According to a court filing dated 19th September this year, Alameda Research, a trading firm owned by FTX CEO Sam Bankman-Fried, will repay approximately $200 million in loans to Voyager Digital.

Voyager will receive some 6,553 $BTC and 51,204 $ETH, along with seven other tokens, including the now-defunct $LUNC and $DOGE.

The repayment is due on the 30th of September at 5pm (UTC-5). Failure to do so will result in the loan increasing by 9.59 $ETH and 1.07 $BTC per day.

This follows Voyager filing for chapter 11 bankruptcy protection, after the collapse of crypto hedge fund Three Arrows Capital (3AC).

Also Read: Crypto Lending Platform Voyager Files for Bankruptcy – Here’s What It Means

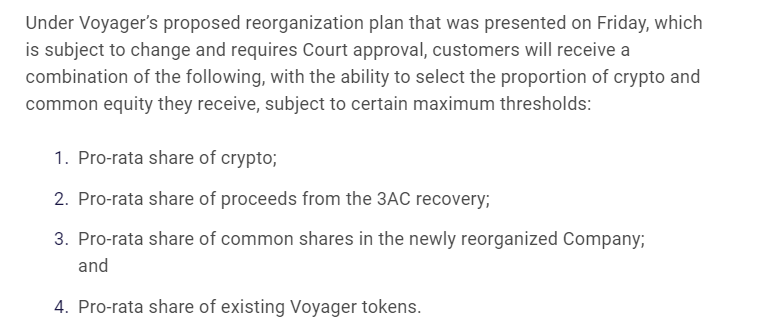

Will Users Get Their Crypto Back?

Voyager has at leas a $700m hole to plug, which translates to the size of their 3AC loan.

While the $200M they would receive amounts to a sizeable proportion of that, Alameda Research put up collateral for their borrows.

happy to return the Voyager loan and get our collateral back whenever works for voyager

— Alameda Research (@AlamedaResearch) July 8, 2022

That amount comprises of approximately 4.6 million $FTT, and 63.75 million $SRM, totaling roughly $161 million.

With a $39 million difference, the amount that Voyager will receive actually only accounts for 5.5% of the 3AC default. Despite their $500M loan from FTX, it seems that there will be no reimbursement till they hear back from Su Zhu and Kyle.

At the time of writing, $VGX is trading at $0.71, 20% up on the day.

Also Read: Nobody Is Too Big To Fail; The Fall Of Celsius And 3 Arrows Capital

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief