Despite multiple banks collapsing and general fear in the markets, Bitcoin has been smashing every local high recently, trading at a yearly high of $26,000 last night.

While many, including popular counter-trade indicator Jim Cramer, have christened the recent rally as a bull trap, others are calling for further upward momentum, and the start of an extended upward move to new highs.

With uncertainty around crypto at an all-time-high, let’s dive into a few possible indicators for Bitcoin’s future, and how the rest of the crypto markets will be affected.

Top Investment Banks Project Less Rate Hikes For 2023

As the aftermath of Silicon Valley Bank and Signature Bank continue to unfold, leading investment bank Goldman Sachs has released a report stating that rate hikes have become unlikely in the immediate future.

While they still project the Federal Reserve to continue increasing interest rates starting May this year, they cited that the ongoing stress placed on banks could the FED to deviate from their plans for now.

Other analysts have predicted similar outcomes, or even possibly a slashing of interest rates while the government tries to deal with the situation.

Everyone who had deposits at those banks can access their money today.

— President Biden (@POTUS) March 13, 2023

That includes small businesses that need to pay their employees and stay open.

No losses will be borne by the taxpayer.

We'll pay for it from the fees that banks pay into the Deposit Insurance Fund.

Furthermore, President of The United States Joe Biden has stated that “no losses will be borne by the taxpayer”, possibly hinting at further money printing.

Of course, the increase in M2 money supply in the United States by the Federal Reserves was something that spurred the 2021 bull run, and crypto investors are quick to draw parallels with the ongoing situation.

While Singature Bank and SVB’s combined Assets Under Management of approximately $300B pale in comparison to the money printing that occurred during the pandemic, it still represents a 1.5% increase in M2 money supply.

Bitcoin Funding Rate Spikes Following Massive Crypto Rally

As the market exploded following a test of the local lows, traders continued to long the largest cryptocurrency by market capitalization, Bitcoin, at any cost.

This caused Funding Fee Rates across major exchanges to close in on levels we have not seen since the bull market. Even as the market settles, exchanges like OKX and CoinEX still see upward of 0.1% funding rates, or approximately a 50% haircut on capital traded when annualized.

The perpetually high funding rates indicate that capital is being used to long futures, instead of buying SPOT, which traditionally marks that a rally is losing momentum. Of course, it could also translate into overt bullishness in a trending market.

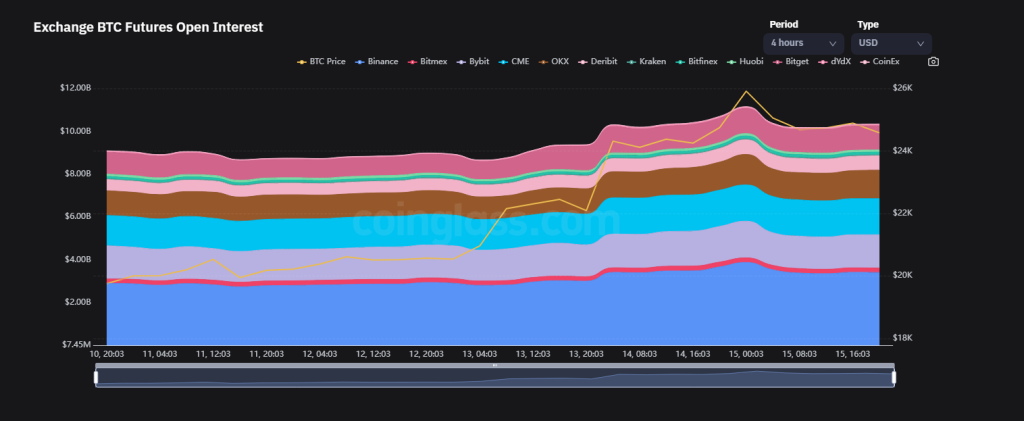

Although there has been an increase in Open Interest on BTC futures, the lack of convergence with SPOT prices likely indicates that we could be topping out at $26,000 for this rally, or entering an accumulation phase before further continuation.

Short-Term Bitcoin Holders Taking Profits

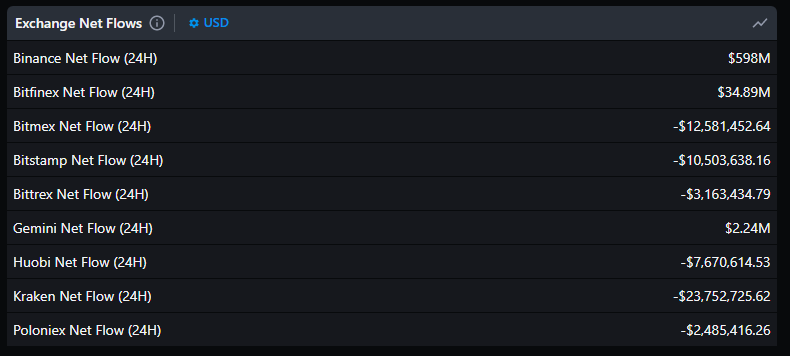

According to data from Messari, Exchange Netflow, which measures the difference between deposits and withdrawals on centralized exchanges, has been spiking over the last two days.

While exchange netflow on major exchanges have been trending at ~$400M for the last month, they recently spiked to over $1.5bn, with ~$1.7bn in deposits on Binance alone.

The rise in net inflow to exchanges translates to increased selling pressure as users hurry to sell off their crypto. This also corresponds with a rise in the outflow of stablecoins from exchanges, as they either seek to off ramp or cash out their trades.

Glassnode’s “Coin Days Destroyed indicator”, which usually signals price volatility to the downside, also started to spike during the latest crypto rally.

Closing Thoughts

Although we haven’t yet seen the altcoin rally that we would want to, Bitcoin not instantly crashing from it’s local high has been a positive sign for the market.

Despite a possible risk-on phase coming in the near future, most indicators hint toward the current rally come to an end for now, as both bulls and bears take a moment to recollect themselves.

JUST IN: Credit Suisse Stock plunges to all time low pic.twitter.com/ypzftYfmGT

— Chain Debrief (@ChainDebrief) March 15, 2023

Furthermore, key catalysts like the Ethereum Shanghai upgrade, constant uncertainty surrounding banks, and possible unlocks from GBTC and mt. GOX could translate to a sideways crypto market until they occur.

Also Read: From Panic To Profits: How A Bank Run Sparked A Crypto Market Rally

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief