On a decentralised app (dApp), we can not only lend but borrow as well, to earn yield. You might wonder how it is possible to earn a yield on borrowing because that would never make sense in traditional finance, but (almost) anything is possible in the world of decentralised finance (DeFi).

Before we get started, let’s take a look at some of the more well-known platforms for lending and borrowing across the different chains.

For starters, we have Aave, Polygon, Avalanche, Maker, and Compound. These are just some of the more well-known dApps but there are so many more throughout each chain.

At this point, you might think that a lending and borrowing protocol is pretty boring. True, it may not be the most exciting type of dApp in DeFi but it certainly is a key piece of infrastructure.

On Defi Pulse, five out of the top 10 dApps by TVL are in the lending and borrowing category!

Right now, when you lend, you are the banker. There are no intermediaries in the DeFi space, so whatever gains you lost out on when doing so in the traditional space, you are now able to enjoy in full.

Of course, the inverse is true, and you are exposed to a higher level of risk. So, let’s take a look at some of the advantages and disadvantages of borrowing and lending on dApps.

Advantages

Leveraged lending & borrowing

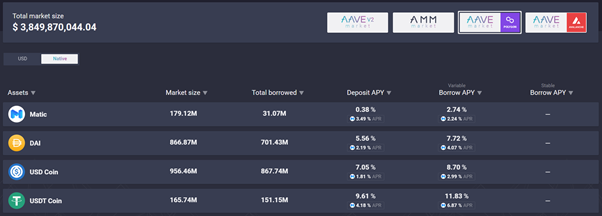

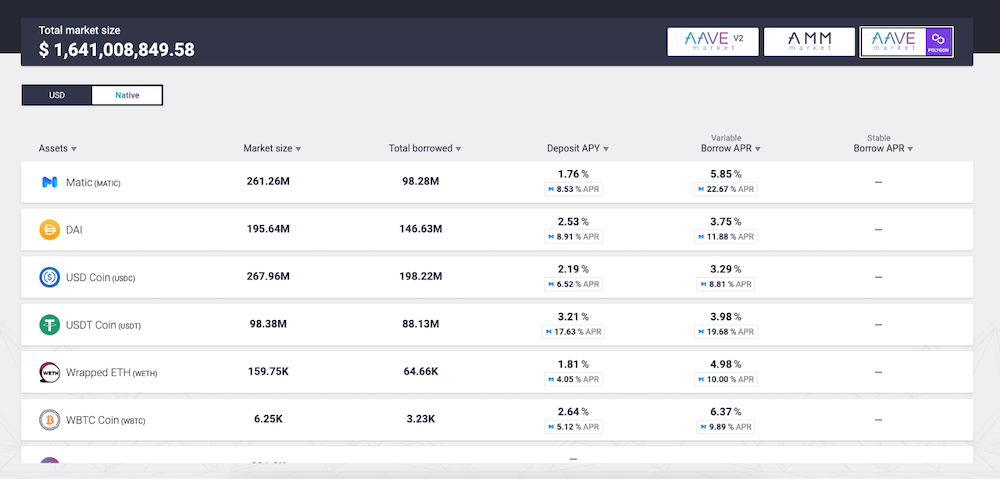

For illustration purposes, we will use the Polygon network on Aave. Do head over to the website for updated rates.

At a glance, the rates might not seem all that attractive. One might even conclude that they would be better off putting their money in a centralised earn platform.

However, with the use of leverage, we will soon see why dApps offer attractive opportunities for the risk-taking investor. Unlike centralised earn platforms, you can both lend and borrow, without an intermediary.

This is how it works: You first deposit a certain asset, let’s say ETH, on Aave. With that, you now can use that deposited ETH as collateral to borrow against it.

The coin that you borrowed can be in turn used for other purposes. But for now, we will examine this strategy known as recursive leverage. For example, you deposit USDC to borrow DAI, then use the DAI and swap it to USDC and deposit it back as collateral.

That is one iteration. Depending on how much risk you are able and willing to take, you can then go on to ‘loop’ multiple more times.

