Yield optimizers are tools that help to manage investments to maximize returns, much more efficiently than manual means.

They are an on-chain asset management protocol that uses data analysis and optimization techniques to auto compound rewards to earn the highest compound interest rate possible.

Typically, yield generated from protocols are not reinvested automatically and users have to manually collect them and reinvest them.

If a user wants to reinvest their earnings manually, it would require a few transactions and the gas fee might be so expensive that it is not worth the hassle.

The most basic yield optimizers strategy involves reinvesting revenue back into yield farms so it can compound and grow.

This effectively reduces the need for users to manual reinvest the revenue and also users can save on gas fees.

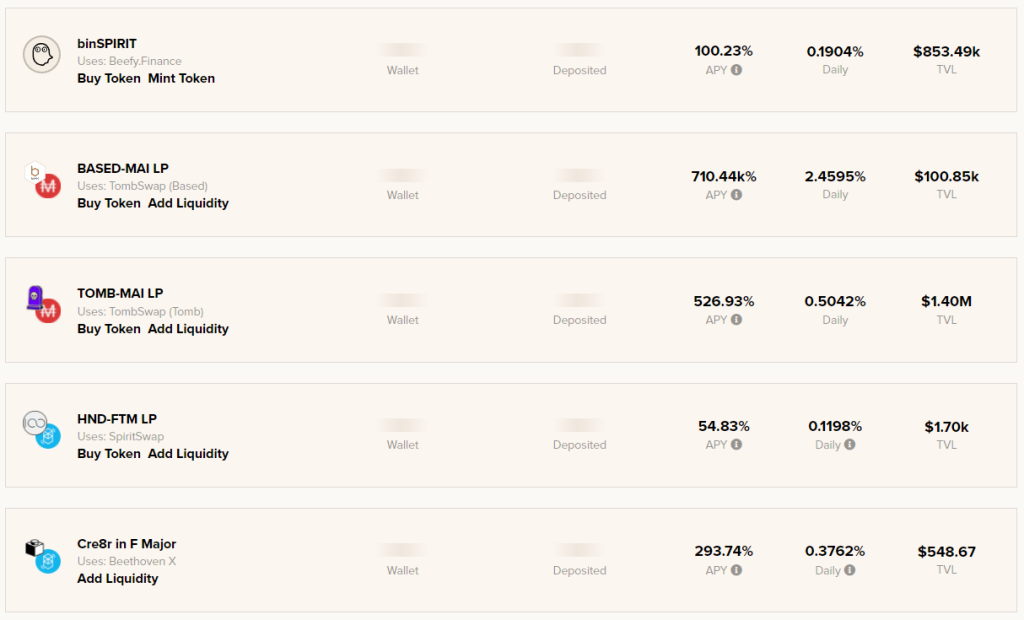

This is why it is not uncommon to see yield optimizers providing high-interest rates and mouth-watering APYs of over 100%. If you dig deeper you can even find some vault offering APYs north of 1000%.

The projects featured are all popular yield optimizers and are listed in no particular order. Here are the top five yield optimizers:

1. Pickle Finance

Launched in September 2020, Pickle Finance was an experimental protocol with a noble cause to help ensure that stablecoins remain pegged to their value.

How it works is that Pickle Finance simply churns out more rewards for under-pegged stablecoin pools to incentivise users to sell over-pegged stablecoins and buy under-pegged stablecoins.

Gradually, Pickle Finance started to evolve to incorporate other aspects of Decentralized Finance (DeFi), with the aim to be the one-stop shop for maximising crypto return.

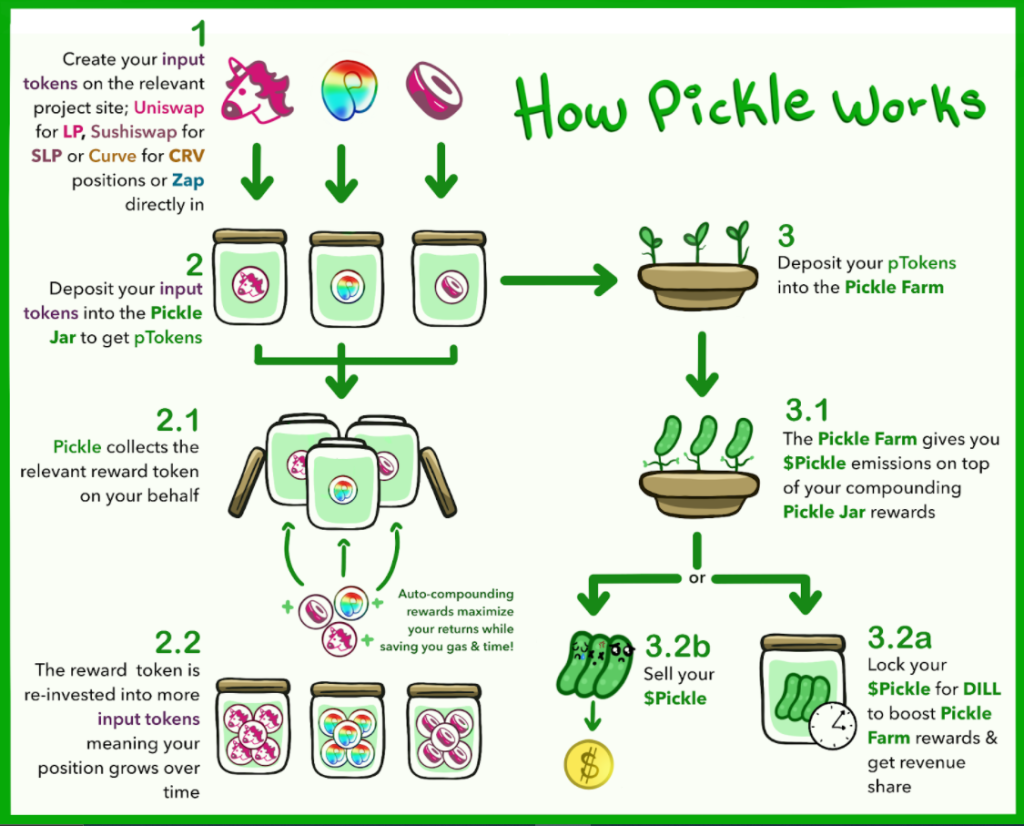

The transition was largely successful as now Pickle Finance is widely known as the go-to yield aggregator. The protocol boasts of multiple farms across different chains where users can “set and forget”, as the protocol would automate the process to compound the returns.

Ultimately, Pickle Finance is just a yield aggregator that helps you compound your return. The APY you get is largely based on the APY you are getting from the original protocol. For instance, if you provided liquidity on Uniswap, Pickle Finance compounded APY would be based on Uniswap APY.

Pickle Finance currently charges a 20% reward fee for the tokens being compounded. For certain chains like Ethereum, Arbitrum and Polygon it charges an additional 0.2 performance fee and for OEC and Moonriver, it charges a 0.1 performance fee.

At the time of writing, Pickle Finance has extended support to include a wide range of blockchains: Arbitrum, Aurora, Cronos, Ethereum, Fantom, Harmony, Metis, Moonbeam, Moonriver, OEC, Optimism and Polygon.

2. Beefy Finance

Similar to Pickle Finance, Beefy Finance is a decentralized, multi-chain yield optimizer that helps investors to compound interest rewards.

Beefy Finance was launched on October 2020 by a team of anonymous developers that aim to help investors to automate and maximize returns.

Beefy Finance’s native token is $BIFI and it is a ‘dividend-eligible’ token. What it means is that $BIFI holder get a share of the profit generated from the protocol. Token holders also get to participate in governance and are able to shape the future of the project.

Currently Beefy is leading the multi-chain support as it supports: Arbitrum, Aurora, Avalanche, BSC, Celo, Cronos, Fantom, Fuse, Harmony, Heco, Metis, Moonbeam, Moonriver, Polygon

3. Alpaca Finance

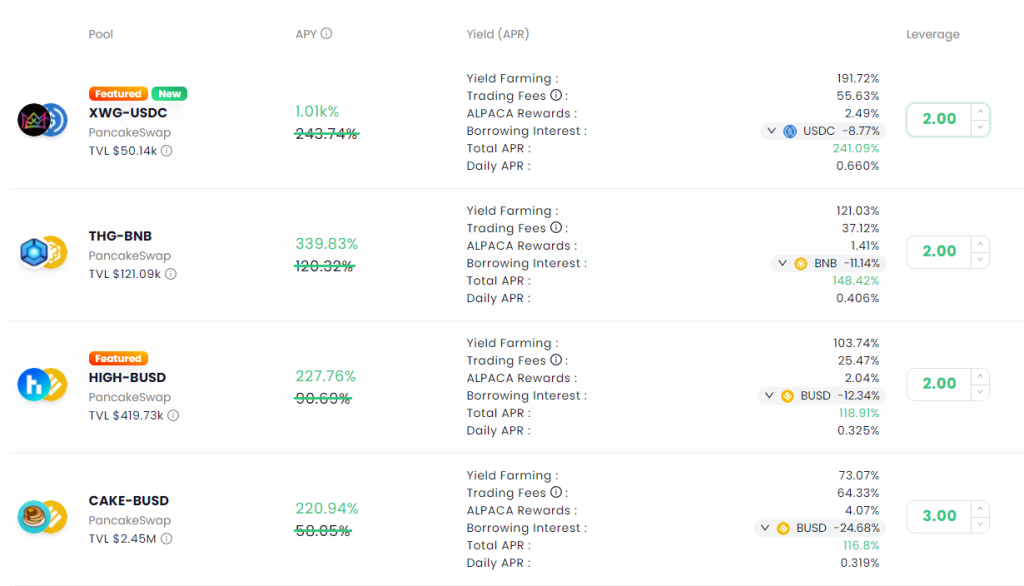

Alpaca Finance is one of the largest lending protocols on the Binance Smart Chain. It is not only just a lending protocol, it also has other DeFi elements like yield optimisation.

Not only does it automate and compound yield for investors, but it also allows investors to do leveraged farming.

Leveraged yield farming is not commonly seen in the DeFi space but the concept is really simple. It basically allows investors to borrows funds to increase their yield farming position so they get more yield in return.

Most importantly, leveraged yield farming allows for undercollateralized loans. This capital efficiency allows yield farmers to generate higher than normal APYs. Yield farmers can use as much as 4x leverage on certain yield farms.

4. Tulip Garden

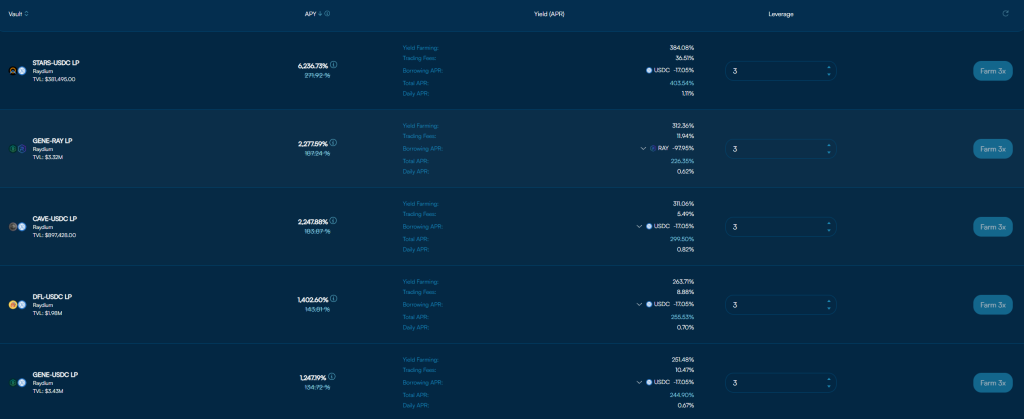

Tulip Garden is the first yield aggregator built on the Solana blockchain. Formally known as SolFarm, it managed to raise a staggering US$5 million to expand its team of engineers.

With over US$400 million in TVL, it is currently the seventh-largest protocol in the Solana ecosystem based on TVL.

Similar to Alpaca Finance, the main feature of Tulip Garden is also leverage farming. For certain farms, the leverage farming APY can be as much as 6000% APY.

Tulip Garden is not just a yield aggregator platform, it is also a lending protocol and a decentralized exchange (DEX). It is basically an all in one DeFi platform.

5. Yearn Finance

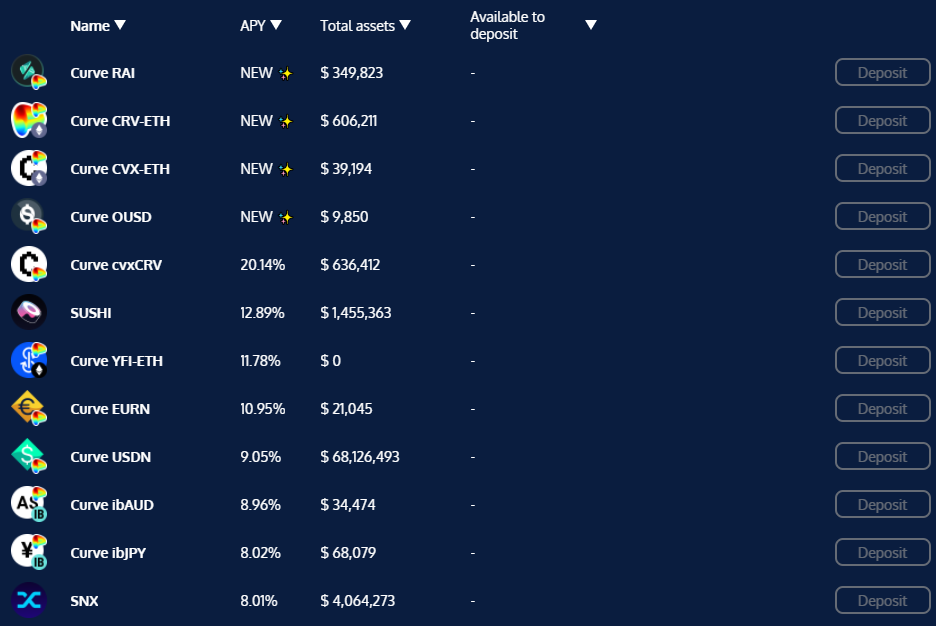

Launched in 2020, Yearn Finance was founded by DeFi star developer Andre Cronje. It is by far one of the leading yield aggregators in DeFi.

Yearn Finance started out as a stablecoin yield aggregator where investors can deposit stablecoins and the protocol would look for yield farms that can help them earn the highest yield.

Over time it evolved into a community-driven robo adviser for yield. The vaults are equipped with unique strategies to earn yields that were once only available to those with the technical knowledge and expertise.

Investors can rest assured that their funds are in good hands as Yearn would only farm on credible and audited projects.

Also Read: A Look at Yearn Finance: The DeFi Gateway And Yield Aggregator Protocol

Conclusion

Do note that this is not the complete list of yield optimizers out there in the crypto world. There are many more yield optimizing protocols popping out every other day.

Using a yield optimizer also comes with added risks. Instead of interacting with one protocol, you are now effectively interacting with two protocols and different smart contracts.

Smart contracts are susceptible to attack and bugs in code hence the added risks. Many yield optimizers in the past have been a target of attack and lost millions of dollars in the process. In short, high risks equal high rewards.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image: Chain Debrief

Also Read: Low-Risk Yield: Here Are The Top 5 Staking Protocols On The Solana Network