DAOs (Decentralized Autonomous Organizations) are revered as the future of decision making. From remote working, collaborative groups, and even governments, they often get placed on a pedestal of sorts.

However, much like most of crypto, they are still a young concept and require much development.

InfoTokenDAO, an exclusive group for Web3.0 researchers, experienced this the hard way when one of their most respected members betrayed them.

Also Read: Genius or Destructive? MakerDAO Founder Plans To Depeg DAI Stablecoin

The DAOwnfall?

While most DAOs are founded as a vague reflection of governance, InfoTokenDAO has a rich history beyond that. They are a group of 100 that attempt to enrich the community through various means.

This is @InfoTokenDAO.

— Information Token (@InfoTokenDAO) December 25, 2021

If you are interested in talking please reach out to one of our members.

Thank you to everyone who participated in our ciphers this week, you helped to publicly reveal the ethos driving @InfoTokenDAO.

So, what is information worth to you? pic.twitter.com/S9WbFpPUSU

They received an allocation of $VELO from Velodrome Finance, a liquidity marketplace on Optimism, as part of their launch.

The allocation was managed by five individuals, all of which seemingly had full access to the private key. It also contained LP positions, funds from bribes, and a lot more money.

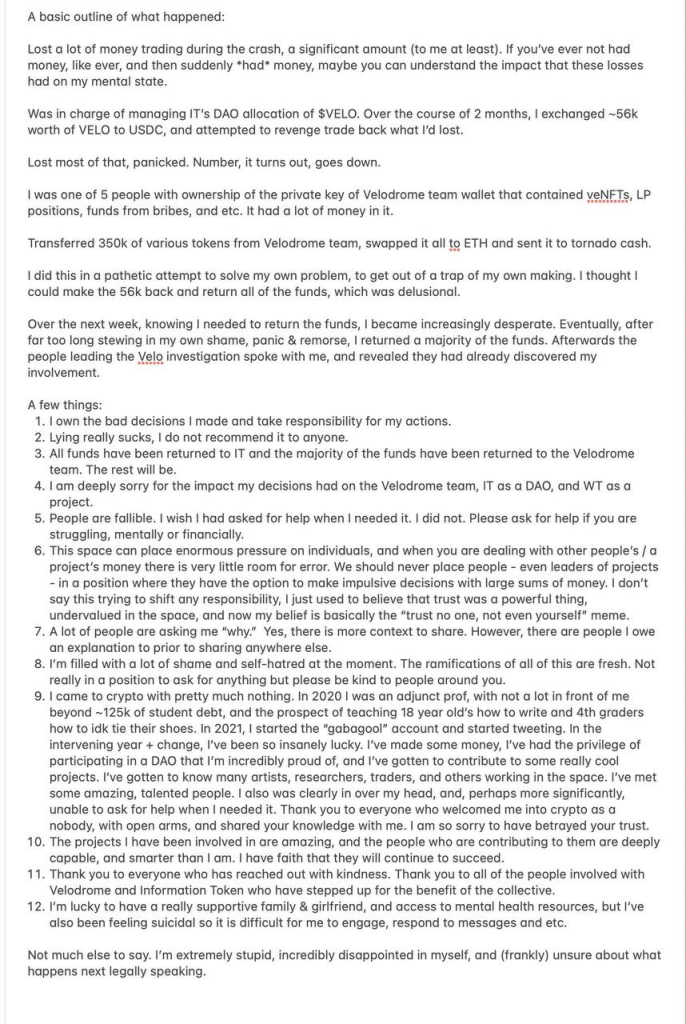

One of them was twitter personality Gabagool.eth.

On August 4th, he abuse this privilege to transfer ~$350,000 from it to his own account via Tornado Cash.

Since then, he has issued a public apology, and stated that he has returned “a majority of the funds”.

At the time of writing, both InfoTokenDAO and Velodrome have cut ties with Gabagool.eth, and claim that user funds have not been affected.

What This Means For DAOs

While most DAOs use a multi-sig wallet, this issue occurred due to a single point of error.

It does not mean, however, that multi-sig wallets are a guarantee of safety. In a 2/3 multi-sig as pictured above, it would only have required one more bad actor to crack the wallet.

Multi-Sigs are also often controlled by anonymous protocol creators. Should they choose to rug and leave, it would be almost impossible to track them down.

With the rise of phishing attacks, no one is truly safe, especially traditional crypto “security protocols”.

Closing Thoughts

Recent hacks have been storming the headlines, and shining a harsh spotlight on Web3.0. Could this be the end to our decentralized, anonymous ecosystem?

Probably not.

However, the easiest path, centralization and KYC, would probably be the go-to for many protocols that have “made it”. With the United States sanctioning Tornado Cash, and many major platforms following suit, it seems that we are sadly reverting back to the good old days of traditional finance.

Also Read: How Iran and Taiwan Are Using Crypto To Bypass Sanctions, Thwart Attacks

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Web Coin Market