Cryptocurrency is here to stay – or at least that’s what this recent rally has been telling us. With Bitcoin hitting a recent Year-To-Date High of $31,000, and Ethereum following in it’s footsteps following the Shapella upgrade, faith in Web3.0 has seemingly returned to all-time-highs.

With that in mind, we can now return to once again chasing a new high in net worth – a goal many of us thought would only come in 2-4 years. As the elusive millionaire status returns to creep into many of our minds (or maybe just mine), we have to wonder – how much ETH exactly do we need to get there?

Also Read: Cardano To US$10? How I Recovered From A 70% Portfolio Drawdown

A Primer on Cryptocurrency Valuation Models

In an extremely naïve article I published earlier in my crypto journey, I reflected that the world of Web3.0 was far too young to have it’s assets graphed out by TradFi valuation models.

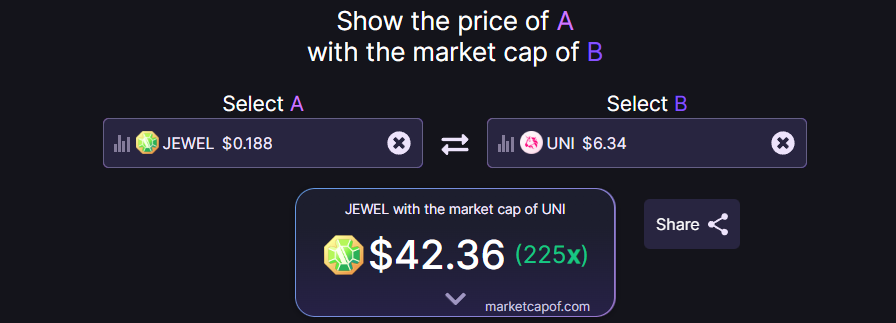

While these “compare market cap of A to B” were all the rage during the bull market, the harsh reality was that almost no projects lived up to their potential.

Even when they did, poor tokenomics, sudden rugs, and the wrath of a bear market eventually forced them into slow, painful deaths. Deflationary mechanics and veTokenomics were also susceptible to the hyper volatility of Web3.0 – making it hard to “HODL” at the bottom.

Regardless, Bitcoin (and Ethereum) have managed to grow exponentially over the last few cycles, with the former adding a zero during every bull market.

That is to say that even if most of Web3.0 were to evaporate into thin air, it is likely that our two blue-chips will eventually pave the way for more exciting projects in the coming decade, be they ponzis or potential unicorns.

Furthermore, while these valuation models in no way guarantee that “X” amount of $ETH will translate into $1M, making an educated guess can help us set the foundation for accumulation, or at least prevent us from shifting goalposts too frequently.

If Bitcoin Hits $1M, Where Will ETH Be?

Two halving cycles will occur from today till 2030. By that time, only 1.5625 Bitcoin will be produced per block.

Assuming demand stays constant, that translates to a 4x reduction in supply, a model that results in the $1 million Bitcoin price prediction that has plagued headlines recently.

History doesn't predict the future. But this is the history. 4 year cycles so far. #Bitcoin

— CZ 🔶 Binance (@cz_binance) January 30, 2023

(Source: Data is public. Table made by @gautamchhugani, I think) pic.twitter.com/deG75mNS84

While a 33x in the world’s leading cryptocurrency by market capitalization seems ludicrous to us today, it may very well not be the case in a few years.

Over 80% of Bitcoin’s maximum supply have been mined, and a price of $1 million per token at maximum supply translates into a market capitalization of $21 Trillion – roughly double of the current gold market capitalization.

While I don’t personally believe that Bitcoin will double the market cap of gold, let’s take this into consideration for a second.

Ethereum currently accounts for approximately slightly under half of Bitcoin’s market capitalization. Assuming it maintains it’s total supply and manages to achieve exactly half of Bitcoin’s market capitalization, this would translate to an $ETH price of $87,706.

$87,706 is a 41x from current prices.

To be a millionaire by 2030, this would require you to hold 11.4 $ETH, or $24,114 at current prices.

Also Read: The Shocking Truth About Bitcoin’s Limited Supply

A More Technical Breakdown

While scouring the internet to find a better valuation model (that did not flip constantly depending on the market), I stumbled across this YouTube video by InvestAnswers.

Behold the remarkable stability of the digital behemoth, #Bitcoin. For the past 50 hours, brushes off CPI, it has been tightly confined to a minuscule 1% range 95% of the time. Peculiar lack of volatility is nothing short of mystifying! pic.twitter.com/LGRJVclvuD

— InvestAnswers (@invest_answers) April 13, 2023

While slightly outdated, it does take a more reasonable stance than the Balaji prediction of $1M per Bitcoin.

I’ll let you watch the whole video if you want a thorough breakdown.

But in essence:

- Worst Case Scenario: $25,606

- Conservative Model: $34,406

- Aggressive Model: $55,199

These valuations assume that Bitcoin will flip gold by 2030, and therefore reach a over $10T in market capitalization.

The worst case scenario uses a 22% annual growth rate. The conservative model assumes Ethereum hits 50% of Bitcoin’s market capitalization, and the aggressive case uses a ratio of 1ETH=0.1BTC.

Assuming these numbers, to be a millionaire you will need:

- Worst case scenario: 39 ETH or $82,000 at current prices

- Conservative Model: 29 ETH or $61,355 at current prices

- Aggressive Model: 18 ETH or $38,243 at current prices

My Personal Prediction

If you’re wondering why you should listen to the thoughts and price prediction of a random writer – you don’t have to. In fact, I’ll more likely be wrong than right.

Instead, I’d like you to open your mind to some possible valuations of ETH and how to adjust accordingly.

The current train of thought on crypto Twitter is that ETH will hit $10,000 by the next cycle, and presumably be up only from here on out. So do we just front-load everything in now?

Let’s take the safe estimate of 39 $ETH, or $82,000 at current prices, needed to become a millionaire by 2030.

Most of us do not have $82,000 to allocate to a single asset right now. Furthermore, if you assume Ether is going to exponentially rise, the average price you will be allocating at will drastically increase over the years.

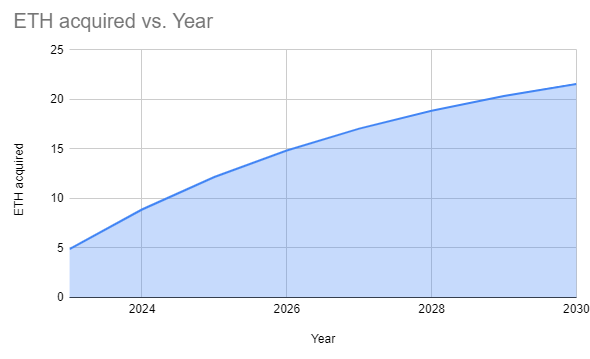

Even if we sandbag and accumulate ETH only at the lows of every market cycle (assuming a CAGR of 22% and a starting price of $2,100), you would only have accumulated around 21 $ETH by then – far less than what’s needed to be a millionaire.

So either we yolo on small caps or treat ETH as a bank account?

One thing I’ve taken away from all these price predictions is that Ethereum is still one of the greatest bets of our lifetime. A “safe” 5x in just a few years is practically unheard of.

Realistically, ETH’s chart will also be subject to more volatility than what was assumed in the ETH accumulated vs. Year chart above.

One way to become a millionaire faster (and for less money) is to take advantage of the crypto market’s volatility, and dynamically DCA into the markets.

This seems easy, but takes a lot of conviction – something that only comes with an extended stay. ironically, it gets harder to press buy when ETH goes -90% into -90% instead of when everything is pumping.

By taking advantage of this, airdrops, and random 100Xs along the way, we can get to our goals much quicker than through conventional means.

Once again, while this seems easy enough – 1000% gains on random shitcoins will test our conviction, preventing us from selling tokens, and forcing us to buy in again at random all-time-highs.

Personally, I believe that ETH will be drastically above the $10,000 price prediction set out by many analysts today. Given the successful Shapella upgrade, EIP-1559, and the rampant rise of Layer 2s (which use $ETH for gas fees), the value accrual to Ether seems extremely asymmetric to the upside.

Closing Thoughts

Instead of starting at portfolios All-Time-Highs, I prefer to track my worst points, making a new low every cycle. Thankfully, this bear market has been very good to most who did not leave the space.

Generously taking from a total data set of 1 bull market and 1 bear market, my low in 2030 would be approximately a 25x from here, meaning I would require $40,000 in starting capital, a surprisingly achievable goal.

But I’ll probably get rugged along the way and still be poor.

Regardless, one takeaway from all the analysis is that if you believe in Web3.0 surviving till 2030, ETH, and Bitcoin, will both likely put in a 10x from here onwards.

And who’s to say that a 10x in under a decade isn’t life changing money?

Also Read: Whales Begin To Dump as Crypto Fear and Greed Reaches Yearly high

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: chaindebrief