There are probably many crypto investors feeling uncertain about the market today. Some are bearish while others remain optimistic. Is it a complete failure and will it come back? How long will the bear last, and what needs to change?

The year has been a roller coaster ride. From an insane NFT bull run and animal coins mania, to massive scandals like the fall of Frog Nation and LUNA. It is time to develop some new reflections on the market and what is to come.

Here is my take as a fellow degen and retail player:

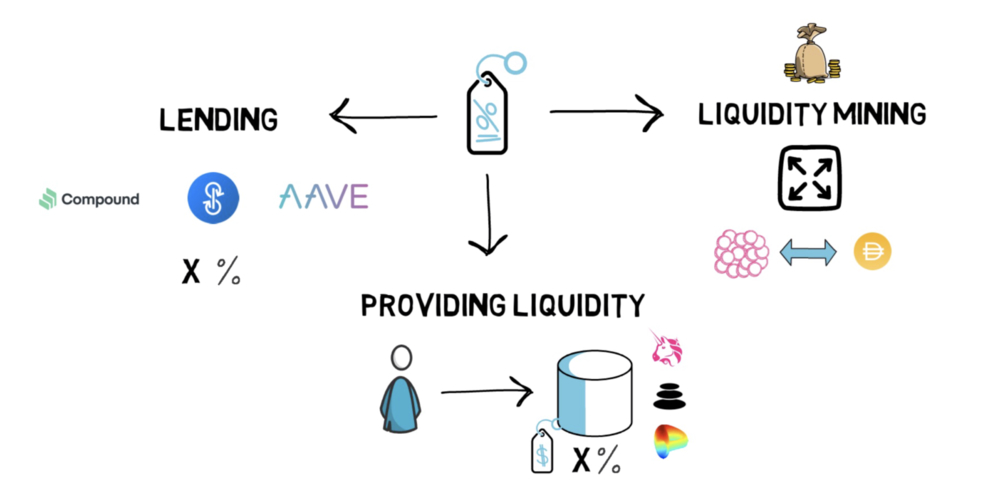

Yield farming is done

At this point of the cycle, the allure of high APY staking/farming mechanism is gone. Depositing your funds and trying to ape into these projects is a death sentence at this point.

If we were to see crypto as a PvP game, then the game of farming and acquiring tokens early has become extremely efficient over the past two years after DeFi summer 2020.

It is widely known now that DeFi yield farming mechanics are unsustainable and token dilution eventually floods the open market. This causes the later buyers of the native token to become bagholders (but hooray for governance right!)

Players no longer wish to purchase and acquire DeFi tokens but see it as a mechanism to farm and dump as quickly as possible.

Naturally, the bribery market and vote escrow tokenomics now exist in protocols like Curve and other related products like Redacted, but is that something a retail player like you and me would be interested in? Would you lock a portion of your portfolio for a long period of time? That depends on your conviction of course, but I will not be leaning towards that as a small player.

Also Read: Understanding The Curve Wars And What It Means For The Ecosystem

You might be asking, what if we were to farm the tokens with only our stables?

Stablecoin farming is not the exception

Consider the following risks when you place your stablecoins into a DeFi protocol.

- Smart contract exploit risk

- Rugpull risk

- Stablecoin depeg risk

- Stablecoin regulation risk

<Stable> : <Price> (24h vol on Gecko)

— testinprodcap (@testinprodcap) May 13, 2022

USDM : 0.45 (Mochi not on Gecko)

USDN : 0.94 ($35m)

USDO : 0.74 ($7k)

USDP : 1 ($81m)

USDQ : ~0 ($0)

USDR: 0.369 ($369k)

USDS: 0.975 ($1.3m)

UST : 0.138 ($761m)

USDT : 0.995 ($79m)

USDU : 0.982 ($4k)

USDV : $0.999 ($26m)

USDX : $0.660 ($2m)

The LUNA/UST collapse has been a stark reminder that not all stablecoins will survive.

For some investors, it gets even better — you place your funds on a centralized custodian that lends out your money. In other words, you expose yourself to a default risk from that specific platform, while they take a further cut of your yield as a third party. To me, it beats the purpose of DeFi, while skewing your risk/reward ratio to the downside.

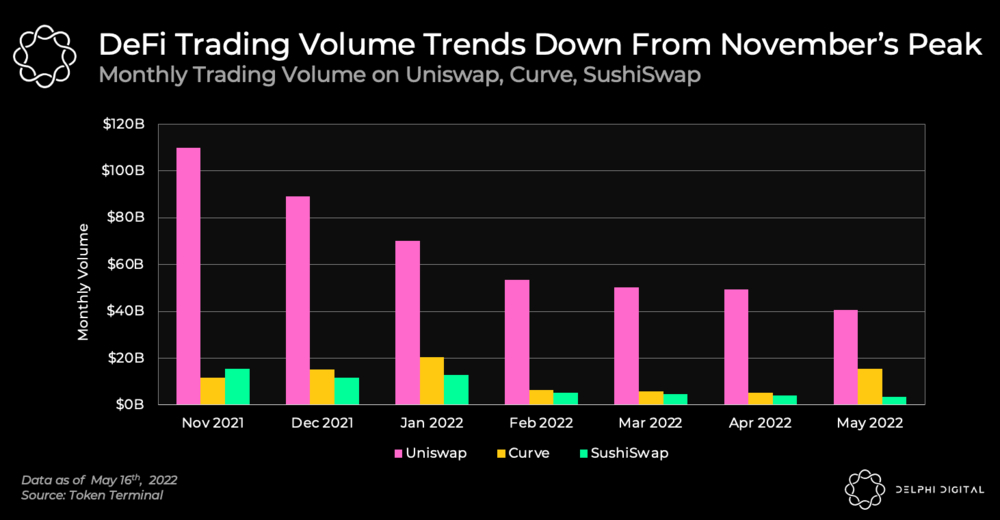

Based on all these risks, farming with stablecoins becomes less attractive. And as the bear settles, stablecoin yields have also cratered massively.

remember when all of normie crypto journalism was hyperfixated on dunking on savings accounts rates?

— L (@llllvvuu) May 16, 2022

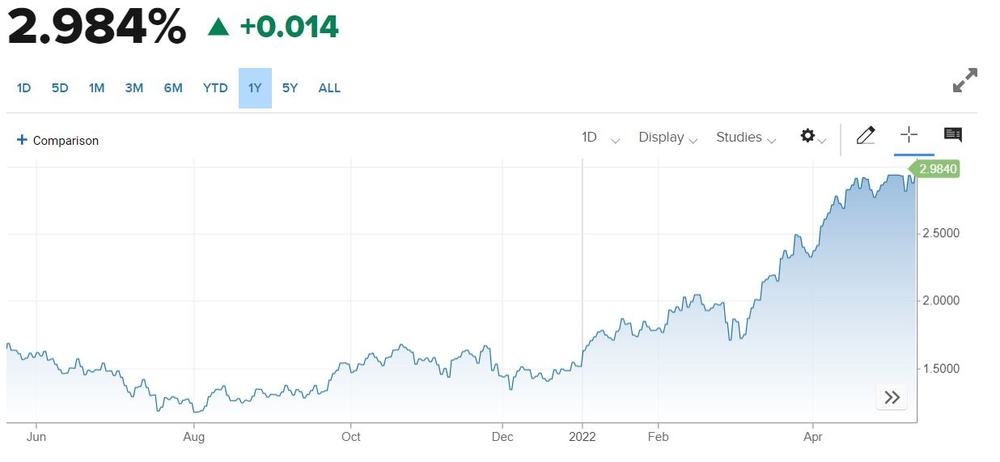

> compound (0.67%) is now lower-yield than tradfi savings accounts (0.7%+ FDIC insured), while having a BBB risk rating

> A/AA/AAA 0.5y spot rates at 1.31%, positive yield curve

Let’s also consider that interest rates have started to rise and bonds are now offering a fairly similar APY now.

Stablecoin yields continue to get crushed in DeFi while risk-free US treasury bond rates start to go up. At what point is farming in DeFi completely worth it?

The pitch used to be that DeFi APY would outpace inflation and was naturally better than traditional finance. In the bear market now, I would consider this to be the first major stress test on the natural demand for using DeFi protocols (beyond inflationary tokenomics).

Yield farming and liquidity incentives will not go away, but at this stage of the cycle being a “degen farmer” will not be worth it.

GameFi and NFTs are not your savior

So what about the gaming and NFT space which also did well in the past bull run?

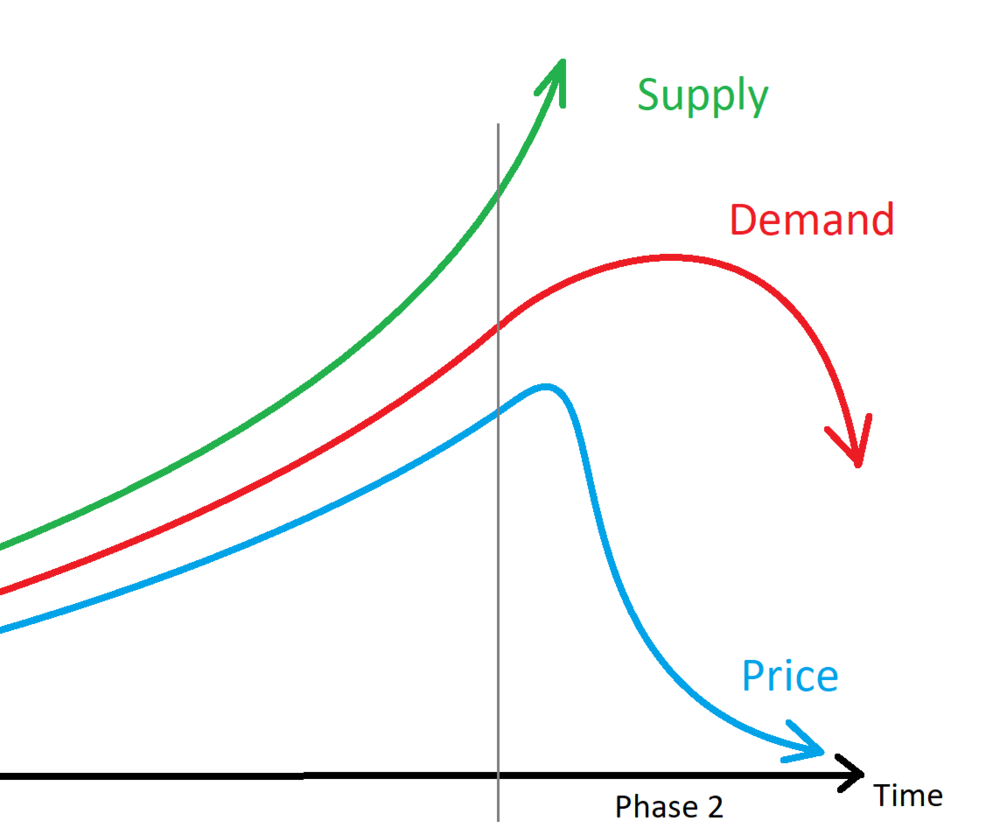

To put it bluntly, most GameFi projects and other variations of X-To-Earn, such as StepN, will not succeed. Many of these games often have a strong growth at the start and it is attractive to earn yields based on “normie” activities.

Also Read: I Earnt US$70 For 10 Mins Of Running With STEPN But This Move2Earn Model Might Not Work

However, P2E systems often do not account for the massive growth in supply outpacing demand, which leads to an unsustainable system eventually.

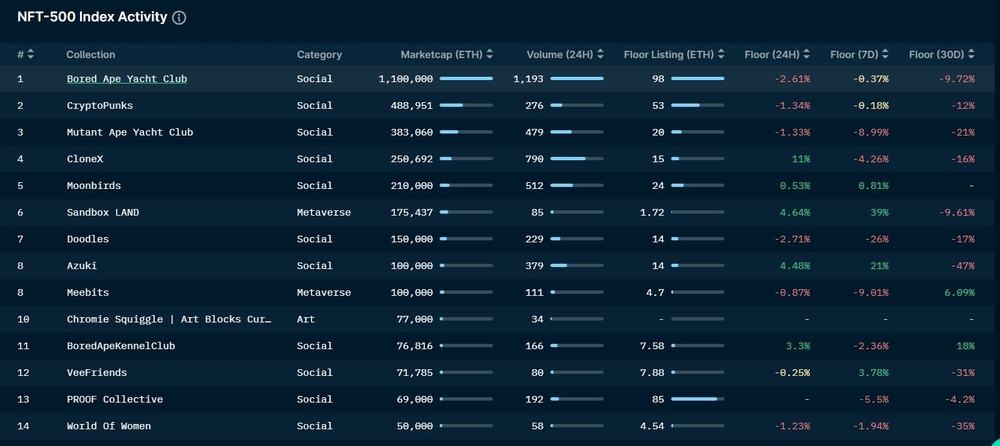

NFT floor prices have also been on a decline in general.

Regarding NFTs, I believe that only the high end ones will survive as a form of rare art and financialization of these high end NFTs will be inevitable.

However, to me, both gaming and NFTs as a whole are also tied to the broader bear market and have their own general weaknesses.

The inflection point

In my previous article summarizing the Twitter Spaces talk on LUNA, Darius Sit from QCP Capital mentions the following point:

“There has to be a catalyst that breaks the correlation between macro and crypto.”

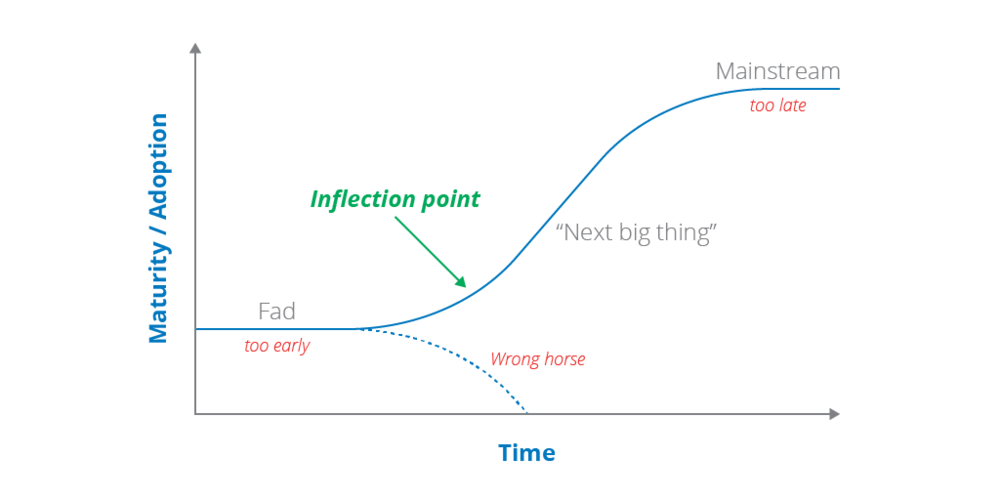

While I do not believe that crypto will be completely decoupled from the macroeconomy, I have a similar perspective on this concept of a “catalyst” in crypto — the inflection point.

This occurs when crypto is no longer a fad but becomes an unstoppable trend. It is when crypto and Web 3.0 is seamlessly integrated in our lives and every level. Retail to enterprise have to use it as a necessity rather than an option.

In 2020, DeFi blew up with the narrative that this was superior to banks in terms of transparency and yield. It was a disruptive technology in a time of need: high inflation in countries and low savings rates in your bank was a dominant demand pull factor towards DeFi. Interestingly, the marketing for Anchor was also based on this exact same pitch (earn 20% on your savings).

A parallel is drawn when considering GameFi. In Phillippines, earning via Axie Infinity at some point was a better alternative income source amidst the economic fallout of the COVID pandemic.

People were driven towards that as crypto provided a solution for the needs of the disenfranchised.

While these mechanisms turned out to have problems as per my criticisms above, there are some lessons to learn from it.

What’s stopping us?

Firstly, as an optimist, the inflection point where mass adoption becomes a necessity will happen eventually.

Secondly, the above examples are foreshadowing of what is to come in the next 5-10 years:

- Developing nations gaining permissionless access to yield and income

- A transparent and more reliable financial system

What we saw above were unsuccessful attempts to go past this point and accelerate mass adoption.

I currently believe that we are at a phase where a massive chasm in adoption is present.

This gap exists partially due to the flawed mechanisms of current protocols today (lack of sustainability), a bear market washing away euphoria, and the natural skepticism around blockchain and what it currently offers.

Is there hope?

A16Z, one of the largest tech venture capital firms in the world, recently published their 2022 report on the state of crypto. Key takeaways can be found below.

Introducing a16z’s 2022 State of Crypto Report

— a16z (@a16z) May 17, 2022

A lot has changed since we started investing in crypto nearly a decade ago.

Here are 5 key takeaways from the a16z crypto web3 industry survey and data analysis by @darenmatsuoka, @eddylazzarin, @cdixon & @rhhackett ⬇️ pic.twitter.com/JFLXbNh03u

Their report is an optimistic take and when one zooms out and looks at the big picture, it is hard to bet against the eventual dominance of Web 3.0. To me, the benefit of patience and long term innovation will win out against this chasm that I described.

I see this as a game where each time the game ecosystem goes bust, pain is felt, funds are lost, and the flow of funds eventually go from weak hands and projects to a more robust builder and player base. This is good for us in the long run, and eventually allows us to “bridge” the gap.

Rising from the dead once is a fun magic trick. But continually rising from the dead can make ppl believers. Maybe we die and go to zero forever and it was all a symptom of broken economic policy. But every time we don't, believers become more resilient.

— Cobie (@cobie) May 13, 2022

Final thoughts

There is nothing new under the sun.

Markets are cyclical, and that the behaviour of its participants will always lead to boom and bust cycles.

To me, Web 3.0 is indeed innovative and exciting — much information asymmetry still exists in the space and it is the best opportunity in our times to get supernormal returns. Of course, this cyclicality cannot be ignored, and the herd psychology of people in crypto never changes.

My logic is simple – if you are afraid of your tokens going to zero, you probably own too much of it. If you are over-invested and have obligations to take care at home, then take some off the table. this will help your mental edge in the game and prevent you from making poor decisions due to panic.

For me, I will be comfortable in observing the bear market on the side and keep track of any new developments that excite me. Otherwise, keeping your funds in cold storage and not touching them is the simplest but most effective way to stay exposed in the space.

Ultimately, it is up to you as an individual to learn and reflect on what you did this cycle, and hopefully develop the right skill tree to level up in the future. Welcome to the game, Reader.

[Editor’s Note: This article does not represent financial advice. Please do your own research before investing.]

Also Read: Is This Time Really Different? Lessons And Warnings From Previous Crypto Bear Markets