looking for 3 digit APRs and not yet turned away from the many bridge exploits last year, this may be the one for you.

Celer Bridge, created by Celer network, has slowly crept up to being the 8th largest bridge by Total Value Locked, with $135m locked up to serve as liquidity. Furthermore, it currently supports 25 different networks, including Metis and Aptos.

Thanks to liquidity mining incentives, there are currently multiple 3-digit APR opportunities on some of the most popular networks. Despite a low base fee, depositors can earn additional incentives in the form of $OP on the Optimism Network and $CELR on all other networks.

Historical APR: 3% – 150%

Risks: Smart Contract Risk, risk of bridge exploit.

cbridge has been audited by Certik, PeckShield, and SlowMist.

6. StakeDAO (Frax, MIM, USDC, USDT)

StkeDAO, a multi-service DeFi platform for DeFi, builds upon the idea of Curve and Convex, helping users gain boosted rewards on their liquidity provider positions. Instead of staking assets on multiple platforms, users can simply head over to StakeDAO, which consolidates some of the most trusted farms in one place.

These passive yield strategies also help users save time, as the vaults work to auto-compound rewards from third parties such as Curve and Abracadabra to build the depositor’s position.

The smooth UI/UX of StakeDAO also makes it a great place for those new to DeFi to kick start their yield farming journey.

On average, StaekDAO vaults charge a performance fee of 15% and a harvest fee of 1%.

Historical APR: 3% – 8 %

Risks: Smart Contract Risk, Counterparty Risk

cbridge has been audited by Certik, PeckShield, and SlowMist.

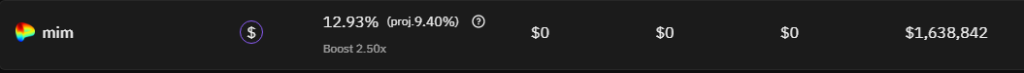

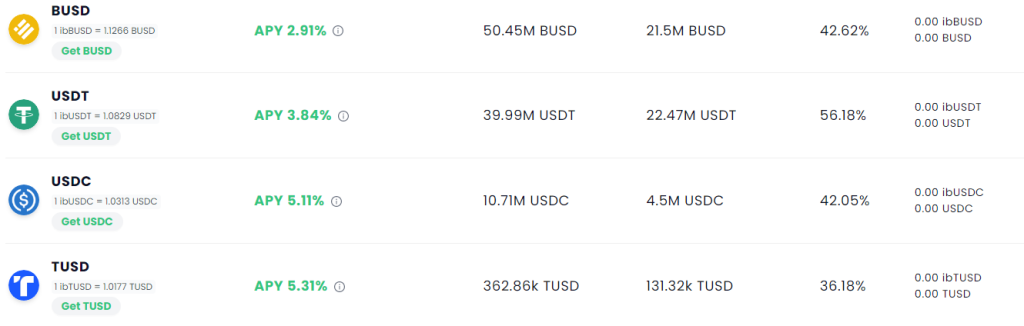

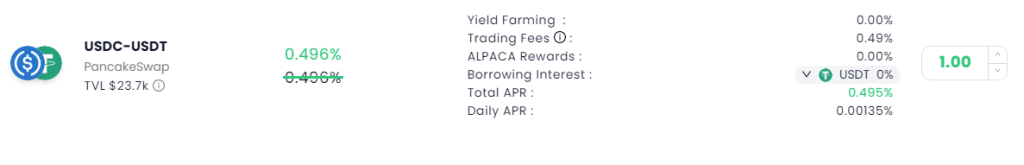

7. Alpaca Finance (BUSD, USDT, USDC)

Following news that Binance CEO CZ would remove the ability to transact in USDT and USDC on the Centralized Exchange, their native stablecoin BUSD quickly rose in popularity, becoming the 7th largest cryptocurrency by market capitalization.

As such, there has been a resurgence in farms for BUSD trading pairs, with some of the best being on the Binance Chain itself.

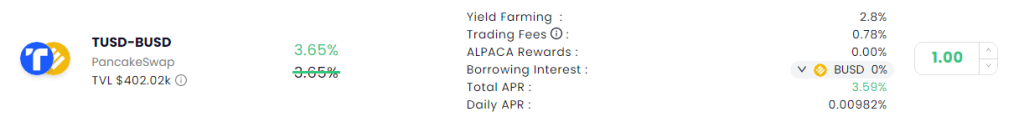

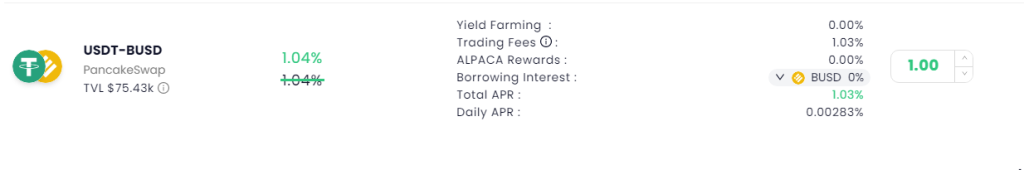

Alpaca Finance, a lending market-cum-leveraged yield farm, has risen to become the third largest protocol by Total Value Locked on the Binance Smart Chain.

On its money market side, lenders are currently able to reap 2-5% on their deposits. There is also an option for TUSD, or True USD, a stablecoin launched by TrustToken, a platform for tokenizing real-world assets.

Alternatively, users can participate in the leveraged yield farms which borrow against the initial deposit to boost the amount of yield generated from a position. However, due to the current lack of yield farming incentives, leveraged stablecoin pairs often generate negative returns.

Historical APR: 3% – 5 %

Risks: Smart Contract Risk, Counterparty Risk, Liquidation risk for borrowers

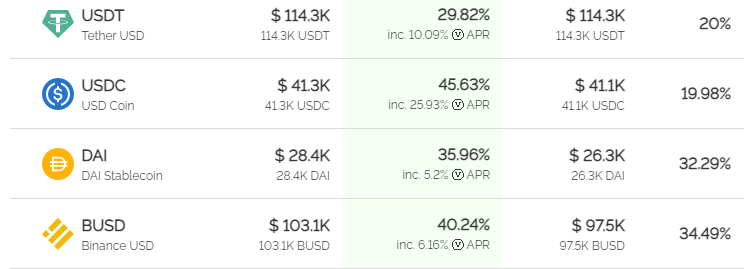

8. Vires Finance (USDT, USDC, DAI, BUSD)

With the Waves blockchain rising in popularity towards the tail end of 2022, Vires Finance became their de-facto money market, allowing users to borrow and lend their cryptocurrencies with ease. While Waves’ notorious algo-stable $USDN has since depegged, Vires still remains a trusted money market, with over $200 million in Total Value Locked.

Surprisingly, there has been a lot of stablecoin borrowing on Vires, driving interest rates upwards. Additionally, there is an optional feature to lock supply for 1 year, where depositors will receive an additional 6% APR in $VIRES tokens.

Additionally, users can borrow against their deposited stablecoins in Vires, much like in Aave, in order to deploy their capital without having to sell off their initial stablecoins.

Historical APR: 30% – 40%

Risks: Smart Contract Risk, Oracle Risk, Liquidation Risk (For Lenders). Due to $USDN depegging, Vires previously had $500M in bad debt which has since been taken on by Waves founder Sasha Ivanov.

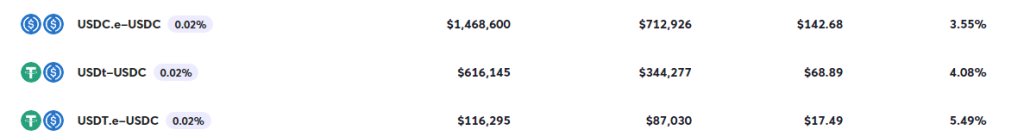

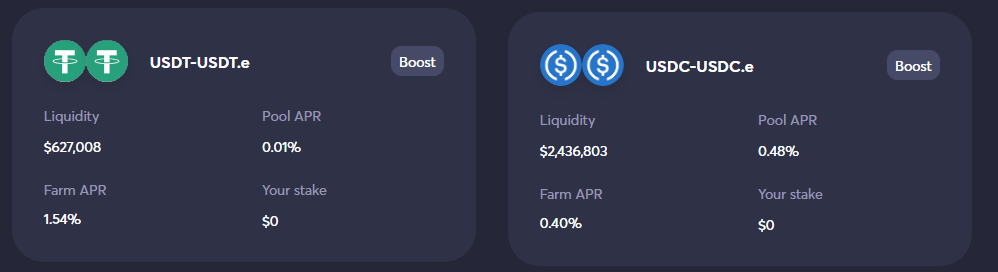

9. Trader Joe (USDC, USDT, DAI)

First built on the Avalanche Network, Trader Joe eventually grew in popularity, ranking third by Total Value Locked an expanding the Arbitrum One.

While originally a Decentralized Exchange much like Uniswap, Trader Joe has since incorporated not only yield farmis, but also money markets into their platform.

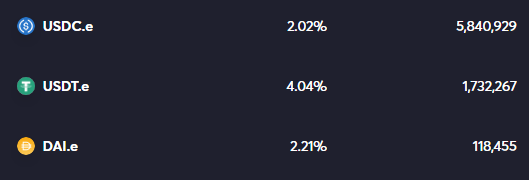

Their staking pools also offer USDC.e-USDC trading pairs, with USDC.e representing USDC bridged over to Avalanche from the Ethereum blockchain via the Avalanche bridge.

They also offer farms with boosted yields from staking Trader Joe’s native token, and a lending market which has significantly better yield opportunity than the other two options.

Historical APR: 0.01% – 4%

Risks: Smart Contract Risk, Liquidation Risk (For Lenders).

10. Centralized Exchanges

While the current climate of Web3.0 means that less and less people are holding their cryptocurrencies on centralized exchanges, it is unavoidable that some people will still use them due to their convenience.

Following the collapse of FTX, however, many centralized exchanges have gone on to create a “Proof of Reserve“, making all their wallet holdings transparent for users to view. While this does not mean that we should place our trust in them blindly, it does bode well for the future of Centralized Exchanges.

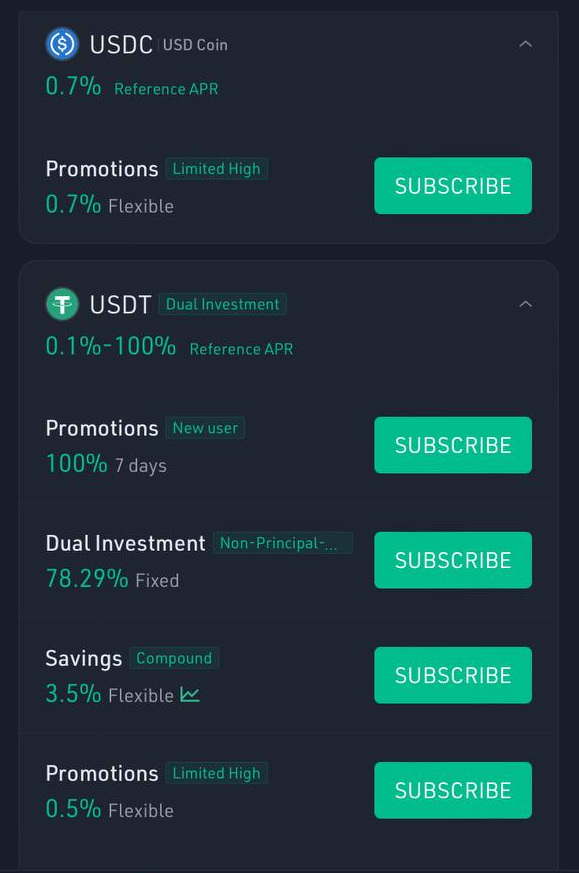

KuCoin offers various schemes to earn on your stablecoins, which includes a simple savings account, compound interest savings, as well as a Dual Investment Scheme, which is a more complex structured financial product.

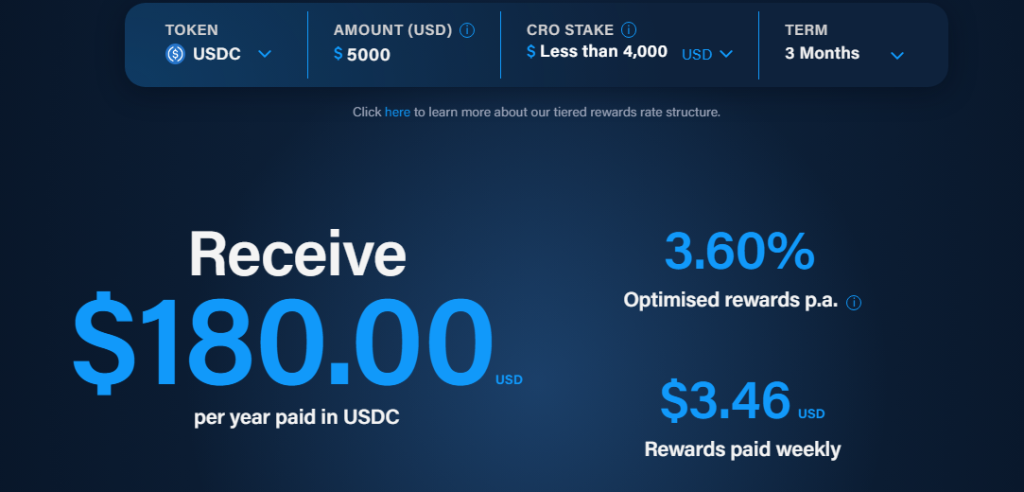

As for crypto.com, they offer up to 8.5% APR on up to $3,000 worth of stablecoins. However, this requires users to stake more than $40,000 $CRO, which is not feasible to most. It also requires depositor to lock their stake for 3 months.

Instead, staking $10,000 with the lowest tier membership yields 3% APR. Similarly, a $100,000 deposit yields 1.21% and a $1,000,000 deposit yields 0.73%.

Changing the lock-up period to “Flexible” instead of 3 months also cuts the APR to approximately 0.4%.

Historical APR: 0.4% – 7% for earn products

Risks: Counterparty Risk

Closing Thoughts

While Yield Farming was all the rage during DeFi summer, it has since taken a backseat in this bear market due to widespread fear of on-chain exploits and liquidity concerns. Furthermore, we are far from the days where select protocols were able to offer 20% APY on “stable” coins, and 6 digit APYs on tokens that seemingly went up only.

However, an extra 5% passive yield on a sedentary token could make a huge difference in a portfolio, especially when the bull market returns. Participating in yield farms also helps users actively stay on-chain, which could be the first step to discovering new, exciting protocols.

Regardless, there is truth to the statement that going on-chain currently incurs more risk, and that should be a strong consideration for anyone looking to explore both Centralized and Decentralized Finance.

Also read: Centralisation Is Dead, True Global Venture Says Decentralization Will Dominate In 2023

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chaindebrief