EverRise is all about building the future of blockchains in a fast, secure and in multi-chain way. At its core, they believe in empowering people and their choices through decentralization. They do so with a suite of dApps which makes Web3 development faster, more accessible and more secure.

In the beginning…

The hype of GameStop was prevalent and “meme” stock was becoming a thing. It served retail investors a voice as an opposing force within the equities space. Almost like a revolution against hedge funds. While Suresh, the CEO of EverRise, followed the genesis of this movement on WallStreetsBets, it led him onto another path, the road towards Crypto and DeFi.

As much as meme culture is often seen purely for “fun”, it didn’t help that the bull market actually made it profitable. Although the meme stigma continues to gloom in web3, it also came as an entry point to many. It isn’t a bad thing after all.

While the EverRise name pays homage to the commonly known term in crypto, “Up only”, the team “encourage solid analysis and mathematical sensibility”, proving its meaning to be more than a direction of a price chart.

The backbone of EverRise has strong ideals behind DeFi. They are ultra bullish.

Importance of security in DeFi

While this is a topic not often talked about, the importance of security in DeFi is paramount. I don’t blame them though, people often get into crypto because of the 100x or the massive returns you can get in a short period of time, with a very little talk about security.

But this can bite them back easily. The rise of projects which do not contemplate “security” as an important aspect of the project is growing at a rapid pace, instead, they chase a quick cash grab or just one contributing to meme culture.

No goal, no roadmap, no plans. But still does a 10x. Does this ring any bell?

Also Read: A Crypto Scam Or Genius Marketing? Here’s How Goblintown Went Viral

So this makes for a sort of recipe for disaster when you get inexperienced investors focusing solely on searching for the “next gem”. It is a trap which finds investors lost in the unscrupulous hands of a “dev” or “project” who may be solely out to get their profit and move on to something else.

On the flip side, there aren’t many projects out there that offer security tools or education because that’s simply not as popular or profitable. Take the videos on youtube as an example, “The Next 100x” Or “Top Coins to buy before 2023” will garner significant eyeballs but there’s simply no interest in, “a deep dive into why blockchain needs a robust security system”.

As the YouTubers continue their pursuit of getting more views, it leaves behind a negative impression that chasing gains is far more important than building infrastructure. “The conversation of security has to happen”.

The perfect DeFi

The perfect DeFi will involve bringing value, it should also have elements of being decentralized if not it would just be like the traditional finance e we know about.

It will “will strive to find a way to make that accessible to its holders.” and beyond making it accessible, the protocol also should “be governed by its holders, and the holders are the ones who should have the final say on how the passive income is allocated.”

The $RISE token currently carries a 5% transaction tax, all of which goes to promoting liquidity through a buyback and distributing the bought-back tokens to stakers.

The perfect DeFi protocol will, over time, monitor these taxes and run quantitative analytics to determine optimal transaction tax ave roundtable discussions where the long-term yield structure is agreed upon (or voted for). “Without this kind of dispassionate analysis, the APY game is pure guesswork at this point.”

The future adoption of DeFi

At the end of the day, DeFi means, quite simply, the efficient allocation of capital. And “decentralized” means “not under the control of any one entity.

For DeFi to be widely adopted, it must find a way to generate minimally viable communities which can distribute capital amongst themselves in an efficient manner, without centralization.

For that to happen, it is important for protocols to “figure out their identity – their reason to exist.” If that reason is strictly financial gain for all the holders, “the protocol will run into a prisoners’ dilemma – it becomes simply a game of who can sell the top and buy the bottom.”

EverRise does that differently. They are instead choosing to focus on the identity that focuses on safety, security and education yet a structure which supports passive income.

“DeFi succeeds when it finds a way to benefit long-term adopters more than it benefits early adopters.” With that identity in place, in achieving security and safety, “people might become much more comfortable allocating a significant portion of their net worth to their favourite protocols, rather than seeing DeFi as a place to splash around and catch that next “100x gem”.

What is next for EverRise?

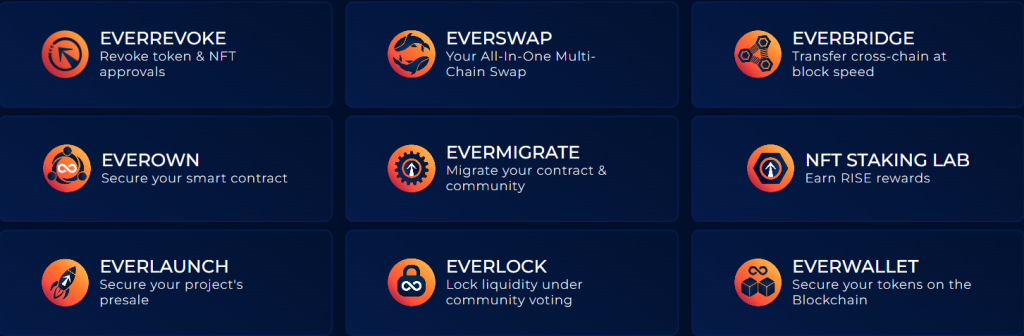

Apart from building a multi-chain DeFi security across BNB, ETH, MATIC, FTM and AVAX, EverRise is also making waves with its other products. They recently built the EverBridge in fixing existing issues face by bridges in crypto.

The EverBridge allows Web3 builders and individuals to move freely between networks at block speed. Enabling them to expand their projects across Ethereum, BNB Chain, Polygon, Avalanche and Fantom networks.

Get there faster. Transfer tokens at block speed. No mint and burn. Welcome to #EverBridge.https://t.co/HE2CXZVv9H

— EverRise (@EverRise) September 15, 2022

Beyond the EverBridge, they also have other products envisioned for the rest of 2022. This includes a (1)EverLaunch; a launchpad to support launching DeFi Projects, (2) EverLock; liquidity and token locker for projects, (3) EverEarn; a liquid staking protocol for stablecoins to earn $RISE, (4) RiseAudit; Smart contracts audit programme.

Also Read: How Climbing Mt. Everest Helped Covalent’s CEO Double Down On Himself

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chaindebrief