Just 12 months ago, the lending and borrowing industry was robust. In retrospect, it was peak euphoria.

Crypto lending is essentially banking but for the crypto world. Just like customers who earn interest on their savings at their banks, crypto users can choose to lend out their crypto assets to willing borrowers for a fee.

It is a known fact that banks offer paltry returns on your dollars while the yield on stablecoins easily ranges between 10% to 20%. But what’s the caveat? Unlike traditional regulated banks, crypto lenders aren’t overseen by financial regulators. They may never see their deposits again if the platform collapses, as we’ve seen with Celsius and Hodlnaut.

How space has evolved

‘Lending out your cryptos’ boomed in 2021 but crashed twice as hard this year.

When I first saw the 20% yield offered on Anchor protocol for $UST, I thought to myself that there must be a tremendous amount of demand for $UST, causing a shortage of it in the ecosystem. After all, high yields reflect a high utilization rate as demand is hot in the borrowing industry hence the attractive rate to entice lenders.

I was wrong. There was hardly any demand for $UST. Do Kwon was advertising Anchor as retailer’s go-to savings platform and tricked many with promises that have now failed. This led to the collapse of the now infamous hedge fund 3AC and contagion is still felt throughout the crypto industry today.

Also Read: Nobody Is Too Big To Fail; The Fall Of Celsius And 3 Arrows Capital

We saw many lenders carrying bad debt as a credit crunch surfaced.

The industry now

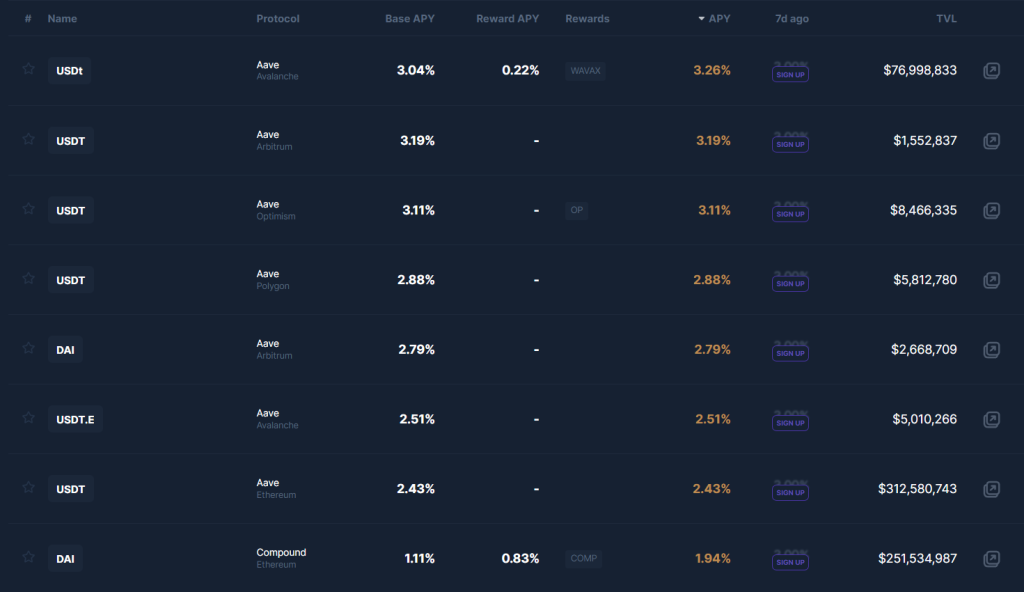

The leading lending platforms now offer a measly 3% APY on your stablecoins deposit, one which your local bank’s fixed deposit can easily match. So why take on the smart contract risk if there is no premium?

We no longer see enticing stablecoins APY because there is hardly any demand for it these days. Many have quit, and remaining retailers are cautiously deploying capital, with a select few continuously engaging in leveraged bets, which stipulates the borrowing of funds.

As a result, we have seen a drastic decrease in interest rates on the supply side of the equation.

Lenders are beggars, and beggars can’t be choosers

Recently, Maple Finance stated that Orthogonal Trading “has been operating while insolvent.”

On December 3rd, Orthogonal Trading informed us that due to funds held on FTX, they incurred a much larger loss than previously disclosed to us, and will not be able to repay loans or uphold their obligations as a borrower. https://t.co/VI6MfsNpOb

— M11 Credit (@M11Credit) December 5, 2022

1/3

This is a blow to the nascent market for uncollateralized lending in DeFi — which is dire because uncollateralized lending is one of the likeliest avenues that could scale DeFi into a substantial alternative to TradFi.

It was perhaps inevitable, given that Maple Finance was in the same predicament as 3AC’s CeFi lenders. There were few options to lend to apart from hedge funds and traders.

Money was pouring into the crypto markets from both CeFi and DeFi lenders, and there was no one to lend it to other than traders. This led to the market for lemons and moral hazard as traders satiate themselves through highly leveraged degenerative directional bets, which were unfortunately on the wrong side of the equation.

Read More: Is Maple Finance In A Sticky Situation? Why We Need To Rethink Unbacked Lending

Back to capital markets basics

If the purpose of capital markets is to direct scarce resources to their highest uses, DeFi capital markets have been a flop. Ironically, in this case, resources were over-abundant. There was a lot of capital coming in and very few options.

Now, less capital is coming in in the depth of crypto winter. Per data from Messari, of the $50 billion in VC money raised this year, only $2 billion was introduced in August. It is arguably still too much. With stablecoin borrow rates at less than half the yield on risk-free T-bills, it seems there is still more money in crypto than we know what to do with.

The silver lining to Maple Finance is that depositors are well aware of the borrowers. In comparison, depositors of BlockFi were kept in the dark despite having their funds lent out to the same limited set of borrowers. These were all uncovered only during the downturn in the lending industry that we are now experiencing dearly.

Conclusion

We are all rooting for DeFi to take the crown from TradFi one day. In my opinion, for DeFi to succeed, we do not need more money. We need more substantial reasons for what to do with it.

A good example is Goldfinch Finance — whose business model is lending to emerging markets borrowers that otherwise have no access to capital markets.

The highest use of DeFi seems to direct money to the unbanked rather than force-feeding money to the overbanked.

With that, I am excited to see how the space progresses over time and am confident there will be a day comparable to TradFi.

Also Read: Key Takeaways From Messari’s Top 10 DeFi Trends In 2023

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Holdnaut