In the last week, Bitcoin managed a 30% rally, amidst fear in the stock market and the massive liquidity issues plaguing banks.

Additionally, airdrops from platforms like Arbitrum and Blur have triggered a flurry of on-chain activity, bolstering TVL and transactions all across Web3. Theis has led to a rally from both the largest cryptocurrency, as well as altcoins across the board.

However, crypto whales have begun distributing into the rally, as seen from net exchange outflow, possibly from the sub-20K Bitcoin level where we saw massive accumulation.

Also Read: U.S. President Clamps Down on Crypto, Capital Gains – A Complete Breakdown

Fear and Greed Index Could Indicate Overconfidence in Crypto

The Fear and Greed Index is an indicator that shows market sentiment based on a variety of factors. Factors include both qualitative and quantitative sources, such as market volatility, trading volumes, and social media trends.

It then depicts market sentiment from a scale of 1-100, or from “extreme fear” to extreme greed”. Historically, buying at “extreme fear” and selling at “extreme greed” has been a profitable strategy, especially for long-term investors.

Recently, the Fear and Greed Index reached a yearly high of 68, a 40 point growth since the start of the year. In line with other indicators such as the Relative Strength Index, this shows that Bitcoin is currently in the overbought range, and that the market could be in for a correction soon.

For reference, the Fear and Greed Index returned a value of 84 during the peak of 2021’s bull market, and dropped to as low as 20 during the recent dump to $16,000.

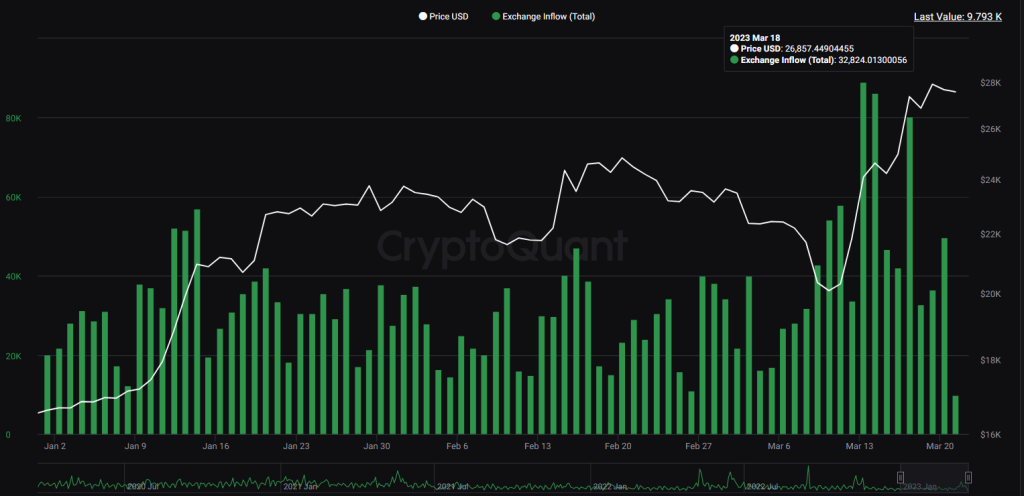

Bitcoin Exchange Inflow Reaches Yearly High

According to data from Cryptoquant, the amount of Bitcoin being deposited to exchanges just peaked for 2023. The highest one-day deposits was on March 13th, with 86,000 Bitcoin, or approximately USD$2 billion being sent to centralized exchanges.

Traditionally, an increase in Exchange Inflow indicates that investors want to take profits on their crypto holdings, with a sudden spike in exchange inflow often heralding a retracement or pullback.

The drastic change is even more obvious when taking into account total exchange netflow, which measures the net difference between crypto being deposited and withdrawn from exchanges.

Last week saw four instances with netflow over 10,000 $BTC, with the highest spike once again being on March 13th, with a net 27,763 Bitcoin being deposited onto exchanges.

According to data from Glassnode, the Market Value to Realized Value indicator (MVRV) is currently trending to an all-time average of 1.8, signaling that bitcoin is no longer considered undervalued compared to on-chain metrics.

MRVR reaching 1.8 also indicates that a large supply of Bitcoin ” was acquired below the the current price, and is not back in profit”, which could mean further distribution.

However, Glassnode also notes that despite massive selling pressure by whales, the current uptrend in crypto has yet to be disrupted, as the majority of long term holders have yet to realize profits.

Time For Risk On Assets Like Crypto?

Despite the current run on banks spreading to even the largest FDIC-insured institutions like Credit Suisse, both equities and crypto have been trading higher over the past few weeks. Commodities and rare metals have also seen breaks to the upside as they are commonly viewed as hedges against the possible depreciation of the U.S. dollar.

However, the market is still uncertain over

Thanks to a possible liquidity injection by the Federal Reserve and a pivot that could potentially cut interest rates, there has been speculation that we could see a bullish period for risk-on investing in the near future.

Furthermore, Glassnode has shown that whale distribution has not served to significantly hamper the current bullish trend we are on, with additional research showing that exchanges are being drained of their crypto supply on aggregate.

Hopefully, we may just get the answers to all our questions tomorrow morning. A strong signal will be sent during the FOMC meeting by chair Jerome Powell regarding the FED’s decision to pivot. With notable investment banks predicting rate cuts, any results at or below the market estimate of 25bps could produce another rally for risk-on assets.

Also Read: From Panic To Profits: How A Bank Run Sparked A Crypto Market Rally

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Analytics Insights