The U.S. announced that the annual rate of unseasonably adjusted CPI in May was 8.6%, the highest since December 1981. Bitcoin fell below $30,000 following the release of higher-than-expected U.S. CPI. https://t.co/WkNaJLclsx

— Wu Blockchain (@WuBlockchain) June 10, 2022

There’s no doubt the current bear market was triggered by the higher-than-expected inflation numbers. Crypto, inclusive of Ethereum and the NFT market, took a nosedive when US CPI was reported to be 8.6% year-on-year, higher than the market’s expectation of 8.3%.

The plummeting of the crypto market also caused Celsius to be insolvent. The billion-dollar DeFi company took a number of hits from the Luna collapse to the stETH depeg. This caused a liquidity crisis and Celsius had no choice but to stop all withdrawals and start restructuring.

Also Read: Nobody Is Too Big To Fail; The Fall Of Celsius And 3 Arrows Capital

The impending collapse of the billion-dollar giant also caused further market-wide panic. Both Bitcoin and Ethereum got nuked hard and many got liquidated in the process.

Ethereum the 2nd biggest coin in the crypto in terms of market cap, hit a low of US$1,012. So this begs the question, what happened to the Jpegs?

Jpegs got rekt

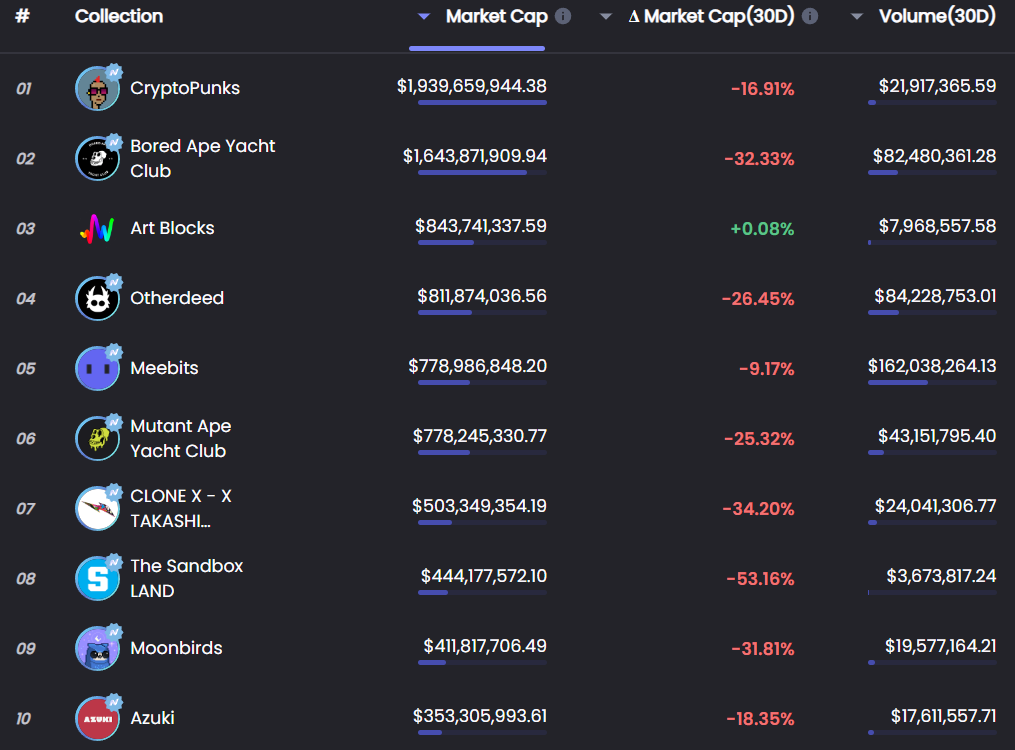

Many top NFTs in the market got rekt hard. Bored Ape Yacht Club (BAYC) even made headlines because the floor price was a low 68 ETH.

The crypto market meltdown made investors rethink their investment vehicles and many chose to sell their illiquid NFTs at a discount.

This could have triggered a cascading effect on prices as holders spiral into a frenzy to sell their NFTs.

The downward selling pressure caused the market cap to compress and many top NFTs see a dip of 10% – 50% in market cap.

Greater fool theory for NFT

Obviously, expensive digital images of monkeys are going to improve the world immensely

Bill Gates

Billionaire Bill Gates slammed NFTs and said that it is based on the greater fool theory. The greater fool theory argues that prices go up because people are able to sell worthless or overvalued items to a “greater fool” who is willing to pay a higher price than you did.

