At the height of the DeFi boom, money markets played a crucial role in every ecosystem, offering traders a way to utilize their capital without liquidating their existing assets.

For example, instead of selling off longer-term holdings for access to spare capital, users could post their holdings as collateral in order to free up instant liquidity.

Since its launch in 2022, Radiant Capital, a DeFi money market protocol, has been steadily gaining traction in the realm of Web3, defying the challenging bear market conditions.

While Aave and Compound have traditionally held the position as go-to options following the decline of yield farming, attention has now turned towards Radiant Capital due to its introduction of innovative features that have caught the industry’s eye.

Curious to know what Radiant Capital is all about and why it has been attracting increasing attention lately? Let’s delve into the details and explore the factors that have piqued the interest of more observers.

Also Read: Introducing Defi 2.0: Behind The New Wave of Decentralised Finance

Radiant Capital: Unveiling DeFi 3.0

Similar to Aave and Compound, Radiant Capital functions as a DeFi Money Market, allowing users to deposit collateral in order to obtain loans in the form of various cryptocurrencies.

Radiant Capital currently supports 9 cryptocurrencies on the Arbitrum and Binance Smart Chain Networks, where users can earn up to 69% and 130% APR respectively.

Users are currently enjoying substantial yield rewards on Radiant, thanks to its generous liquidity mining program that benefits participants on both sides.

Notably, the current incentives on Radiant Capital outweigh borrowing fees, allowing users to explore the strategy of “Looping”, or leveraged yield farming.

Furthermore, Radiant Capital has pulled ahead of the crowd thanks to inspired innovation during a bear market.

“We will be outlining various strategies to solve some of Radiant’s initial mistakes in V1 while ushering in a new ecosystem that our community has colloquially labeled as “DeFi 3.0”.”

-Radiant Capital

One of the many possible upgrades to money markets thrown around during the bull market was the possibility of cross-chain lending.

While the idea of posting collateral on one chain and taking a loan on another seemed simple enough, the reality was much harsher – especially with the escalation of exploits regarding bridges and other cross-chain protocols last year.

However, Radiant Protocol has managed cross-chain lending by leveraging Layer Zero’s stable router interface. This has allowed ecosystem interoperability between the Arbitrum and Binance Smart Chain networks, with more sure to come.

These developments, alongside their visionary tokenomics, has helped Radiant protocol multiply their Total Value Locked (TVL) by more than 8x since the start of 2023.

Also Read: Taking The Risk Out of DeFi: How Circle’s Cross-Chain Transfer Protocol Changes The Crypto Landscape

Radiant Capital $RDNT Tokenomics and Use Cases

$RDNT, the native token of Radiant Capital, was launched in July 2022 with an initial circulating supply of 217,696,083 in a fair launch on decentralized exchange Sushiswap, accounting for 21.77% of the token’s maximum supply of 1,000,000,000.

*Radiant Capital did not participate in raises prior to its token release, and was entirely bootstrapped by the team.

The token itself takes the form of an OFT-20 (Omnichain Fungible Token), a token standard introduced by Layer Zero Labs.

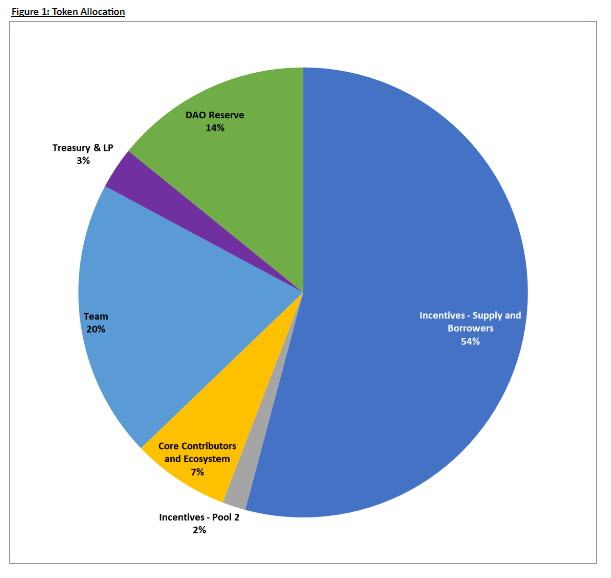

According Radiant Capital’s official documentation, distribution of the total supply is as follows:

- 54% – incentives for suppliers and borrowers, released over 5 years

- 20% – team, released over 5 years

- 14% – Radiant DAO reserve

- 7% – Core Contributors and advisors, released over 1.5 years

- 3% – Treasury & LP

- 2% – Pool 2 liquidity providers (Fully unlocked)

*Distribution and cliff is updated in line with Radiant v2

Similar to Aave and Compound, $RDNT accrues value through various protocol fees generated from borrowers, which was equally split between lenders and token lockers.

However, their v2 upgrade has prioritized Radiant Capital’s long-term cross-chain vision. This shifted the protocol fee split, with 60% going to lockers, 25% as a base fee for lenders, and 15% for DAO controlled expenses.

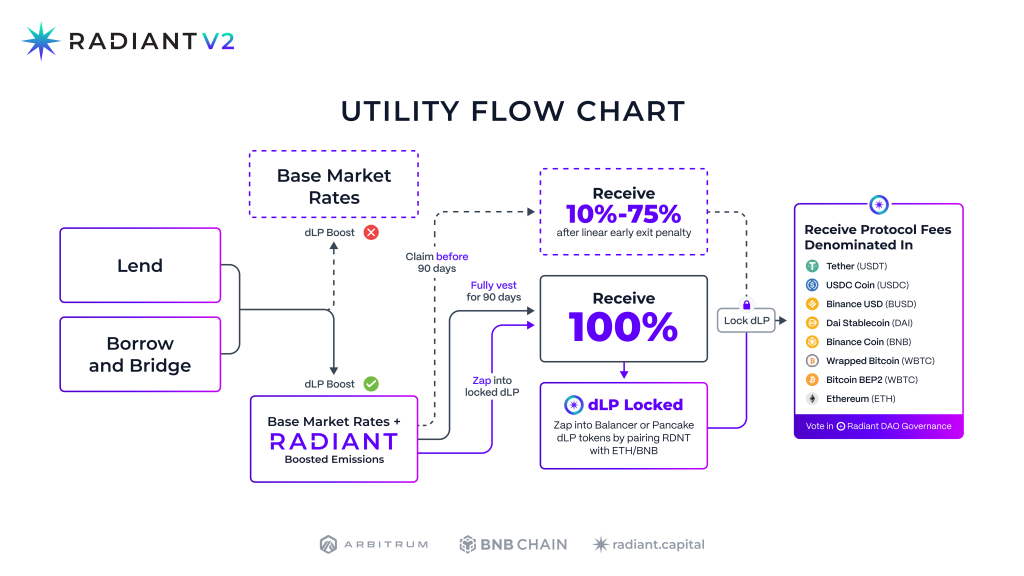

Users can also “lock up” their $RDNT tokens by zapping them into dLP, or Dynamic Liquidity, similar to LBPs (Liquidity Bootstrapping Pools) on Balancer. There is currently no single-sided staking option for $RDNT.

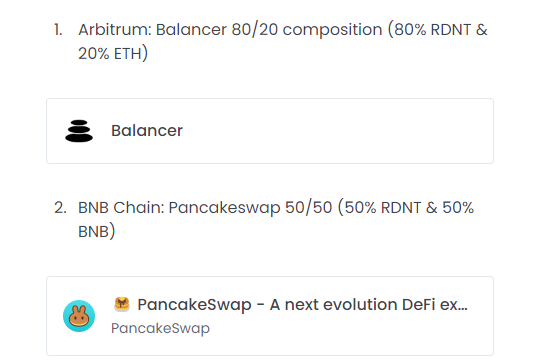

To mint dLP, users have to either provide a liquidity pair comprised of $RDNT and $wETH in an 80/20 ratio on Balancer, or a 50/50 ratio of $RDNT and $BNB on PancakeSwap.

Minting the dLP gives holders access to three primary forms of utility:

- Activating $RDNT emissions on deposits and borrows

- Platform fee-sharing

- Voting and governance power in the Radiant DAO

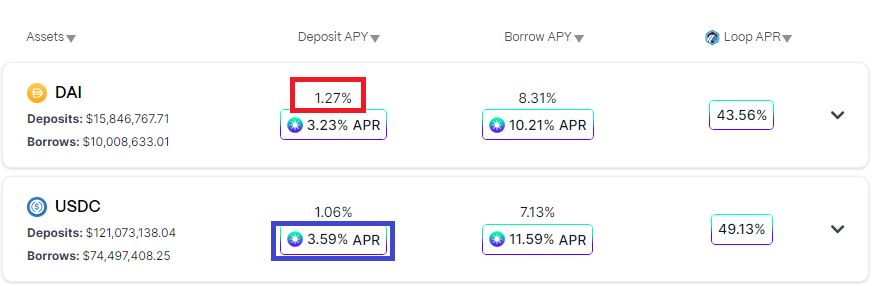

The key point to note is that dLP is required for the generous liquidity rewards provided on both the supply and lending side on Radiant Capital.

While all users are able to receive the base fees (in red), for using the platform, only those who have locked dLP are eligible for the additional $RDNT emissions (in blue).

More specifically, users have to provide a minimum of 5% locked dLP tokens, relative to the size of their deposits to activate such emissions.

For example, if user A has $1000 deposited in Radiant Capital, he would have to lock $50 in dLP tokens locked to be eligible for such rewards.

Similar to Curve’s veTokenomics, incentives scale with locking duration, with rewards being maximized with a 1 year lock duration.

This not only disincentivizes pure “mercenary capital”, but also creates an intricate flywheel where depositors aiming for higher emissions constantly have “skin in the game”.

7/ @gametheorizing breaks it down beautifully here: https://t.co/alWkcTpIAS

— Andrew Kang (@Rewkang) June 7, 2023

1. User has $1M in deposits and meets the 5% in “locked LP” for emissions

2. RDNT price falls → User now below 5% threshold

3. User is incentivized to buy RDNT and re-lock more LP to stay above 5%.

Radiant Capital was also the 7th largest benefactor of $ARB airdrops in the entire Arbitrum ecosystem, and has made public their intention to incentivize those who have locked their dLP for the maximum one year period.

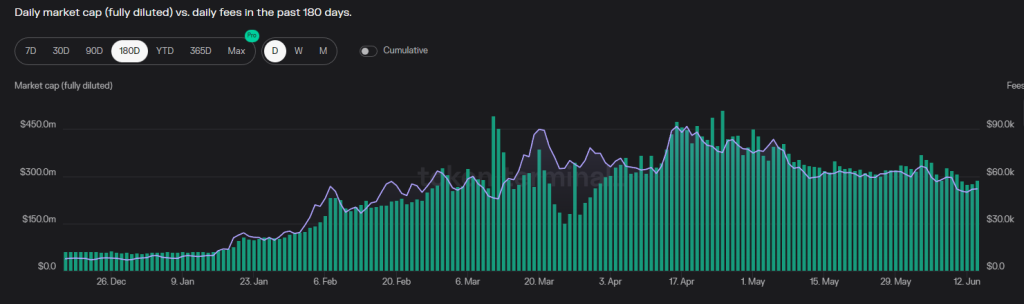

Radiant Capital’s ingenious flywheel has been instrumental in their remarkable achievement of generating nearly $2 million in fees within the past month alone. Moreover, the protocol has distributed more than $10m since inception, and recently overtook Aave and Compound in both revenue generated and daily active users.

Also Read: This Trader is Single-Handedly Destroying GMX Stakers

Radiant Capital’s Future Developments and Roadmap

Even in the midst of a bear market, Radiant Capital and its vibrant community have displayed consistent activity across various platforms, including active engagement on social media channels and participation in governance forums.

🤝@ArbidexFi X @RDNTCapital 🤝

— Arbitrum Exchange (@ArbidexFi) May 17, 2023

We are thrilled to announce our partnership with @RDNTCapital 💥

🔵New Quantum pool $RDNT/WETH is live! Start farming $ARX+WETH at juicy APRs now!💰

💸Buy $RDNT at the lowest fees only on #Arbidex

Start Earning▶️https://t.co/aDCoUIYv9C pic.twitter.com/vjSrgLHUIU

While they do not currently have an official roadmap, the protocol has been relentlessly forging partnerships to enhance the user experience, proactively delivering continuous and seamless improvements.

9/ Total TVL in both $ and ETH terms have followed hockey stick growth all year

— Andrew Kang (@Rewkang) June 7, 2023

Given we have taken a position, we will also be working with Radiant on some new growth hacking incentives to supercharge TVL growth and increase market share. Details to be announced in the future pic.twitter.com/rd89GSbl7q

It also seems that they have officially partnered with Andrew Kang’s Mechanism Capital, an investment firm focused on the decentralized finance (DeFi) ecosystem.

Through Mechanism Capital’s extensive investment portfolio, there exists potential for unlocking a multitude of network effects. This presents an exciting opportunity for tapping into various synergies and amplifying the impact of Radiant Capital’s initiatives.

With an evident focus on growth, it seems Radiant Capital is making dedicated efforts to broaden its presence and capitalize on its recent streak of achievements. While whether Radiant Capital will eventually surpass established DeFi primitives is still uncertain, the signs point towards a promising future for the protocol.

Also Read: Time Is Literally Money With Chronos Finance

[Editor’s Note: This article does not represent financial advice. Please do your research before investing.]

Featured Image Credit: Chain Debrief