Collateralized Debt Positions or CDPs can be traced back all the way to MakerDAO. Maker pioneered CDPs and it allowed minting of DAI by accepting ETH as collateral.

This essentially revolutionises the decentralized finance DeFi space as it allows users to long ETH while being able to buy other tokens using the newly minted DAI.

Value proposition

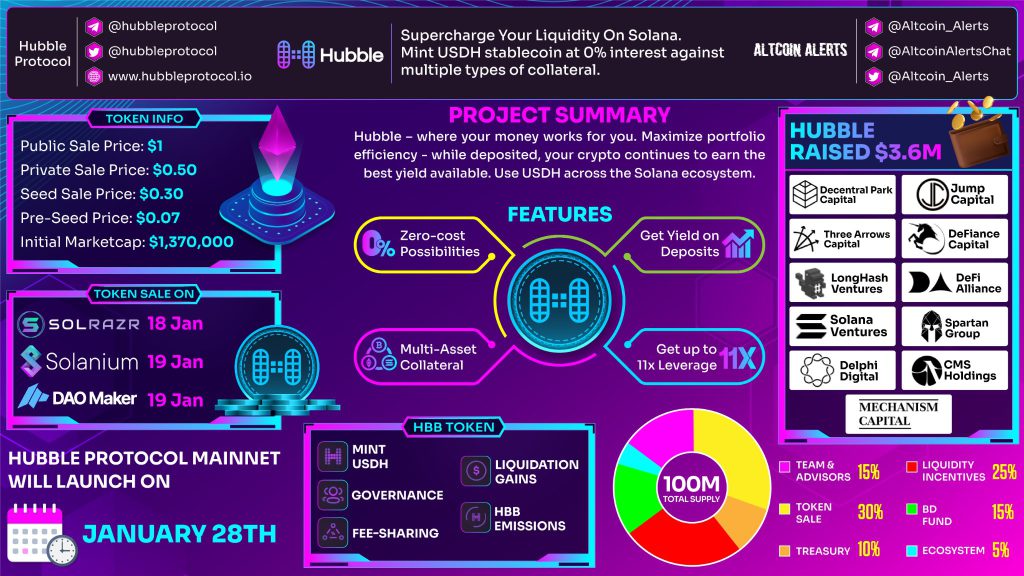

Hubble is a Solana-based DeFi protocol. It aims to improve liquidity on the Solana chain. It is also widely known as the MakerDAO of Solana. While it might seem similar to MakerDao, there are several distinct features that set it apart from MakerDAO.

First and foremost, the biggest selling point of Hubble is the zero interest borrowing protocol. Unlike MakerDAO that charges interest, Hubble only charges a 0.5% USDH minting fee and zero interest on the borrowed amount.

In addition, Hubble allows users to borrow up to 90.9% of the collateral value much more than MakerDAO’s 67%. Users can effectively leverage up to 11x by looping through Hubble protocol.

It also comes with a self-paying loan feature similar to Alchemix. The deposited collateral earns yield while sitting in the protocol. This would create a situation where the yield obtained would negate the 0.5% minting fee and the borrowing cost would be in essence zero.

Over time, the generated yield will be used to pay back the loan and the user would see a reduction of the loan amount.

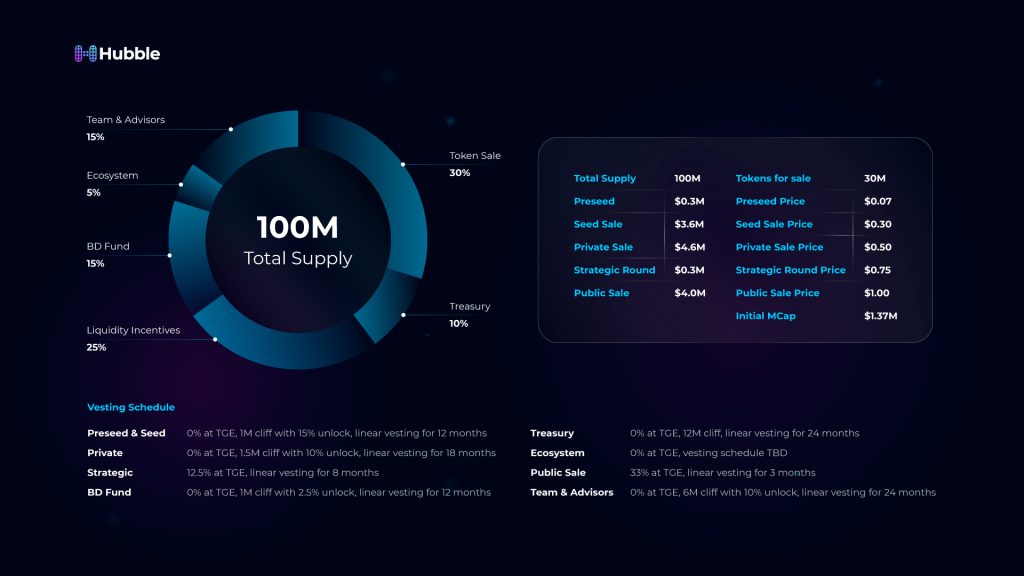

Tokenomics

$HBB is the native token of Hubble Protocol. Users can stake $HBB to receive 85% of revenue generated from the protocol. Revenue is generated from a one time 0.5% fee when the user either mint or redeem USDH.

$HBB holders are also able to participate in the DAO governance aspect of the Hubble protocol. As the protocol advances into the next phase, more products would be added and there will be more streams of revenue.

Prominent backing

Hubble’s pre-IDO seed round raised a whopping US$3.6 million, and the seed funding was supported by many top tier VCs in the crypto space.

Some of the more prominent VCs that joined the seed fund are Billionaire Su Zhu’s Three Arrows Capital and Singapore-based Spartan Capital.

Other notable investors include leading cryptocurrency research firm Delphi Digital and Decentral Park Capital who recently raised US$75 million to invest in DeFi.

Roadmap

Hubble’s Mainnet will go live on 28 January 2022.

$HBB IDO will be available on three different platforms:

- SolRazr

- Whitelist: January 18th-20th

- IDO: January 20th-23rd

- Solanium

- Whitelist: January 19th-21st

- IDO: January 21st-23rd

- DAO Maker

- Public: January 19th-26th

- Community: January 25th-26th

Diversifying the IDO into three separate platforms allow more users to participate. This would also ensure smooth traffic as not all participants would crowd on the same platform.

The roadmap can be broken into three distinct phases:

- Phase one enable DeFi borrowing and also collateralized debt positions for minting USDH

- Phase two focuses on DeFi structured products

- Phase three would venture into revolutionary borrowing space and would offer undercollateralized DeFi loans

Conclusion

In a nutshell, Hubble will be more than just a borrowing protocol as it would expand and touch on the other aspect of DeFi. Furthermore, the use of yield-bearing collateral to back USDH would see an exponential increase in USDH and it will become the core stablecoin for the Solana ecosystem.

1/ Humbled to announce an important milestone for Hubble. A thread.

— Hubble Protocol (@HubbleProtocol) December 17, 2021

3/ Welcome aboard: @Delphi_Digital, @jumpcapital, @cmsintern, @TheSpartanGroup, @MechanismCap, @DeFianceCapital, @defialliance, @DPCio, @SolanaFndn

— Hubble Protocol (@HubbleProtocol) December 17, 2021

5/ We’re building the next generation of financial services for the world, and the launch of USDH and our innovative borrowing platform is just the beginning of what we can do.

— Hubble Protocol (@HubbleProtocol) December 17, 2021

7/ Our roadmap holds many challenges: structured products, undercollateralized lending, and the exploration of novel and cutting-edge financial technologies.

— Hubble Protocol (@HubbleProtocol) December 17, 2021

9/ Hubble is more than a protocol. Hubble is developers, marketers, storytellers, and a community built around an idea that will one day see Hubble DAO stand on its own two feet.

— Hubble Protocol (@HubbleProtocol) December 17, 2021

Featured Image: Hubble Protocol

Also Read: What Is Solice? Introducing The Next VR Metaverse On The Solana Blockchain To Watch Out For