Stablecoins are the backbone of the crypto world. They are designed to have a value that is much more stable than normal volatile cryptocurrencies. Stablecoins are cryptocurrencies with value pegged to the underlying asset. The underlying asset may vary from coin to coin.

Stablecoins like USDT & USDC are pegged 1:1 to the value of USD and other stablecoins like DGX & ZPG are pegged 1:1 to the value of gold.

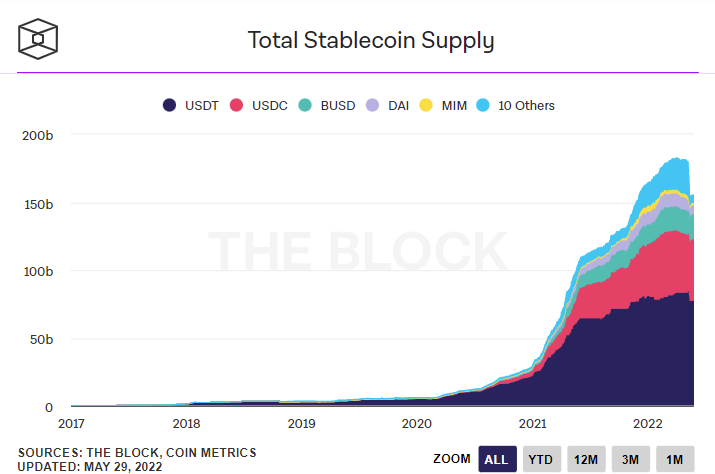

The stablecoins market has seen exponential growth from US$29 Billion at the start of 2021 to a staggering US$164 billion in a year. Stablecoins has also recently grew popular especially with the bear market condition, when coins are going through high volatility actions.

Not all stables are equal

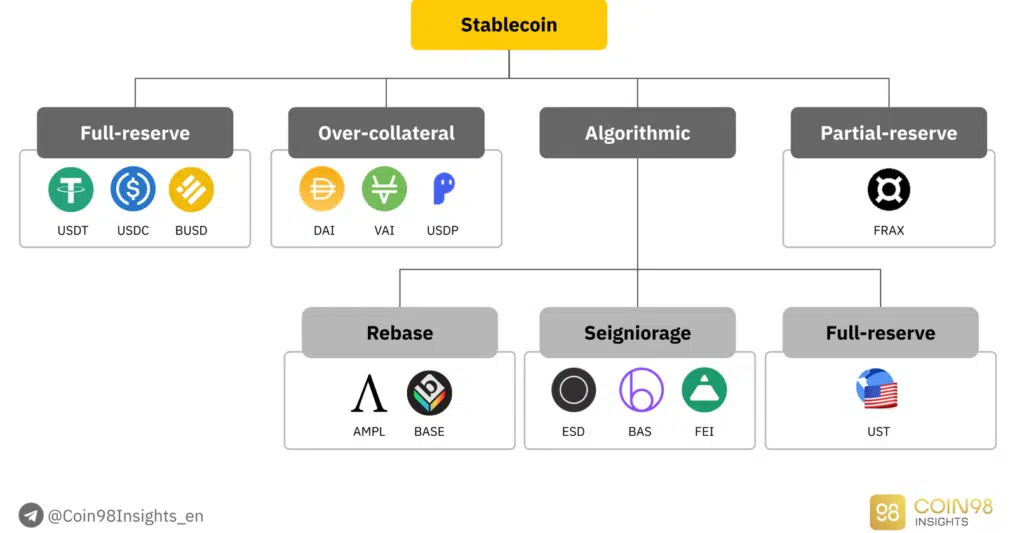

There are four main categories of Stablecoin:

- Fiat-collateralized

- Commodity-collateralized

- Crypto-collateralized

- Non-collateralized

Fiat-collateralized stablecoins are the most common type of stablecoins out in the market. Every single fiat-collateralized stablecoins are backed by a single unit of fiat.

Commodity-collateralized stablecoins are stablecoin that are backed by other kinds of interchangeable assets such as precious metals. The most common type of precious metal used as collateral is gold.

Crypto-collateralized stablecoins are stables that are backed by other cryptocurrencies. These stables are often over-collateralized by other cryptocurrencies to absorb the price volatility.

Non-collateralized stablecoins or algorithmic stablecoins are stables that are not back by anything at all. It is the most decentralized stablecoin that uses an algorithmically governed approach to control the supply.

Is it really stable?

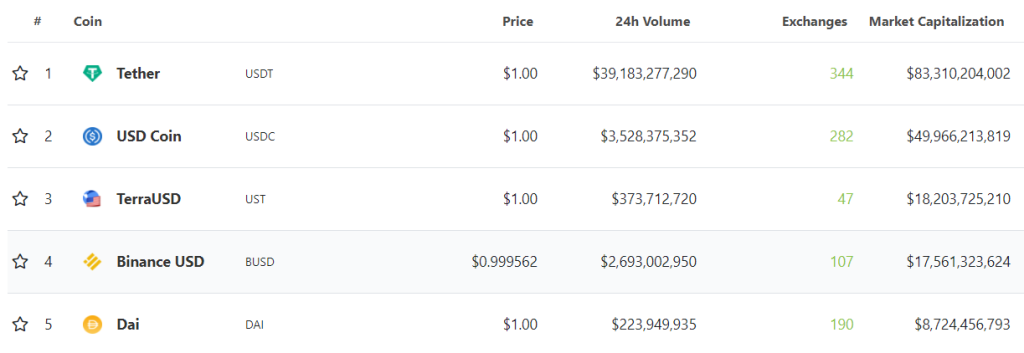

USDT (Tether) is the third-largest stablecoin with over US$83 Billion market cap. There has been a lot of controversy surrounding Tether and its USD reserve.

Contrary to popular belief, USDT is not backed by a full USD reserve. USD cash only makes up a small portion of the reserve and it is largely backed by cash equivalents.

If the community loses confidence in USDT, the dumping could potentially depeg the stablecoin. So it is important to diversify across a few different stablecoin like USDC and DAI. While on the topic of diversifying, it is also a good idea to diversify across a few stablecoins yield farms.

I guess the stability of the stablecoin really depends on its collateral, and ultimately your own discretion. Based on Huobi Research, stablecoins with fully/over collateralized fiat/crypto assets tends to garner a higher stability rating.

Non of the information below constitutes financial advice and please do your own research before getting your wallets into any.

Read More on the fall of UST stablecoin here: “Terra Is More Than UST”: Will Do Kwon’s Revival Plan Save The Terra Chain?

With that aside, here are 5 stablecoins yield farms that you can ape into especially in this bear market:

