According to a report by leading investment bank Jeffries Group, the NFT market capitalization is expected to exceed USD $80 billion by 2025, more than doubling in value from today.

While much of this can be attributed to the non-fungible profile pictures we know and love, a growing use case for NFTs is the tokenization of Real-World-Assets, or RWAs.

As the digitization of RWAs such as stocks, collectibles, and Real Estate grow in popularity, it’s imperative that we understand both the benefits and risks associated with it.

Also Read: Why Real-World Assets (RWA) Are The Key To DeFi’s Future Growth

How Does RWA Tokenization Work?

At the most basic level, RWA tokenization involves taking an asset and creating a digital twin of it on the blockchain. This can be done in one of two ways – either through the creation of a synthetic version of the asset, or through the ownership and tokenization of an underlying asset.

Let me explain.

Method 1: Synthetic Tokens

The most apt example of this is Synthetix, a platform that allows you to trade Synthetic versions of various RWAs on-chain, instead of via a traditional exchange. On Synthetix’s perpetual futures platform, this includes commodities such as Gold and Silver, as well as currencies such as the Euro and the Japanese Yen.

Users put up collateral in order to mint these synthetic assets, supplying them to enhance the market’s liquidity.

To ensure prices do not stray away from SPOT, or the actual value of the asset being traded, Synthetix uses both on-chain and off-chain oracles to adjust funding fee rates.

Method 2: Tokenizing an Underlying Asset

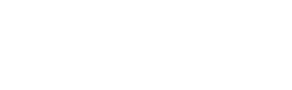

CitaDAO is a platform that tokenizes real estate in the form of ERC-20 tokens, enabling transactions of the underlying asset.

In this case, Real Estate is tokenized so that it can be bought and sold on the blockchain.

By tokenizing the property into ERC-20 tokens, CitaDAO also fractionalizes it, allowing holders to own a portion of the underlying Real Estate for as little as $1.

Yield (rental income) generated is then used to buy back and burn ERC-20 tokens that represents the underlying property, incentivizing liquidity through fees while theoretically increase the value of the token.

Unlike Synthetic Tokens, these token prices are decided by the free market, instead of on-chain oracles.

Why Do We Need RWA Tokenization?

A recent report by HSBC and Northern Trust Corporation projected that 5-10% of all assets globally will be tokenized in the next 10 years, translating to a market size of approximately US$14.5 trillion.

Beyond Real Estate and commodities, they highlighted mutual funds, carbon credits, and bonds as industries prime for disruption.

But why?

Tokenization comes with a slew of benefits, including lower management fees, the ability to invest regardless of geography, and fractionalization.

Perhaps more importantly, tokenization allows instant liquidity for markets that would otherwise not be present.

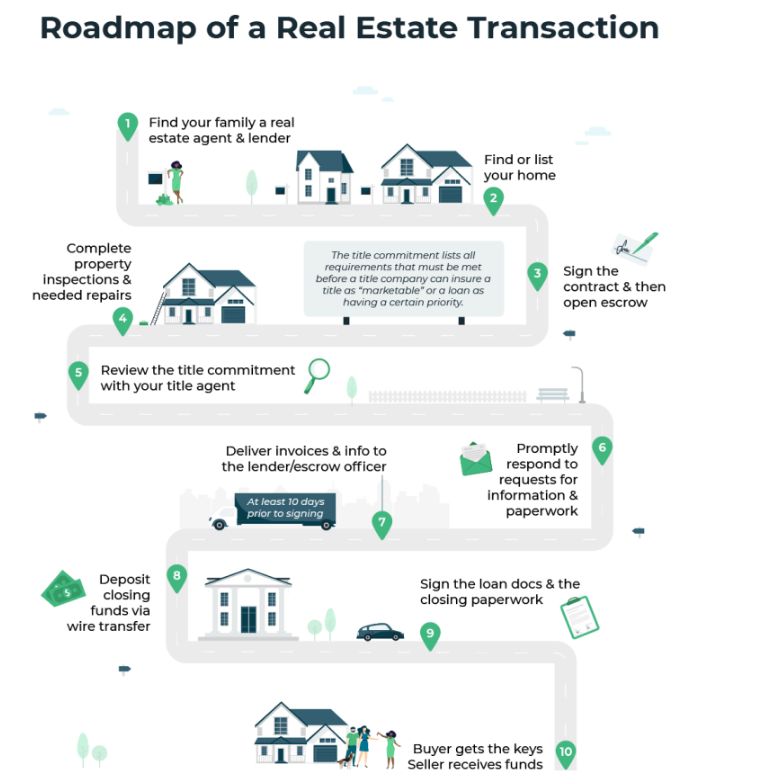

For example, let’s say an investor A owns a condominium worth $1,000,000 within his portfolio, expecting it to double in value over 10 years. During this period, A also identifies another investment opportunity that he would like to partake in, but lacks the capital to do so.

Traditionally, A would have to sell his condominium in order to free up capital to enter the new investment opportunity.

Not only would he lose exposure to the property, the process of selling it would incur high transaction fees (up to 14% in Singapore!) and the seller would have to endure a lengthy transaction period.

Alternatively, A could post the condominium as collateral to take out a loan from the bank, an endeavor that also involves a lengthy process, and is subject to various conditions such as bank approval, type of property, and whether the property is fully paid for.

In the world of Web3, if the condominium has been tokenized, A could simply sell his tokens into the respective liquidity pool in order to realize instant liquidity.

Better yet, he could post it as collateral on a lending market and borrow stablecoins or other cryptocurrencies. A not only retains exposure to the condominium, but can now instantly enter the new opportunity, possibly at a net gain from interest rates and yield farming.

Moreover, if A instead finds a counterparty to finance their loan, they could automate the OTC process through smart contracts.

Risks of Tokenization

While there are immense benefits to be gained from the tokenization of Real World Assets, it’s not all sunshine and roses in the world of Web3.

For example, what if you tokenize an entire building as an NFT, and your wallet gets hacked? Does legal ownership now transfer to the hacker?

Hilarious as this example may be to anyone in traditional finance, these are real risks that we have to acknowledge due to crypto’s nascency. With the ongoing CeDeFi meltdown and over US$3 billion in hacks last year, we must consider the risks involved with tokenizing an asset.

While the abovementioned situation remains a fringe example, let’s consider something else – liquidity crunches.

We’ve seen the disastrous effects low liquidity can have on pegged or even algorithmically-pegged assets during volatile market conditions.

When prices start to fall, users rush to sell their positions, compounding the effect.

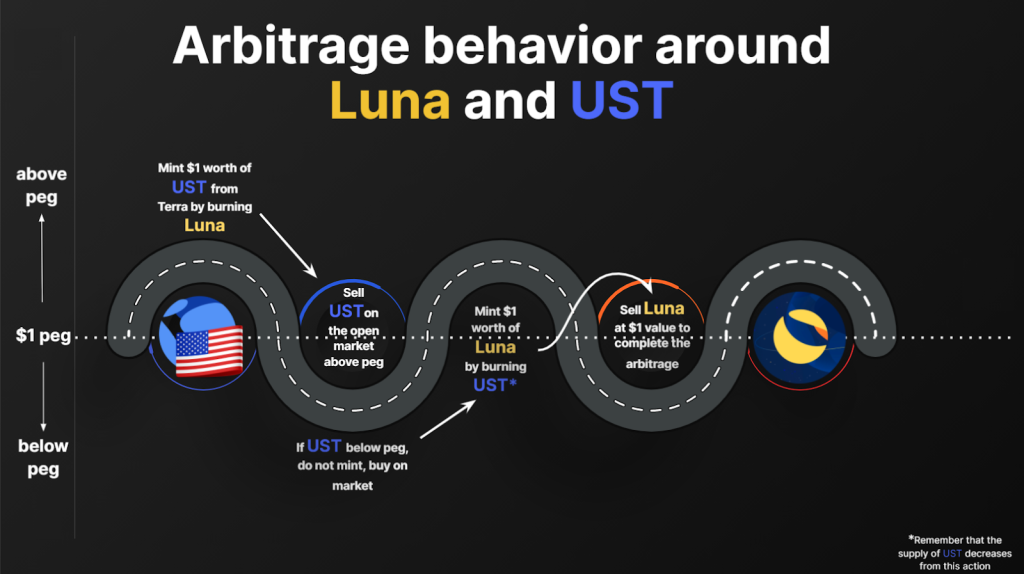

This is usually offset by arbitrage opportunities, where an entity is able to redeem the underlying asset and sell it for it’s real value. Using the profits, he can once again purchase the de-pegged asset and repeat the process ad-infinitum, essentially “closing the loop” and causing it’s price to stabilize.

This was the fundamental mechanism behind Terra’s native stablecoin, $UST. However, due to mass inflation of $UST and network congestion, arbitragers could not “close the loop”, sending $UST into free fall.

A less extreme example would be the Grayscale Bitcoin Trust ($GBTC).

Shares of $GBTC can be acquired through depositing Bitcoin with Grayscale. Due to this mechanism, the total market capitalization of $GBTC should therefore the value of all Bitcoin deposited with the trust.

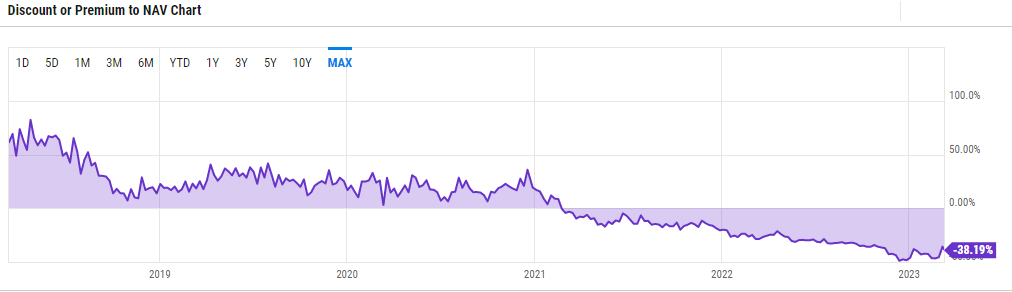

While shares of $GBTC initially traded at a premium to Net Asset Value (NAV), they started to trade at a discount toward the end of the 2021 bull run.

Furthermore, holders of $GBTC shares were not able to redeem the underlying asset, in this case Bitcoin, due to Grayscale being denied approval to turn their trust into a SPOT ETF. This prevented them from “closing the loop”, and bringing $GBTC back to parity with its NAV.

As the market continued to decline, the discount to NAV only steepened as uncertainty loomed over Grayscale, and $GBTC holders liquidated their positions.

Protecting Against Liquidity Crunches With CitaDAO

While fungible assets like Bitcoin can easily be redeemed to “close the loop”, it becomes a lot harder for non-fungible assets like Real Estate.

After all, how do you redeem 1/100th of a condominium unit?

If no redemption occurs, a large whale could trigger a potential sell-off, crippling all token holders regardless of the underlying asset’s value – something Olympus DAO holders would be familiar with.

To solve this, CitaDAO introduced the novel concept of De-tokenization, or “buy outs” for tokenized Real Estate Assets. This can occur not only when prices fall, but also if a single entity simply wishes to purchase the property.

To initiate a buyout, entity B must first own 30% of the tokens associated with the underlying property, which are known as Real Estate Tokens, or “RETs” on CitaDAO.

Once B has accumulated 30% of the tokens, he can offer to buyout the property, proposing a specific price per token.

The buyout system helps to solve a few major issues present with current tokenized assets:

- Redemption of non-fungible assets

- Incentivizes holders to not sell under NAV

- Reduces costs for redemption, as opposed to buying 100% of circulating supply

RET holders can also issue a counter claim, pooling together funds to buyout B‘s tokens at B‘s proposed price. Should the RET holder’s pool outweigh B‘s initial proposed price, they can then buy B‘s 30% stake at the set price. Otherwise, the buyout is successful. (chunky)

This serves to prevent lowball offers from potential buyers, while allowing RET holders a say in the underlying property.

CitaDAO’s third listing at 18 Sin Ming Lane, Singapore, leverages the above mechanisms to bring Real Estate on-chain. The Introducing Real Estate On-Chain, or IRO process, has a soft cap of 634,000 USDC.

Once the soft-cap is met, the unit will be tokenized in the form of an ERC-20 token. Should the soft cap not be reached, all participants will have their committed amount refunded.

You can find out more about the listing HERE.

Closing Thoughts

RWAs will be pivotal to the growth of DeFi, and Web3 as a whole.

During the bear market, these aspects of crypto have shined, with “Real Yield” narratives taking the place of inflationary tokens and more speculative assets.

The bond market, for example, is valued at $46 trillion in the US alone, compared to crypto’s approximately $1T market capitalization.

However, the risks associated with smart contracts and tokenization should not be underplayed. Instead, they should be the most important consideration when a project is looking to tokenize a Real World Asset.

“[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: ChainDebrief