The greater fool theory that Bill Gates spoke of can be attributed to the current state of the NFT market. The NFT market is still relatively new and clearly an emerging sector. It is not an efficient market and it is still immature compared to the stock market.

I do share the same sentiment with Bill Gates but I don’t agree with generalizing the whole NFT space. While the majority of the NFTs in the current market are clearly a cash grab, there are still some innovative NFTs that are generating value for their holders.

Value can be subjective and it can come in many forms. Certain NFTs present value by allowing their holders access to gated events or premium software. Other NFTs deliver tangible products like exclusive shoes and hoodies.

Is this the bottom?

The Fed announced a 75 bp hike in interest rates, the largest rate hike since 1994, following the high CPI data. In the past 7 days, Bitcoin fell 32%, Ethereum fell 38%, and the total market value of cryptocurrencies fell below 1 trillion.

— Wu Blockchain (@WuBlockchain) June 15, 2022

It’s very hard to determine if this is the bottom of the market or just a local bottom. Even experts in the crypto space have no idea if we are at max pain yet.

So how long would the greater fool theory be applicable? especially when Ethereum prices are taking a nose dive, it is a double whammy, almost like the NFT market taking a jab to its stomach from falling demand and a hook to its face with Ethereum plunging.

If we look at the most recent FOMC press conference, the Feds are trying to achieve a ‘soft landing’. The latest 75 bp rate hike is an attempt to tame inflation without driving the economy into a recession. This is could just be the final uppercut in knocking out the NFT market.

One thing for sure is that the crypto market will not recover unless there’s a major shift in macros. That will only happen when inflation numbers are under control and interest starts to decrease. This would inevitably change the market sentiment to “risk-on”.

Furthermore, NFTs was only made popular the end of 2021, a rookie in the industry. Even when many projects rode that huge NFT wave last year, the biggest scrutiny will come now, during the crypto winter.

What will happen to The NFT Market?

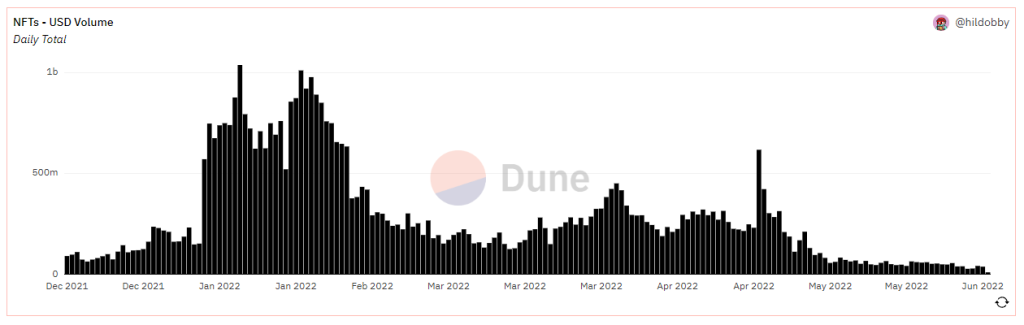

The super active NFTs market that we know and love will surely go into a deep slumber. The NFT volume has started to slow down since May and it looks like it will not recover anytime soon.

With low trading volume, many projects will definitely fade into the darkness and not survive this harsh winter. This is because many of these projects rely on trading volume to generate revenue to pay for the ongoing expenses.

Ethereum price charts show similar sentiments. With that said, we can only wait and see how many of those so-called “blue-chip” NFTs will survive this bear market.

Conclusion

Personally, I’m not an NFT person but an investor in Ethereum, so I standa neutral standpoint. Like many, I’m sceptical about NFTs but I think that with some fine-tuning it could be the new wave of the internet.

For that to happen, the general view of NFTs has to evolve and move away from one that it is just a status symbol.

US$1,000 is the key psychological level for Ethereum. 2 things may happen when price reaches this level, a major sell off or a spike in the coin being bought. What’s worst? Investor confidence. This will shake away cash grabbers within the space and potentially limiting the mass adoption we all want.

Those who remain will either be labelled extremely foolish or be called genius investors 5 years down the road.

All in all, NFTs have a long way to go and many of the projects that we know today will not pull through. Those that survive the bear market will lead the charge to mass adoption and maybe in the distant future, the NFT market will be a force which affects the price of Ethereum.

Also Read: Build The Next Opensea: Will SeaPort Be The Catalyst For NFT Adoption?

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief