Key Takeaways:

- News Events occur when a narrative triggers price volatility

- These are catalysts that can be used to plan trades around

- With News being increasingly competitive to trade, finding an edge is of the utmost importance

___________________________________________

Five times a year, there is free money on the ground. Pick it up, do nothing else, and you will likely outperform most retail traders.

While I came into crypto greedy for 100-1000x opportunities, the 24/7 markets combined with traumatic event after traumatic event has forced me to optimize for what I call “sanity-adjusted returns”. Instead of sticking to the market 24/7, identifying key events or opportunities and trading them consistently has helped me grow my portfolio quickly.

In a previous article, I covered how I earned approximately 100% each month just by trading CPI numbers. While attention has been shifted away from CPI with FTX’s insolvency, news events have still been good trading opportunities.

Also Read: Is Maple Finance In A Sticky Situation? Why We Need To Rethink Unbacked Lending

What Are News Events?

To trade news events, we first have to understand what they are.

News events are narrative-driven events that cause price volatility. The easiest example is inflation announcements, which usually cause sharp price spikes.

While I personally call them “news events”, they are not limited to simply news, but any catalyst that would move prices significantly.

In essence – “buy the rumor, sell the news” vis-à-vis news events.

Other examples include, but are not limited to:

- World Cup ($CHZ, foot ball fan tokens)

- Elon Musk Crypto Tweets ($DOGE)

- Major unlocks ( $IMX, $LOOKS, $AXS)

- Staking ($LINK, $APE)

Identifying Events & Keeping a Calendar

The most important step to trading news is, of course, identifying them.

While there is no easy way around the grind of scouring through tons of information and digesting them all, I’ve come across some tips to simplify the proccess.

Once a week, I check out CoinMarketCal to track the latest news, including listings, unlocks, and staking news.

I also browse Coingecko daily to track trending tokens, and do research or why they are trending, and whether there are similar/ pair trades that I can conduct.

#1INCH @oneinch

— Unlocks Calendar (@UnlocksCalendar) December 7, 2022

13% of tot. supply will be unlocked around 25 December (merry xmas!)

This will bring circ. supply from 44% to 57%

Pretty significant given its size + FTX Alameda and Celsius were heavily invested, and will be forced to dispose all their allocation

A thread: pic.twitter.com/qWUX2UPowt

Putting accounts like unlocks calendar on notifications also helps streamline the process. Making a list of such accounts and scrolling through it once a week can greatly improve your odds of finding a news event early.

So, what makes a news event a good one to trade?

If you’re a level-headed investor, you would likely try to avoid speculative plays. However, you also need to consider what other traders would do.

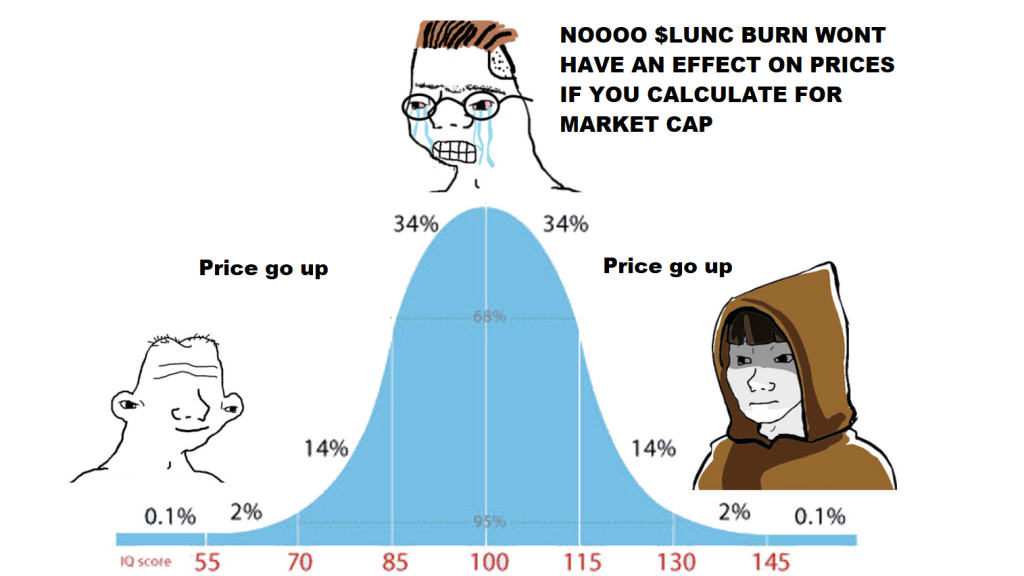

For example, the recent announcement by Binance to implement a burn mechanism for $LUNC would not have affected the token in any meaningful way. However, everyone likes a good burn narrative, and $LUNC had a 68% spike following the announcement.

Generally, you want to look for news that

- You identify before the “crowd” (price has not moved much yet)

- Has an easily identifiable narrative (staking = supply lowered = price go up)

- Fixed date of happening (News occurs on x date, i.e. “staking to begin on 23rd Nov”)

The Art of Trading News Events

Trading news events is an extremely addictive habit, especially if you are right and prices begin to move very quickly. Despite this, you must remain grounded and assume that you are not going to catch the bulk of the move.

PC Principal on Twitter puts it more succinctly than I ever could.

In the early stages of a pump, you forget about reality momentarily and assume your position as yet another bullish moron.

— PC Principal, PhD, MBA, CFA, CA (@PC_PR1NCIPAL) December 7, 2022

But after the initial pump has commenced, you must reconnect with Jesus and become a logical and decent human once again and begin to plan plot your exit. pic.twitter.com/SDC7le6oSU

To add on to this point, you should also be able to identify when you are wrong, so you can either redeploy your capital or cut losses. Decide on a price or time where your thesis is invalidated and stick to it.

After all, you don’t want to be the $AXS shorter that got rekt because no one found out the bridge was hacked.

If instead you are immediately in the green, determine how much profit you should take and when.

For example, the $CHZ trade was popular prior to the world cup, due to their involvement with football fan tokens. While the token mooned multiple times in the later stages of 2022, it eventually died down in November, a whole month before the world cup started.

A rule of thumb would be to take profits on any sudden price movements, and to do way before the actual event occurs.

Finding Your Edge

News trading has become an increasingly competitive environment, especially in a bear market where narratives have run dry. With such stiff competition, finding an edge has become more important than ever.

Always remember that trading is a blood sport, and your gain has to be somebody’s losses.

The first step to finding an edge is to consider what everyone else will do. If you barely notice anyone on the twitter timeline speaking about your trade, you may be early ( or just chose poorly). If your tokens is coming up on major crypto publications, it’s probably too late.

Next, try to notice patterns in news events. For example, inflation numbers moved prices in a strong binary way, which allowed me to perform THIS strategy.

One more thing to keep in mind is mirror opportunities. In crypto, similar projects often move in the same direction. If you missed out on a major move in a GameFi token for example, look at other projects in the category and identify whether there could be a trade there.

Lastly, remember that the correct position is often always flat. If you end up chasing too many narratives, you could have your capital stuck somewhere you do not want it to be, or continuously entering bad positions.

Trades I’m Looking at Right Now

Full disclaimer, I do not claim to be a professional trader, but am simply sharing some key events in the space right now.

The current leading narrative is Arbitrum Season, with a 2x increase in TVL from recent lows.

Given that there is no native token for Arbitrum, it is difficult to simply long one coin and be done with it. Instead, I would look into the ecosystem and cherry pick outperforming projects such as $GMX, $CAP, $VSTA, and $DPX.

A more mid-term narrative would involve FTX’s assets, which would most likely be liquidated going forward.

FTX tokens will be disposed ASAP by bankruptcy officers, desperate to repay creditors

— Unlocks Calendar (@UnlocksCalendar) December 9, 2022

We're putting together the unlocks dates of all their holdings in the thread below, to understand when officers are able to sell⚡️

(will start from main bags, and slowly add the other ones) pic.twitter.com/euP9wdczCe

I personally treat such events as “Token unlocks” and therefore would be net short. However, do take note that many of these tokens are already beaten down, and going short now may be on the risky side.

Other crypto firms undergoing bankruptcy can also be looked at for mirror trade.

While there are other trades I’m looking at, getting caught up in too many narratives will often lead you to making more losing trades, or as Gucci Mane puts it, “lost in the sauce”.

Closing Thoughts

While crypto has taken quite the beating this year, there is no doubt that the markets are still extremely volatile. Even $FTT, the native token of FTX, spiked 2x on speculation that user funds would be returned.

In trading news events, the first person to piece together how the market would react is often the winner. Honing that is imperative to making more gains than losses.

Despite this, the most important thing in the bear market right now is to protect your capital. All the trading in the world will mean nothing if you lose it all while $ETH skyrockets a few years from now.

Make sure to take profits, keep them safe, and of course, secure your private keys.

Also Read: Slaying The Bear Market: 5 Skills You Need To Excel In a Crypto Downturn

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: Chain Debrief