The exponential growth of the DeFi space brings about a variety of innovative products and services that are decentralized in nature.

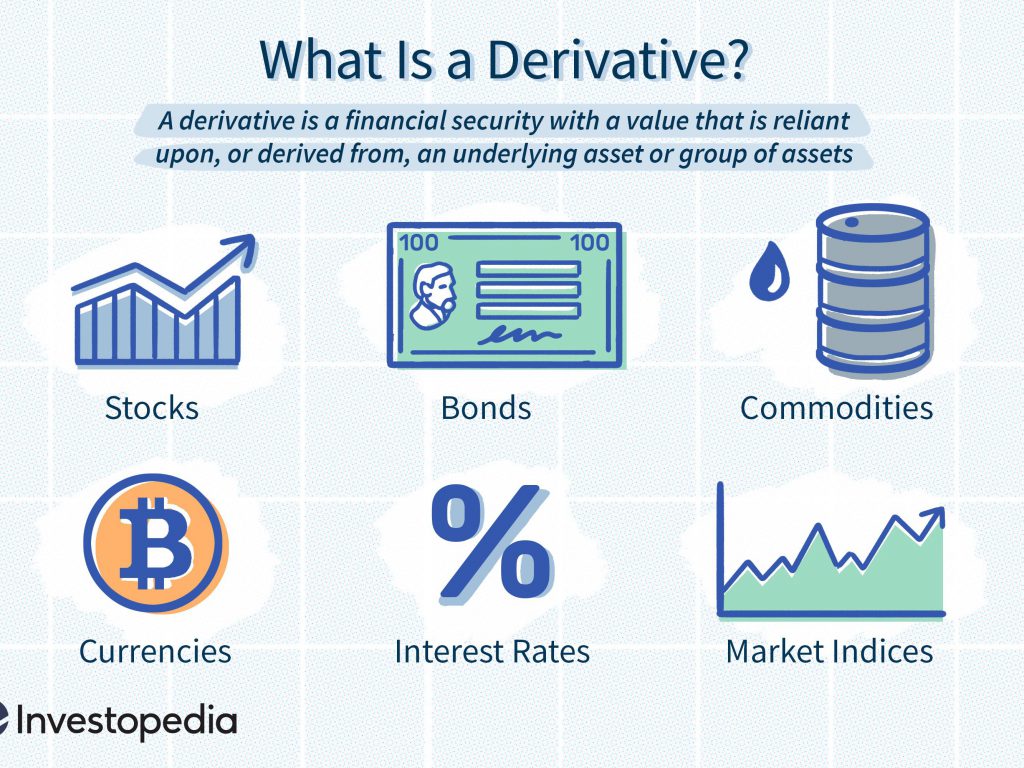

A central component of a fully functioning financial system however, includes the derivatives market, which significantly increases the efficiency of the financial markets.

Derivatives facilitate price discovery of assets, enhance liquidity of the underlying asset they represent, as well as provide an avenue to mitigate financial risk.

Therefore, it was only a matter of time before derivatives were extrapolated to the decentralized community. Synthetix did just that by launching in 2017, much to the fanfare of the cryptocurrency community.

What is Synthetix?

Synthetix is a decentralized protocol that facilitates the trading, borrowing and issuance of synthetic assets on the Ethereum blockchain.

Just like derivatives in traditional finance, synthetic assets (Synths) are tradable versions of any asset in the world. The value of each synth is derived from the value of the underlying asset that it is created from, and provides the yields of the asset without requiring a holder to hold that particular underlying asset.

The main difference between a tokenized asset and a Synth is that the former entails ownership over the underlying asset while the latter does not, thereby facilitating only the exposure to the underlying price.

Synths can be created on the back of any underlying asset with value, ranging from popular commodities like gold and silver, fiat currencies like US dollars or Euro dollars, public-traded stocks as well as cryptocurrencies like Bitcoin (BTC) and Ether (ETH).

Because Synths are issued on Ethereum, you can deposit them on other DeFi platforms such as Curve and Uniswap, and use them to provide liquidity and earn interest.

In order to track the prices of the underlying assets backing each Synth, Synthetix uses Chainlink oracles to ensure that the peg between the value of the underlying asset and the value of the synth is the same.

Oracles are mechanisms that monitor data external to the blockchain, with the main purpose of funneling the relevant data into the blockchain world.

How does Synthetix work?

The Synthetix protocol facilitates a wide range of function that is extremely useful for the community. At its core, a robust derivatives market is vital in the development of a mature market since it provides another avenue for hedging against volatility and facilitates stronger price discovery.

Synths provide exposure to assets normally inaccessible to the average crypto investor — gold and silver, for example — and lets you trade them quickly and efficiently.

Synths are different from tokenized commodities, such as Paxos’ PAX Gold (PAXG), which is backed by gold bars. Owning PAXG means that you own the underlying gold and that Paxos holds it for you, whereas owning Synthetix’s sXAU means that you do not own the underlying asset – you merely have exposure to the price of gold.

The range of functions that can be done on Synthetix include:

- Speculation: Users can speculate on the price of assets without having to own the asset. For example, a user that wants to speculate on the price of gold or silver can do so on Synthetix without the lengthy work needed to buy the commodity, securing them via a custodian and being exposed to various intermediary fees.

- Stablecoin Creation: Users can create synthetic fiat such as sUSD or sEuro using the native Synthetix tokens (SNX) as collateral. With the synthetic fiat, users can hedge their portfolio risks and even earn yields from staking their synthetic stablecoin in other DeFi protocols like Curve.

- Leverage Trading: Users can magnify their investment capital by trading on leverage, allowing them to open positions larger than their original capital. Synthetix allows traders to get leveraged exposure to the underlying assets, with synths such as Perpetual Oil Futures (sOIL) where users can engage in leverage trading to speculate on oil prices.

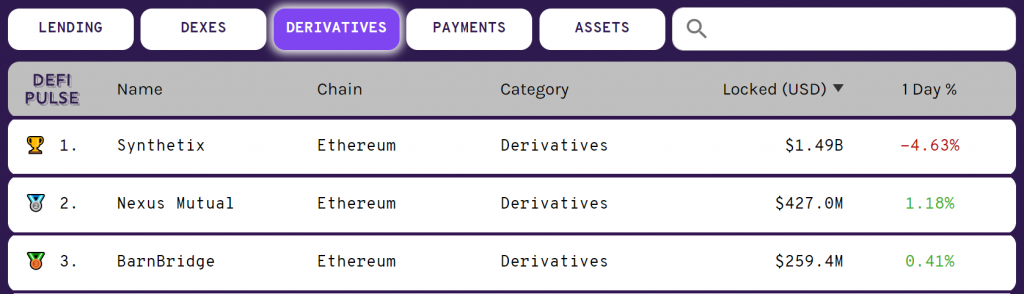

The various functions that can be done on Synthetix has allowed it to be the most popular decentralized derivatives protocol in the space.

In a single month, Synthetix hit roughly one billion in Synth trading volume.

— Synthetix ⚔️ (@synthetix_io) June 30, 2021

That's 15% of our total tracked volume, 6.75 Billion, in one month!

This is a major milestone as it reflects the tangible growth happening to the protocol. Exciting times. https://t.co/aQ1m68A0Us pic.twitter.com/iWcCI02XiI

How to get Synths and access the Synthetix Network?

There are two ways to enter into the Synthetix ecosystem and acquire synthetic assets.

Buying sUSD through Kwenta

This involves acquiring synthetic USD (sUSD), which is the primary base currency, or the main medium of exchange, for all synths on the Synthetix protocol. It therefore necessitates the acquisition of sUSD first before converting it to the synth of users’ choice. This is the easier approach since users can directly trade on existing synths which are trading on the secondary market.

- Buy Ether (ETH) on any exchange of your choice, be it a centralized exchange like Binance or a decentralized exchange (DEX) like Uniswap

- Convert ETH to sUSD on Kwenta, Synthetix’s native derivatives trading platform that is known for zero slippage

- Convert sUSD to any other Synths of your choice

Mint Synths by collateralizing SNX

The alternative way is to directly create synths by collateralizing them with Synthetix’s native token (SNX) and begin trading them.

This is more complicated as users must be cognizant on the various elements relating to the creation of synths, which include being aware of the collateralization ratio and actively managing users’ debt position.

The upside of minting synths however, is that users would be eligible to receive staking rewards, denominated in SNX, as well as a cut of the trading fees on Kwenta, Synthetix’s decentralized derivatives exchange.

- Buy SNX on any exchange of your choice, be it a centralized exchange like Binance or a decentralized exchange (DEX) like Uniswap

- Stake the SNX on Mintr, which is Synthetix’s decentralized application (dApp) that facilitates the asset issuance process of synths by collateralizing staked assets. The amount of synths to be issued will depend on the collateralization ratio

- Synths will thereafter be ‘minted’ or created on the back of the staked assets, whereby users can start trading the newly minted synths on Kwenta

Collateralization ratio refers to the ratio of which a user must stake an underlying asset in relation to the number of minted synths. For example, with a current collateralization ratio of 600%, a user must stake $6,000 worth of SNX to mint $1000 sUSD. This excess collateralization ensures that the protocol is stable in the event of a volatile market.

Why is Synthetix worth looking at?

Notable backers

At the start of this year, Synthetix raised $12 million from venture capital firms that include Coinbase Ventures, IOSG and Paradigm. Synthetix joins a rare list of decentralized projects that is backed by notable VCs in the space. Additionally, it has also partnered with various prominent liquidity providers that include Three Arrows Capital, Parafi Capital and DeFiance Capital.

Foundational pillar within the ecosystem

As the leading decentralized derivatives exchange in the space with over 53% of the market share, it is clear that Synthetix represents a foundational protocol that is much needed across the developing decentralized finance network. It has over a $1 billion of assets locked in its protocol, with a steady growth rate.

From the beginning of November 2020, it shot up 1,000% in 4 months from $2.50 to $28.90 per coin. As of writing, the price is around $9.50.

Synthetix has also recently announced that it will be implementing Optimism on its platform. Optimism is a layer 2 solution for Ethereum, which will reduce transaction costs, making the platform more accessible to retail investors.

Also Read: Nano: A Feeless Distributed Cryptocurrency Network