Maple Finance

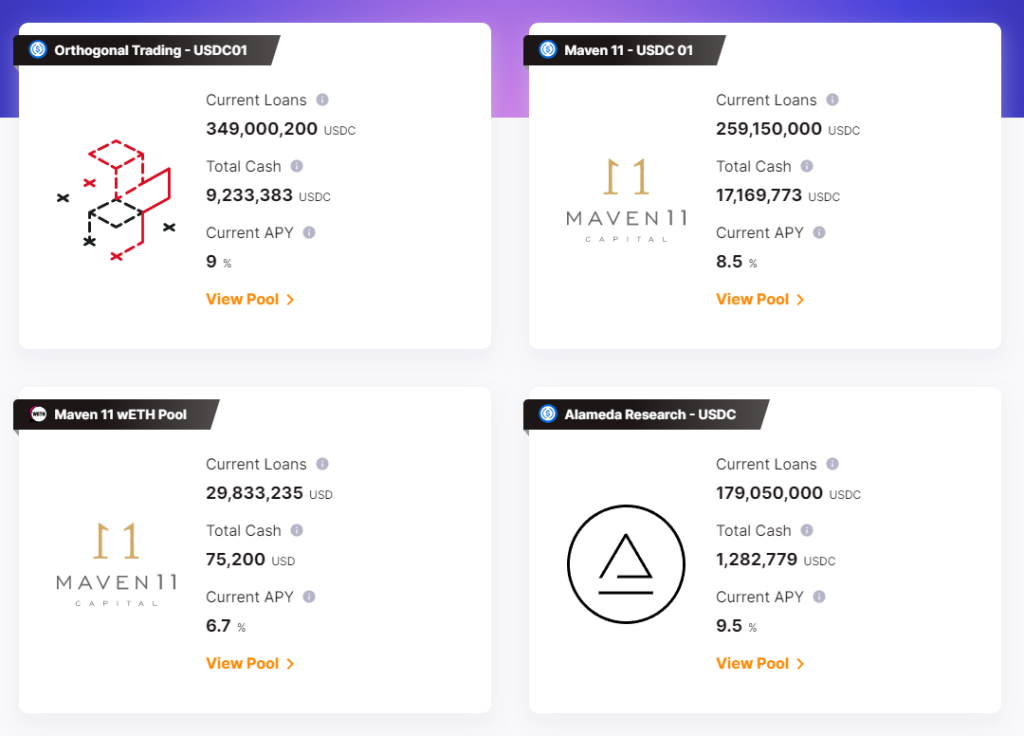

Maple Finance is a lending protocol for institutions and corporations built on the Ethereum network. The capital marketplace provided over US$900 million in liquidity and has earned over US$24 million in interest.

The decentralized credit market provides under collateralized lending for institutions and sustainable fixed income for lenders.

At the time of writing, Lenders can choose to loan out to a variety of highly vetted institutions from Alameda Research to Maven 11.

Lenders get to enjoy sustainable yield that ranges from a cool 12.5% to as low as 3.7% APY. Top VCs such as Dragonfly Capital, Flow Ventures, Spartan, and Nascent are all Maple lenders.

You can read more about Maple Finance here: The Top 3 DeFi Projects To Keep An Eye Out For In April

Aurigami Finance

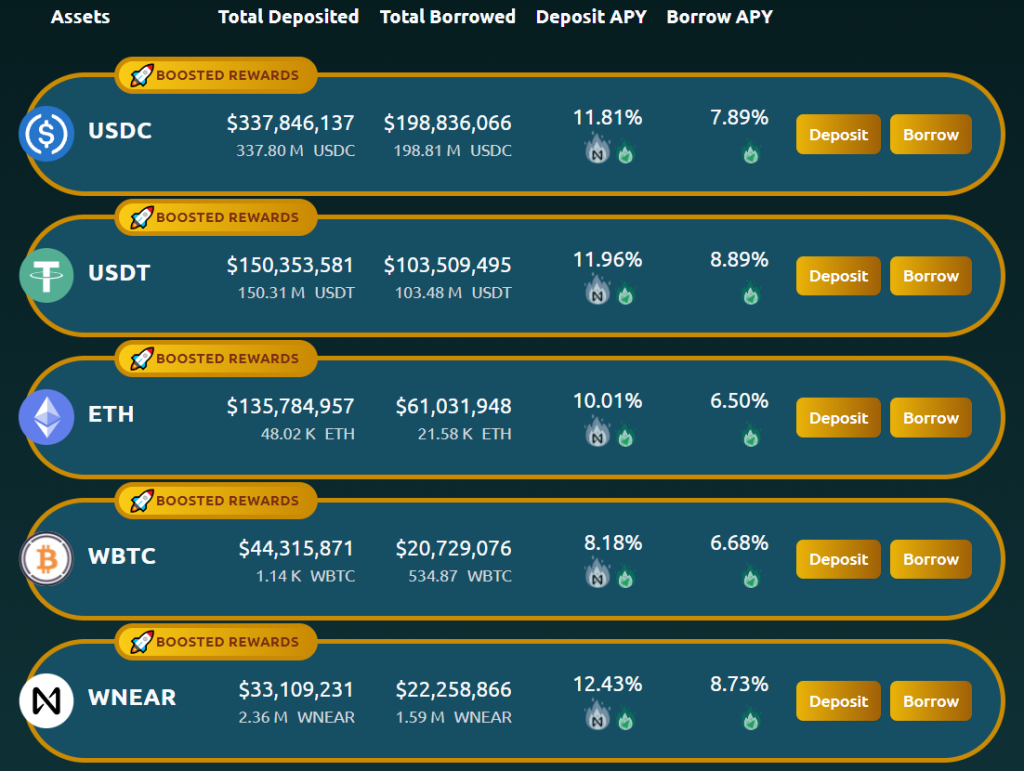

Officially launched in March 2022, Aurigami is a proud recipient of the NEAR foundation grant. It is the first money market protocol on Aurora mainnet.

The decentralised, non-custodial liquidity protocol acts as a bank that allows users to lend and borrow crypto assets.

With over US$284 million in TVL, it is the fastest-growing protocol on Aurora and also the second-largest just behind Bastion Protocol.

At the time of writing, Aurigami is offering 8.82% for USDC and 9.42% for USDT deposits. Do note that the airdrop event has ended and the bulk of the APY is paid out in the native token $PLY.

You can read more about Aurigami here: All You Need To Know About Aurigami — The First Money Market Protocol On Aurora

Raydium

Raydium is the first-ever on-chain order book automated money maker (AMM) on Solana. It is the go-to exchange for trading Solana based crypto tokens.

Raydium is currently the top decentralized exchange (DEX) on Solana with over US$666 million in TVL and US$46 billion in trading volume.

At the time of writing, the USDH-USDC liquidity pair is offering over 21% APY. As both tokens are stablecoins, the liquidity provider would not have to worry about huge impairment loss.

You can read more about Raydium here: Raydium: The Heart Of Solana And Go-To Place For Trading Solana DeFi Tokens

Stargate Finance

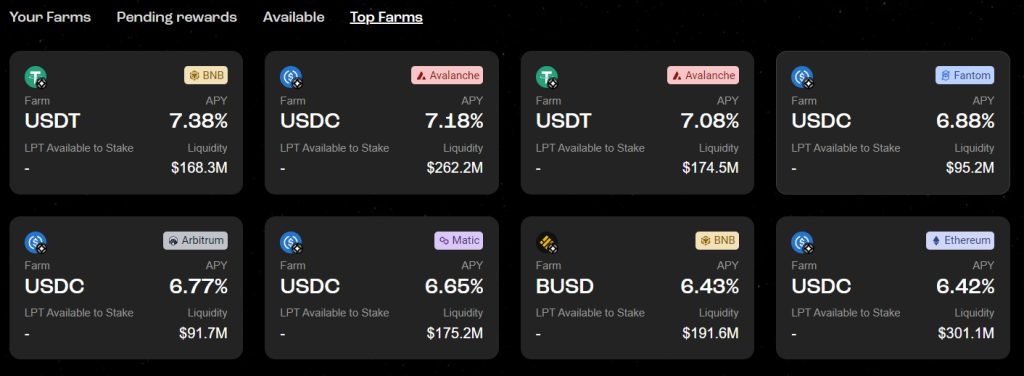

Stargate Finance is a fully composable liquidity transport protocol that lives at the heart of Omnichain DeFi.

With Stargate, users and Dapps can transfer native assets cross-chain while accessing the protocol’s unified liquidity pools with instant guaranteed finality.

At the time of writing, it is offering up to 7.89% APYs on a variety of stablecoins. Do note that while Stargate finance is a relatively new protocol, it is growing rapidly and has attracted over US$1 Billion in TVL.

You can read more about Stargate here: Solving The Bridging Trilemma: Here’s Everything You Need To Know About Stargate Finance

AAVE

AAVE is one of the OG protocols built on the Ethereum network. Created in 2017, it is a DeFi lending protocol that allows users to take out a loan.

Aave is one of the largest protocols in the crypto space with over US$18 Billion TVL across 7 networks. It is a fully decentralized, community-governed protocol with 100k token holders.

Currently, Aave is offering a cool 4.86% APY for USDT on the Arbitrum network and 4.65% on the Optimism network.

You can read more about AAVE here: What Is Aave And How It Enables Anyone To Lend And Borrow Cryptocurrencies

Conclusion

There are plenty of degen high yield stable farming opportunities out there but these few protocols are handpicked based on the APY and protocol security, of course, approach everything with caution.

It is highly recommended to re-evaluate your portfolio periodically based on the market condition and narrative. The crypto scene changes rapidly and the leading protocol today might be dethroned tomorrow.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief

Also Read: Investing Side Hustles: 5 Ways You Can Start Earning Money In Crypto