Key Takeaways:

- Poloniex Owner Justin Sun reportedly purchased a majority stake in Huobi Global

- He will be part of the board of directors, but day-to-day activities will not be impacted

- Huobi Global will also delist 21 HUSD trading pairs, following a layoff of 30% of its staff

___________________________________________

Huobi Global – a leading cryptocurrency exchange, has a new majority shareholder.

It’s founder, Leon Li, has reportedly sold his entire stake to Poloniex owner Justin Sun. While the official announcement states a majority buyout by About Capital Mangement, Wu Blockchain reports that Justin Sun is a core investor of the fund.

A Buyout With FTX?

According to several sources, FTX was rumored to have invested to “help Justin Sun” to acquire Huobi.

While the crypto entrepreneur previously informed Wu blockchain that he did not participate in the round, he was recently announced as a board memeber.

.@HuobiGlobal has announced its global advisory board composed of industry leaders across blockchain and traditional organizations. The initial list of Huobi Global advisors is as follows: Ted Chen, @DujunX , Wang Yang, @justinsuntron, @LeahWald.https://t.co/RudgABiC7F

— Huobi (@HuobiGlobal) October 9, 2022

As part of its Global Advisory Board, he will help to “guide Huobi Global’s business development as well as its strategic roadmap for global expansion.”

Joining him are four other members, namely:

- Ted Chen, CEO of About Capital Management (HK) LTD

- Dun Jun, Co-Founder of Huobi Global

- Wang Yang, VP of HKUST

- Leah Wald, CEO of Valkyrie Investments

still not involved https://t.co/fiIyxTVEiq

— SBF (@SBF_FTX) October 10, 2022

FTX’s CEO Sam Bankman-Fried has since publicly announced that he was not involved in the proceedings.

As for Huobi users – the exchange says that the deal has “no impact on its core operations and business management team”.

Instead, “new international brand promotion” and more benefits will come to the CEX, in order to enhance competitiveness.

Huobi Delists 21 Trading Pairs, Cuts Workforce

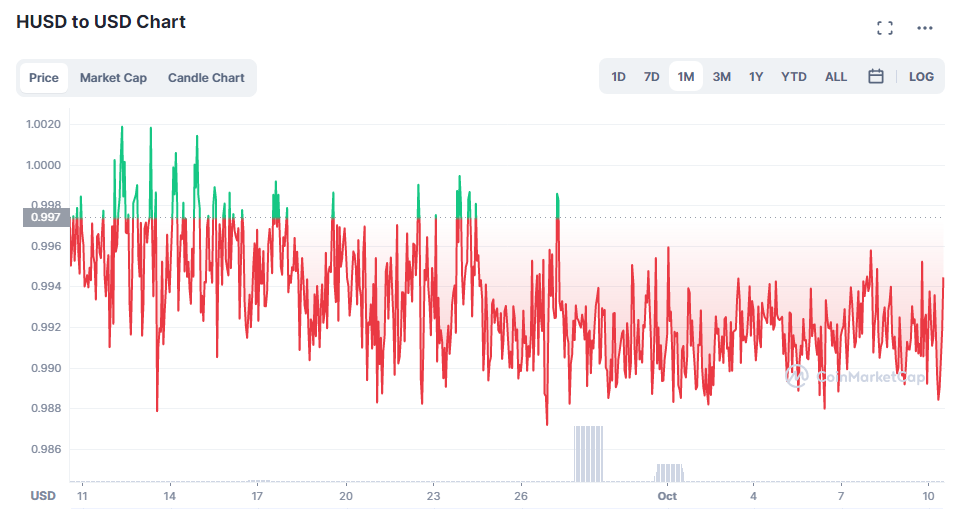

Announced today (10th Oct), Huobi Global will delist 21 HUSD trading pairs, including USDC/HUSD and BTC/HUSD.

This follows a continuous depeg of the fiat-collateralized stablecoin over the past few months.

In contrast to Binance, which has pushed for adoption of $BUSD, Huobi has chosen to reduce reliance on its stablecoin.

The current CeDeFi meltdown may be one of the causes for this – especially in a time of both regulatory and economic uncertainty.

EXCLUSIVE: Cryptocurrency exchange Huobi will start layoffs, which may exceed 30%. The main reason is the sharp drop in revenue after the removal of all Chinese users. Previously, Bybit also announced a layoff plan. pic.twitter.com/jbRG2Aew5G

— Wu Blockchain (@WuBlockchain) June 28, 2022

According to Wu Blockchain, Huobi has also laid off 30% of its staff due to a sharp drop in revenue.

It was forced to relocate the Asian headquarters from China to Singapore following several regulatory shutdowns in the nation. This led to retiring all user accounts in China – which amounted for a sizeable share of their trading volume.

Huobi Global currently ranks at #13 on CoinMarketCap by exchange score, with approximately $500 million traded in the last 24 hours.

Also Read: The Lazy (But Effective) 5 Step Process To Doing Your Own Research In The Bear Market

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief