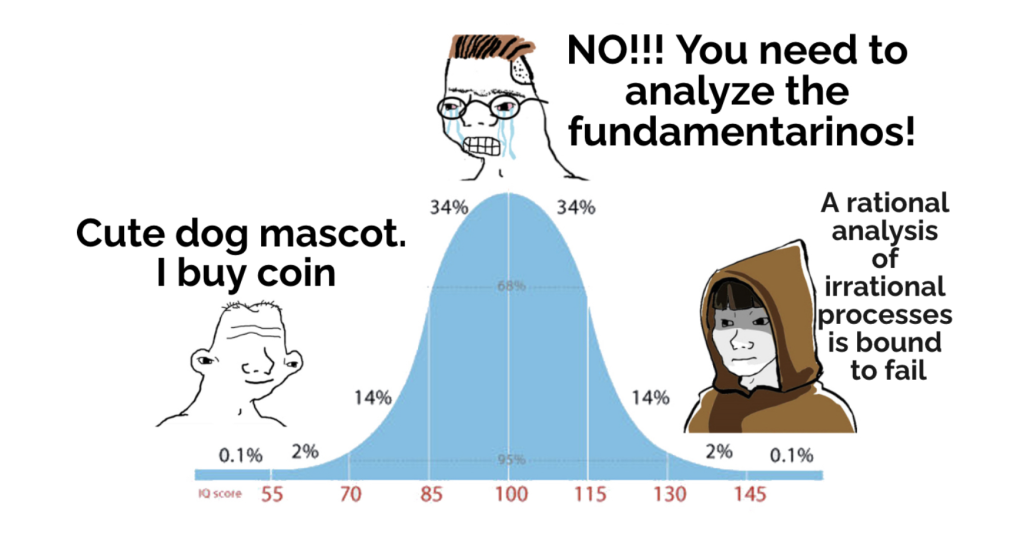

Valuations of crypto are one of the most difficult things to do in the space.

It is confusing because, on one hand, there seem to be some fundamentals or common concepts that attract funds, whales, and other gigabrains into certain projects. Yet what exactly these fundamentals are is often hotly debated.

- Do we look at the revenue a protocol generates?

- How does value go back to the token?

- Are tokenomics sustainable?

These are some of the questions people get into a dilemma, especially when it comes to researching a project.

However, on the other end of the spectrum, some of the strangest tokens and projects somehow reach the most absurd valuation. Ask these people about what revenue metrics they used and you will get laughed out the door.

Is it purely just luck in the bull market? Or is there something going on? How does one differentiate between fundamentals, which token is good, and in general, valuing a project?

Let’s take a look.

Overview

In general, the value of a token can be split into 2 segments:

- Fundamental value

- Speculative premium

If you have been in the space for some time, this will seem obvious, but have you wondered which is more important than the other, and how we know what framework to use for different projects?

Before I answer the question, we have to first look at 2 sectors of the market that seem to exist on opposite ends of the spectrum – DeFi and NFTs.

I will showcase the 2 different methods that people use to review these projects, and ultimately why there may be one principle that binds them together.

DeFi

DeFi, alongside NFTs and the Metaverse, have been one of the few catalysts for the previous bull run. It seemed as though the infrastructure for a “decentralized Wall Street” had arrived.

Let’s not forget the cool APYs and tokens that you could basically print out of thin air for a while.

Now, as the Cambrian explosion around DeFi went on, people even created certain frameworks for analyzing DeFi protocols.

After all, how can we rate the successes of say, Uniswap versus Sushiswap, or dYdX, if we did not know how much trading volume and revenue were generated?

Buzz on research, revenue, fees, and tokenomics was in the air. Certain projects even came up with various incentives surrounding “game theory” (looking at you, OHM!), while others focused on various models such as bribery and locking up tokens.

There was a method to the madness, to say the least.

But do DeFi tokens really accrue some form of value? Why should someone own or buy some governance tokens? How important are these, really?

Firstly you will have have to know what types of tokens exist in the ecosystem, first.

(1/19) De-Fi 101: Tokens

— Haym Salomon (@SalomonCrypto) July 2, 2022

From $ETH to wrapped-ve-token, your guide to the money-legos that builders are using to create the future financial system pic.twitter.com/VDfuxLSYqV

Being able to know what governance tokens do, what veTokens do, and what wTokens are is actually quite important. While we can dismiss and argue on how these tokens should be valued, it is worth noting that these complex ecosystems came up in a short span of time. I do believe that much of what DeFi covers will only expand, and issues eventually ironed out.

Of course, we have to look at tokenomics as well. For example, looking at the fully diluted valuation, how much supply will be released into the market, how much private investors own, etc are all important to know.

Also Read: Make Or Break Your Bank: Here Are 5 Things You Need To Know About Tokenomics

Funny enough, L1s still do much better than the native DeFi projects on its chain. Isn’t that confusing? How do fundamentals explain this disparity?

An explanation can be via the fat protocol thesis, which states:

“The market cap of the protocol always grows faster than the combined value of the applications built on top, since the success of the application layer drives further speculation at the protocol layer.”

In simpler words, the base layer that DeFi projects are built on accrue more value than the “token” of DeFi projects itself…. even though in general, DeFi protocols may generate more revenue than even the L1 it is built on.

Is the fat protocol thesis true? Does it really explain the performance of DeFi against L1s? Well, it’s debatable, but that’s a story for another day.

In general, however, it is largely agreed that there are certain ways to evaluate the success of a DeFi project, and how under or overvalued it is.

I like to use a few simple questions when addressing a project:

- What does the project do?

- Is there a need for what the project is doing in the space?

- What type of tokenomics does it have? How is the vesting schedule like?

- Does it have a dominant position in its market?

And my favourite question:

“How early am I to that ecosystem?”

To sum it all up, there are methods that can be used to research a project. But what about tokens and niches like NFTs that don’t seem to make much sense under such a framework?

NFTs

There is little “fundamental value” or utility to NFTs; well, not in the way we think about other projects, at the very least.

In fact, NFTs are narrative driven (even more so than any other sector) and primarily more of a social status and a flex. Existing as a a cultural unit, NFTs are very reliant on community, marketing, and generally how long it captures attention – I have covered it in a case study on Goblintown here.

Also Read: A Crypto Scam Or Genius Marketing? Here’s How Goblintown Went Viral

Could we have predicted some random monkey pictures to become a paragon of crypto culture in 2018? Could we have imagined top name celebrities to buy and advocate for JPEGs? Probably not. But if there’s one thing crypto OGs know, it is that to “shitcoins” and “pumpamentals” do outperform in a bull market, regardless of cycles.

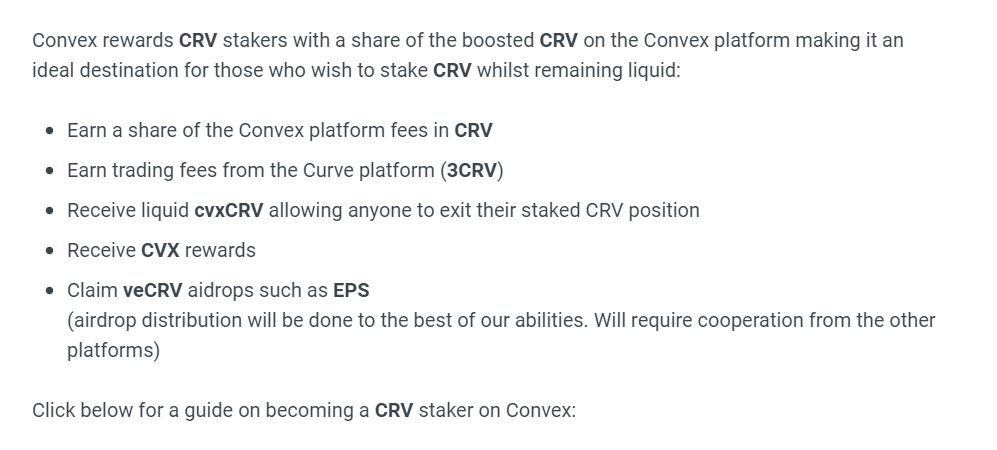

NFTs are of course not exactly older tokens in previous cycles. However, they are basically fun-sized crypto with none of the boring complicated yield farming ponzi jargon – just look at the picture explaining a “blue chip” DeFi project.

Seriously, why?

Okay, you get my point. Not everyone understands (and wants to) look into all of this stuff.

Fair enough. Beginners prefer NFTs – the catalyst for retail interest.

But is speculating on NFTs really a bad thing? Not really, because after all, culture is subjective, and people have the choice to make decisions to own art and what they like to make as a statement. Yat Siu, the co-founder of Animoca, explains NFTs and their importance elegantly in a recent talk here:

Also Read: Building The Foundations Of An Open Metaverse With Animoca Brands CEO

To make things clear, I believe most NFTs will fail and trend towards being illiquid and nigh unsellable (basically a dead coin that never recovers). Successful ones will retain status and value as a luxury good for the rich to trade/hold – some may even be financialized and become some sort of useful asset.

Okay, so now we know that there are 2 different methods to look at the market, but which one do we use? How do we make sense of it all?

To tackle this, Reader, we should look at the ‘stages’ of the game we are in.

The flow of money

Basically, it is more important to identify the environment you are in first, before you make a decision.

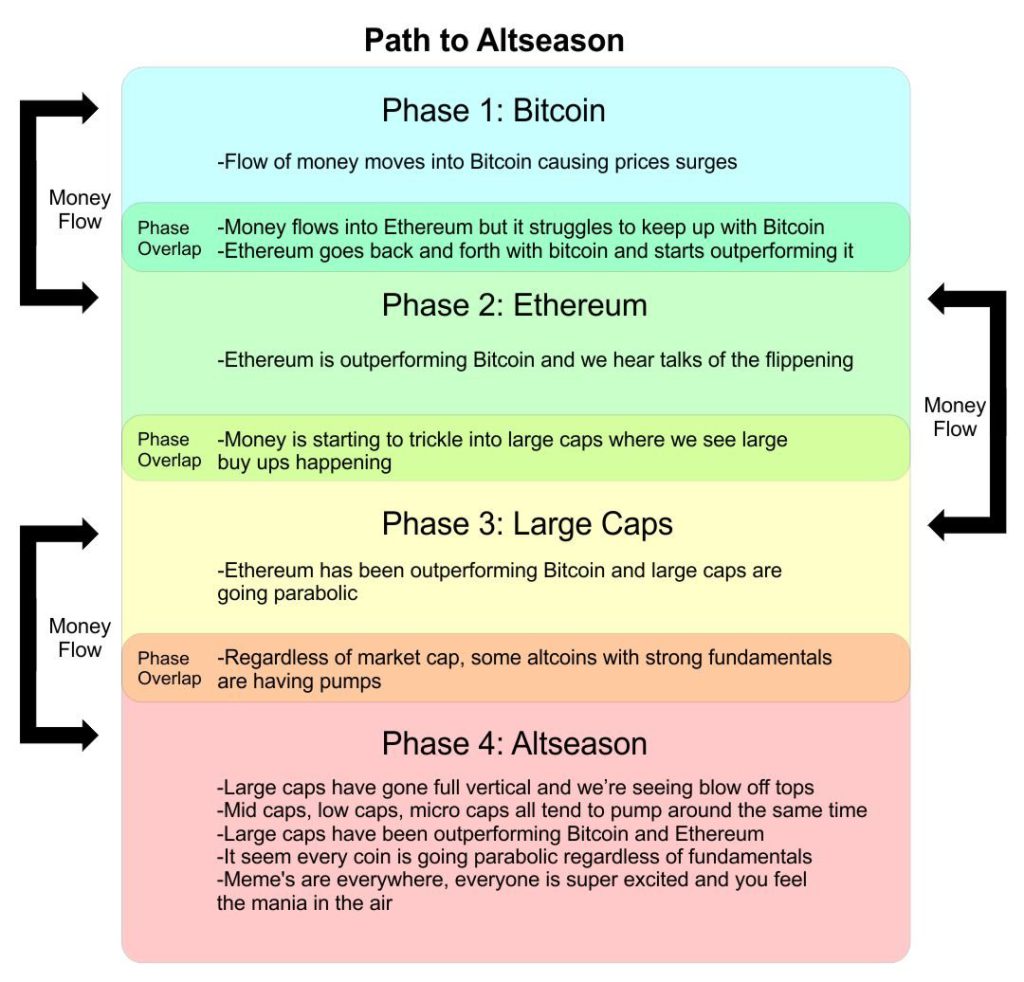

You can look at this chart here to see the flow of money for alt seasons, which has been primarily the case of our current cycles.

Speculative premium for ETH goes up during phase 2, and in general for most alts their speculative premium goes up during phase 4.

The phase overlap between 3 and 4 is when tokens with strong fundamental value start to shine.

In the 2018-2019 bear market, buying projects that were building and brimming with untapped potential did extremely well. Some examples were LINK, SNX, and AAVE (back then known as ETHLend). This was a case where valuing using fundamental research and letting high conviction bags ride would have given you a great payoff… assuming you waited for the next bull run and phase 3 to arrive, of course!

On speculation and reflexivity

From phase 4, however, the narrative changes, and speculative premium becomes the dominant value accrual for a token. So during the full fledged phase 4, how should an investor look at the market at the whole?

By the summer of 2020, DeFi was the next big thing, alts hit phase 4, and narratives/fundamentals became increasingly blurred.

“It seems every coin is going parabolic regardless of fundamentals”

“Memes are everywhere, everyone is super excited and you feel the mania in the air:”

In the middle of mania, just observe that coins are going up because of narrative, so grasping which coins have the ability to gain attention and which sector is the popular “meta” is important.

In that time period, fundamental value and looking at pure utility goes out of the window, although ironically, the idea that a token has “fundamental value” alone might give it even more of a bullish narrative and sentiment – I will explain more on that later.

Take for example the Layer 1 token hype mania in 2021, when every Layer 1 token relied on incentives and launching DeFi dApps to create one big rush of capital (most popular examples were Solana, Fantom, and AVAX). There was certainly some form of fundamental value in a ‘Defi Summer’ on these chains last year.

But as these L1 tokens rose in value, and so too did these early DeFi forks on these L1s, so too did the price and overall sentiment for activity on these chains. Narratives, good sentiment, and the fundamentals become increasingly blurred.

The better the price, the better the fundamentals (or so investors perceived). A positive feedback loop drove the market upwards. In phase 4, market reflexivity was at its finest.

So what is reflexivity? It is a theory by the renowned investor, George Soros, which states that the perception of investors affects the fundamentals, which in turn affects perception and price in a consistent feedback loop.

Decisions made by investors are not solely based on reality, but what they perceive about the market. This creates a loop and explains the boom-and-bust cycles in the economy.

When applying Soros’ theory of reflexivity, especially in a volatile asset like crypto, it makes a lot more sense that the value of a project/token can be directly linked to its price, or what investors perceive the fundamentals to be, based on the price.

This is especially apparent during phase 4 of the money flow in the market.

Let’s take a look at 2021. Back then, BTC had just approached new all time highs. With the bull in full force, speculative activity became dominant, and combined with a influx of capital, generally led to tokens being overweight a speculative premium.

Investors of the Class of 2021 would be familiar with examples like the BSC casino season and PancakeSwap.

How would somebody have navigated this phase of the market? De-risking and taking profits would be a great idea for beginners. But if you were savvy enough, you could have relied on the turn of the tide and rode the sentiment.

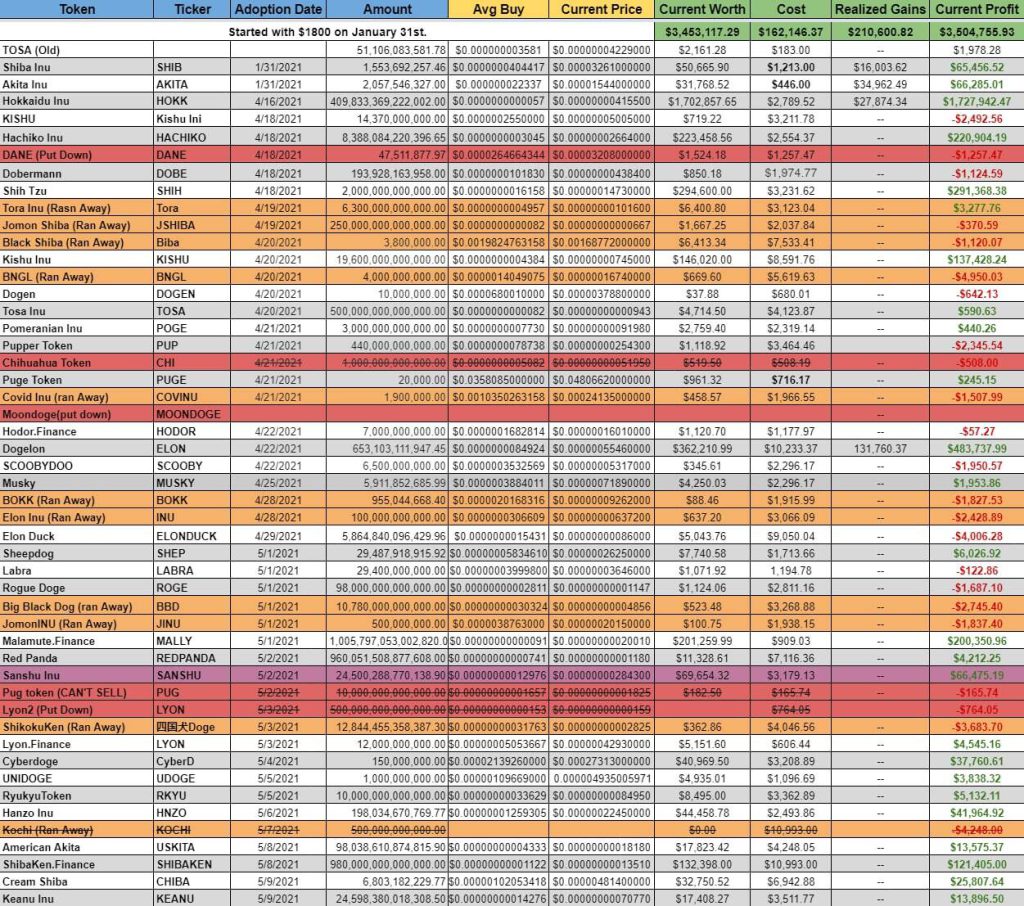

A great example would be this guy that started with $1800 in January 2021, and bought a variety of different animal/dog themed altcoins during Dogecoin mania, while tracking them on his Excel sheet. This was the same person who made a profit of 3.5 million USD.

The fundamentals of “good” projects had not changed at all. ETH still had good on-chain activity, and DeFi protocols were chugging in revenue and more TVL.

But strangely enough, the mania and the behaviour of the market around dog themed coins had its own feedback loop. In its own twisted way:

The prices became the fundamentals, and the fundamentals became the price.

Similar principles of reflexivity also apply to NFTs as well. The speculative premium and the capturing of attention leads to a better price floor. The better the price floor, the more the project has a chance of solidifying itself as THE luxury NFT of the future (e.g BAYC, CryptoPunks).

Interestingly, this feedback loop goes in the opposite direction too. The death spiral of LUNA and UST is the perfect example of this – a loss of confidence and withdrawals led to a depeg, and this depeg eventually led to a crypto contagion that we still feel the effects of till this day.

In any case, if you are buying an alt, it depends on which phase of the market you are currently in. This is incredibly important when it comes to valuing crypto.

Are we at a reset where people are selling and taking profits? Or are you in the middle of mania? Are we at the stage where the market is reflexive upwards or downward? Are we at the point where fundamentals matter, or have the fundamentals now changed to reflect just sentiment?

These are some questions you should ask yourself every time!

Closing Thoughts

“You see? Crypto is indeed rat poison squared! Everyone is just speculating and buying Ponzis!” The Nocoiner shouts.

Actually, I don’t disagree that the market is speculative (in fact, speculation and leverage have rekt everyone, from the smallest of fishes to the largest of funds), but let’s not dismiss the entirety of the space.

As we just concluded from the DeFi section, crypto is a highly inefficient market. But it is this inefficient market that presents massive opportunities. Many asymmetric bets exist, and it is up to you to find them, while not blowing up in the process.

Of course, timing the market in such a manner is not easy, and the results are only obvious in hindsight. However, understanding some of the incentives and structure around how people behave, especially in the market, is always beneficial. It is one way I try to sharpen my edge in this market.

No two cycles are the same, but spotting parallels could do you good. If there is one thing that will remain true for the rest of the cycles to come, it will be this – no matter how the technology or the economy has changed, our natural tendencies towards fear, greed, and following the crowd will remain the same.

It's all just the same thing over and over; we can't help ourselves. And we make a lot money if we get it right. And we get left by the side of the side of the road if we get it wrong. And there have always been and there always will be the same percentage of winners and losers.

— GCR, Ezekiel X (@GCRClassic) June 30, 2022

History does not repeat, but it often rhymes.

So let us dance in the rhythm and songs of goblin town, and await for spring.

Also Read: Is This Time Really Different? Lessons And Warnings From Previous Crypto Bear Markets

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Featured Image Credit: ChainDebrief