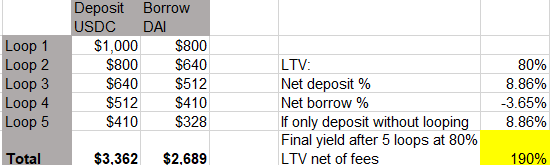

Looping illustration

For illustration purposes, we will ignore fees, assume that 1 USDC = 1 DAI, and borrow at the max LTV which is 80%. Assuming the rates below: (These are rough, back of the envelope calculations so numbers will not be entirely accurate)

This calculation allows you to earn 190% APY by looping five times. Let’s take a look at how this is possible.

Initially, we deposited $1000 to start the borrowing process at an LTV of 80%. Most people stop here, and they then used the borrowed asset for other strategies or purposes.

However, we go on to convert the $800 in DAI to USDC and redeposit it as collateral, and then borrow another 80% of it. In this way, you have begun to leverage your initial principal of $1000.

So, while you can deposit $1000 and be on your merry way earning 8.86%, leveraging will allow you to earn up to 190%! (Again, this is based on multiple assumptions and the number will be lower in real life).

While in theory, this looks great, do remember that stables can depeg, and thus you should never borrow at the max LTV. Also, this is just for illustration purposes and not financial advice.

I personally have not utilised this strategy as it is easy in theory but tough to implement in reality because it is not automated.

Getting paid to borrow

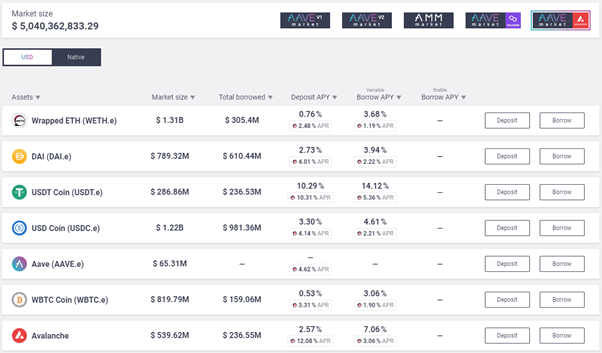

Apart from this complex strategy, did you know that certain dApps incentivise you to borrow? There were two big liquidity mining programs in the past: Polygon which launched a $40m liquidity mining program on Aave and Avalanche which launched a similar program on Aave and Curve but to the tune of $180m. Both are still ongoing, but the rates have been lowered due to the overwhelming response early on.

To give you an idea of how crazy the yields can be, these were the rates when the program first launched (mid-April 2021). Imagine getting paid 15%+ to borrow USDT! This would also help you earn way higher yields in the recursive leverage strategy I touched on above.

I personally think that the features and usability of DeFi projects are improving at a tremendous rate. With more ecosystems popping up and the competition for TVL intensifying, the onus falls on the project developers to make it as attractive for users as possible.

One such example is Apricot finance, which has Apricot Assist. It automatically deleverages your position for you to avoid liquidation. Even though Apricot just launched recently, it already has plans for a V2 and V3 for Apricot Assist.

Disadvantages

Before you start funding your MetaMask wallets again, let’s look at the disadvantages of lending and borrowing on DeFi protocols.

The strategy I mentioned above has insanely high returns only because you would be greatly leveraging your principle, making you a chad degen.

If the market were to tank or undergo a correction, you might not be in time to repay your loan, and this will be very ugly as your entire position is at risk of being wiped out negating all your earnings. So, it is very important to only take on risks that you are able to stomach.

Also, because such liquidity programs are highly valuable, the high yields often does not last very long. Just look at the recent Avalanche liquidity mining program which attracted $1.5bn in TVL in about 24 hours on Aave, it is not around $5bn.

This will affect the rate of rewards and decrease its attractiveness. Hence, to be on top of such alpha, you would need to devote a certain amount of time to keeping up with DeFi related news. This is often unrealistic as we all have our studies or work as a priority.

Conclusion

In conclusion, I believe that lending and borrowing protocols are the bedrock of DeFi ecosystems. While it is simple, there is still money to be made and the number of strategies to utilise are growing.

Also, while some of these strategies are highly complex, developers have begun to come up with automation for such strategies to target a wider audience.

At the end of the day, while it makes life easier for all of us, we still have to understand the underlying logic of such strategies to protect ourselves.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing]

Featured Image Credit:

Also Read: Staking LUNA? How Stader Labs Simplifies The Staking Experience For Terra Users