Earlier this year, Optimism announced $OP, their native governance token.

While individuals managed to land thousands in tokens, protocols were rewarded with more. Much like programs such as Avalanche Rush, these incentives are meant to drive users towards solutions based on the Optimism Network.

Also Read: Here’s How To Claim Your Optimism Airdrops

DeFi Spring

There are three protocols on Optimism currently distributing the $OP token.

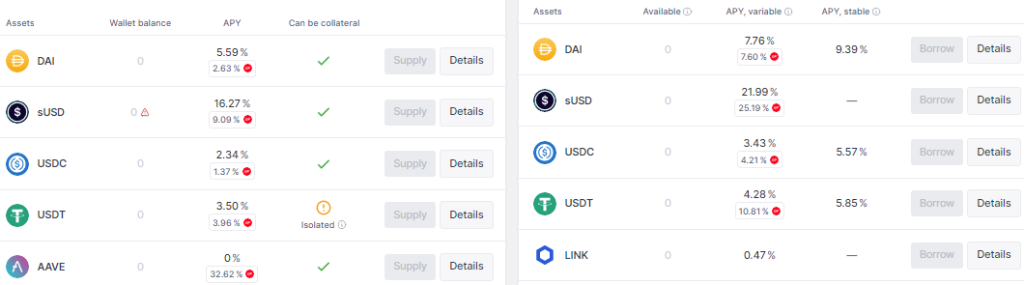

1. AAVE

The first is Aave, which is offering up to 32.7% APY for lenders.

Furthermore, lending $USDT while borrowing $USDT nets a 14% APY after fees.

By “looping” your collateral, you can increase the return on a stablecoin position, with almost no liquidation risk. Of course, this can be done without looping and steal result in double digit APYs.

Currently, lending $USDT on Ethereum returns 1.47% APY.

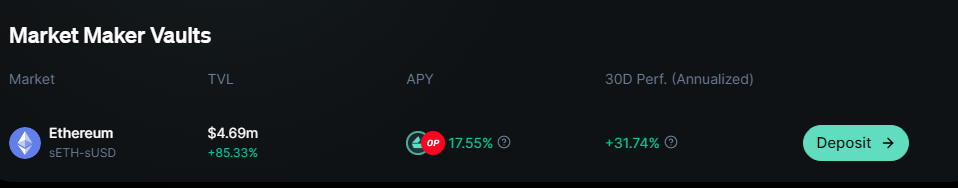

2. Lyra Finance

Lyra Finance has also started distributing their $OP tokens.

The decentralized exchange, which offers staking and marketing making vaults, allows users to deposit liquidity provider positions for yield.

On top of an annualized yield of ~30%, they are currently offering 17.55% in $OP rewards. This is despite their TVL almost doubling in the last 30 days.

By depositing an ETH-stablecoin position, users are able to net 30% APY, 10x higher than on Lido – with low impermanent loss.

3. Velodrome Finance

Lastly, Velodrome Finance, a trading and liquidity marketplace on optimism, is also giving out $OP.

🚨 Lock Bonus Update

— Velodrome (🚴,🚴) (@VelodromeFi) July 21, 2022

One week left for $veVELO lockers to earn the first round of bonus airdrops!

And we've decided to 3x the bonus for new lockers, increasing the pool to 150,000 $OP. 🤯

That means we're giving away over 325,000 $OP to new and existing $veVELO lockers. pic.twitter.com/Qj3keGZgHj

This will be done in rounds, and eligible for users who lock their native token, $VELO for specific periods of time.

While their first round is over, they will be disturbing hundreds of thousands worth of $OP in the near future as well. Furthermore, $VELO lockers will be able to obtain bribes from their tokens.

At the time of writing, locking $1 of $VELO rewards you with ~$0.8 of $OP.

How To Find Opportunities

While it may be tiring to bridge over to optimism, it is probably worth if for the extra yield. More protocols may also come forth to distribute their airdrops.

The quickest way to find out about new opportunities would be putting various twitter accounts such as Defi Airdrops on notifications.

With that said, the recent exploits on protocols and bridges means that there is more risk in bridging and locking. As such, you may want to verify that these protocols are audited before depositing your funds in them.

Also Read: Why The Ethereum Merge May Double Your Net Worth – And Collapse Crypto

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: cryptoslate