Ethereum started transitioning from Proof-of-Work (PoW) to Proof-of-Stake (PoS) consensus with the launch of the Beacon chain in 2020.

This allowed validators to stake Ether, or $ETH, which was used to secure the blockchain and they earned rewards for this but the staked Ether or rewards could not be withdrawn until the Shapella upgrade.

Before the Shapella upgrade (also known as Shanghai/Capella upgrade) came “the merge” in September 2021 which saw the Beacon Chain merged with the Ethereum mainnet.

The merge officially made Ethereum a PoS chain and the Shepella upgrade made it possible for stakers to withdraw their staked Ether and rewards.

Now the Shepella upgrade happened on April 12th, 2023 remember people have been staking Ether since 2020 (Beacon chain launch). As a result of this, the total locked-up Ether before the Shepella upgrade was about $18 million ETH ( $32 billion) which accounted for roughly 15% of the circulating supply.

So about $32 billion in ether was accessible for withdrawal this made some crypto enthusiasts be of the opinion that this would negatively affect the price of ether due to perceived sell pressure.

Let’s take a look at how Ethereum has performed since the Shepella upgrade.

Also read: Here’s EVERYTHING You Need To Know about Ethereum’s Shapella Upgrade!

Ethereum Post Shapella Upgrade

Contrary to what some people might have expected, the price of ether rallied during Shapella upgrade.

ETH entered the month of April trading at $1,824 by the 12th of April(the day of the upgrade) ether was trading at $1,892. It rallied all the way to $2,118 which was a yearly high just five days after the upgrade.

So there was no dumping after the Shapella upgrade.

Instead it pumped and since then for the most part Ether has been trading above $1,800. Overall, Ethereum has had a positive year so far given the fact that it started 2023 at $1,196 and that has been its lowest YTD.

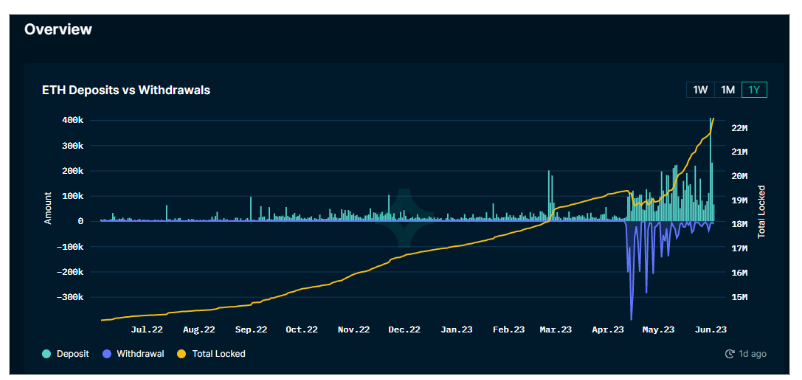

After the Shepella upgrade to the time of writing about 6.07m ETH has been deposited for staking with 3m ETH withdrawn which is slightly below 50% of the new deposit.

Breaking down these withdrawals, 1.11m ETH were rewards from staking and 1.89m principal (i.e. initial ETH staked ). The most withdrawal happened on the 15th of April 395,803 ETH was withdrawn.

The last time withdrawals surpassed deposit was on the 28th of April, from the 29th of April till the time of writing deposit has surpassed withdrawal and the most deposit was on June 1st when 408,940 ETH was deposited.

At the time of writing $36.35 billion worth of ether is currently staked, which is about 16% of the market cap of Ethereum.

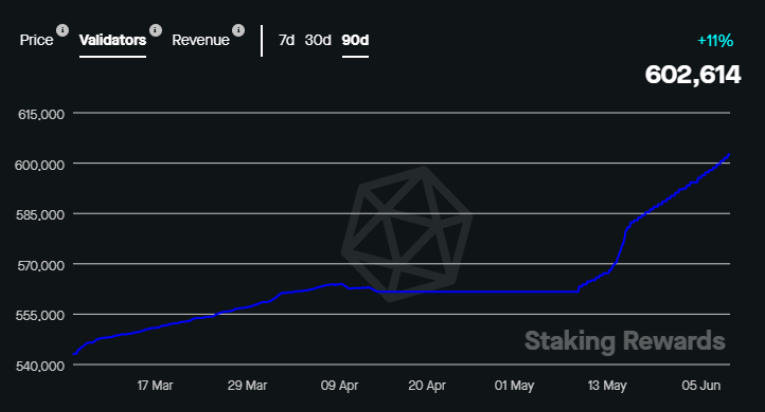

Ethereum had 563,047 on the day of the Shapella upgrade and maintained just about this range between April 12th to May 9th the number of validators started to increase as of May 10th and there are currently 602,614 validators on the Ethereum blockchain.

As for the number of daily transactions on the network it has been pretty much the same as prior to the upgrade, post-Shapella upgraded daily transactions have been ranging between 867,000 to 1,200,000 transactions daily which is the same range prior to the upgrade in 2023.

The same can be said for daily active addresses prior to the upgrade daily active addresses ranged between 350,000 and 530,000 in 2023, post Shapella upgrade this is still the range.

Closing Thoughts

When the Shapella upgrade happened on April 12th 2023 Ether had a circulating supply of 120,437,441.39 ETH at the time of writing it currently has a circulating supply of 120,243,004.86 ETH which is a difference of 194,436.53 which have beenburnt.

Ethereum moving from PoW to PoS is one of the most monumental landmark events in the history of blockchain.

We are talking about a blockchain that had 18m ETH accessible for withdrawal but still rallied even when stakers could withdraw.

We are talking about a chain that has seen more deposits than withdrawals since May 29th till date and has over 600,000 validators.

How has Ethereum performed since Shapella upgraded? It has performed quite alright.

Ethereum is currently the most decentralized layer-1 blockchain, its native token Ether is deflationary and has a relatively wide adoption with a fleet of use cases giving birth to the term “Ultra Sound Money”.

Also Read: TrueFi, DeFi’s Battle for Institutional Adoption, and Why You Should Care

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: ChainDebrief

This article was written by Godwin Okhaifo and edited by Yusoff Kim