Key Takeaways:

- Solana’s downtime and exploits have limited effects on long-run price trends

- Their young, vibrant ecosystem remains an attractive place for developers

- More protocols are building around Solana’s Virtual Machine, including Nitro Labs on Sei Network

___________________________________________

By this point, Solana’s downtime has been meme’d to death. With the most recent outage earlier this month, any hope that the Layer 1 will overcome this issue in the near future has likely dissipated.

We’re continuing to investigate the recent Mango Markets hack.

— OtterSec (@osec_io) October 12, 2022

Let’s clear up some misinformation. 🧵 pic.twitter.com/hCtTwz1l5c

To put the metaphorical cherry on top, Mango Markets, the 5th largest protocol by TVL, was entirely drained earlier today. With more than $100 million, or approximately 10% of the entire ecosystem’s TVL vanishing, outlook for the Layer 1 has taken a turn for the worse.

Despite social metrics pointing towards extremely negative for the blockchain, we must remember to respect the contrarian point of view. As such, let’s take a look at five reasons why Solana is likely to remain the strongest alt-Layer 1, and in the top 10 cryptocurrencies.

Also Read: An Introduction To Solana – Why It Is The Hottest Blockchain Right Now

1. Downtime and Exploits? It’s All Priced In For Solana

Network outage? Priced in. Major hack? Priced in.

“Your consciousness is just an illusion, a product of the omniscent market. Free will is a myth. The market sees all, knows all and will be there from the beginning of time until the end of the universe“

Reddit User zsd99

By now, the market is more likely to price in an outage than consistent uptime.

In fact, by overlaying the times when Solana experienced network downtime, we notice that blockchain performance did not affect overall price trends. While some did cause reversals, these were just temporary instances of a larger movement.

Overlaying Bitcoin’s graph also hints towards the cause of $SOL’s price falling. Instead of any individual point of failure, it’s price has been a victim of the overall crypto market.

In the same vein, crypto natives have become desensitized to major hacks. From the recent $162 million hack of Wintermute to Harmony’s exploit that left the network unusable, such major events have caused even multi-million hacks to be “priced in”.

2. How Their Dwindling Ecosystem Somehow Signals Bullish

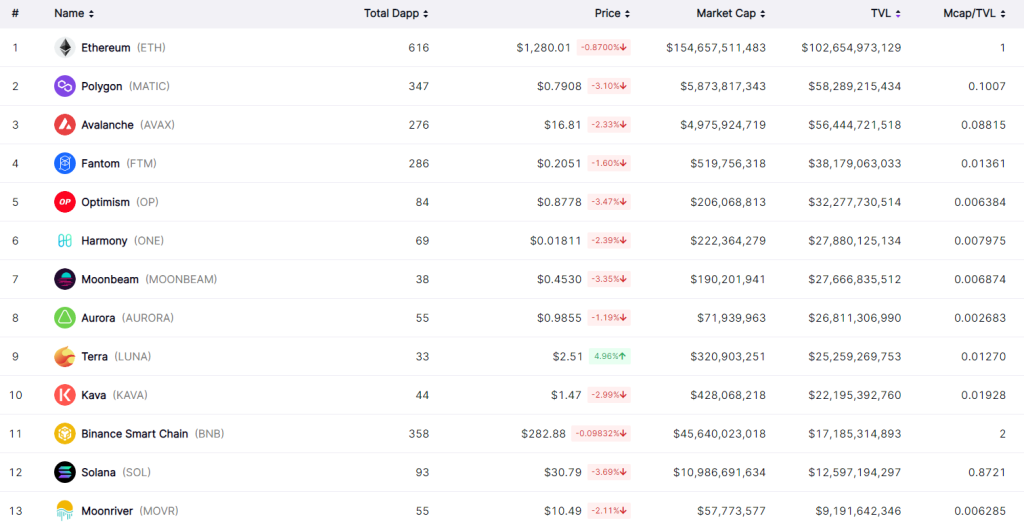

Solana’s TVL has sunk below the $1 billion mark following the mango market exploit, falling below competitors such as Avalanche ($1.5B) and the Binance Smart Chain ($5.4B). Using the TVL/market capitalization comparison, $SOL may seem overpriced to speculators.

However, as Covalent HQ’s CEO puts it, “If you want financial advice, the application layer is not here“.

With value accruing towards the layer 1 instead of ecosystem tokens, focus is thrown towards the underlying blockchain and not the myriad of protocols built on it.

While a healthy ecosystem is essential in the long-term, building out applications is not imperative, especially in a bear market. Resources can be used to upgrade the network, improving uptime and throughput.

As the bear market returns, however, Solana can use their healthy war chest of funds to incentivize building, reviving the vibrant list of protocols calling it home.

3. SVM – A New Standard For Virtual Machines

The Ethereum Virtual Machine (EVM) has become the standard for blockchains, especially layer 1s. By being EVM-compatible, they offer a familiar environment for developers to build in.

Solana, however, utilizes the Sealevel Virtual Machine (SVM), allowing it to process transactions in parallel.

Introducing Nitro 🚦The first Solana scaling solution

— Nitro SVM 🚦 (@Nitro_Labs) September 15, 2022

Nitro is building an L2 for Solana that combines Solana’s powerful execution environment and developer community with the thriving Cosmos and IBC ecosystem

A 🧵 on why Solana DeFi users and developers should be excited 👇 pic.twitter.com/nFhGbGfHN4

Recently, Nitro Labs, which is being built on the brand new Sei network, announced that they will be pushing for SVM to become the new standard for blockchains.

Having an alternative to EVM means that projects do not have to be rebuilt from scratch should they wish to migrate from Solana. It also implies that more networks will have better interoperability with Solana.

As SVM increasingly rivals EVM, there will be a healthy ecosystem surrounding Solana, with it’s own set of use cases and ecosystem that others will find hard to rival.

Also Read: SolanaFM Successfully Completes $6.3 Million Seed Round, Eyes Aptos and Sui For Expansion

4. Sam Bankman-Fried; FTX CEO, Solana’s Godfather

One of the main reasons crypto users have been so bullish on $SOL has to do with Sam Bankman-Fried (SBF). CEO of leading Centralized Exchange FTX, his now-legendary tweet signaled the start of up-only for the coin.

I'll buy as much SOL has you have, right now, at $3.

— SBF (@SBF_FTX) January 9, 2021

Sell me all you want.

Then go fuck off.

SBF’s public display of erm, affection for $SOL instilled an un-replicable confidence in the Layer 1. After all, if one of the world’s youngest billionaire announced that he way buying, wouldn’t you follow?

Furthermore, their young, vibrant community of builders and developers – including Singapore-based Solana FM remains an attractive place to be.

While we are still a 90% drop away from his declared price, the promise of front-running a crypto giant is extremely enticing. Factoring in the ecosystem that Solana has built, buying in the $20-$30 range would not be an unreasonable comparison to buying at $3.

Also Read: Yoots, The Biggest Solana NFT Project, Is Launching Right Now – Here’s All You Need To Know

5. Learning From The Past: A Case Study on Ethereum

If you’re not convinced by now and remain some sort of maxi, we can take a look at the past of a crypto blue chip, Ethereum.

Back in 2016, the DAO, one of the earliest forms of decentralized organizations, raised $150 million in $ETH investments. However, it suffered what was the largest exploit at the time, with almost all participants left with nothing to show for.

#TheDAO #ethereum #hardfork is scheduled to happen in 3 days https://t.co/eCrUnrsQ3V

— The DAO (@The_DAO_Project) July 17, 2016

This resulted in a hard fork, with the original chain being renamed as Ethereum Classic ($ETC), and a new chain with the recovered funds being the Ethereum ($ETH) we all know today.

Mistakes are bound to happen, and exploits and inevitable in a world where code is law. Till we achieve an uncrackable standard for smart contracts in Web3.0, every failure should be looked at as a learning point.

Ethereum today has recovered from the hack, with trust generally restored. Had the community given up, Web3.0 as we know it today may have never existed.

Solana – A Layer 1 For The Future

Despite the torrential downpour of bad news on Solana, we should be forgiving of the mistakes made.

If billion-dollar projects like Axie Infinity can fall victim to exploits, budding developers should be allowed to fail too. However, this does not mean that security can take the backseat in the space. Instead, more resources should be allocated towards making sure Web3.0 is safe for everyone before dAPPS continue to be worked on.

With that said, a tough balance has to be struck between the two. The reality is that some only want to build, with nary a care for security. Should Solana be able to marry these two worlds, however, they are set to succeed in the long run.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief